“It’s really scary how easy it is [to be licensed to sell seg funds], said Meagan Balaneski, associate portfolio manager with Aligned Capital Partners Inc. in Vermilion, Alta. “And then you just manage people’s life savings and they trust you.”

Said David Benamron, executive vice-president of insurance with Botica Financial Group in Montreal: “It’s a little bit weird that we are actually allowed to sell these funds with the amount of training we receive. And that argument can be made for universal life products as well. Our insurance licence does not give us enough training on the investment side.”

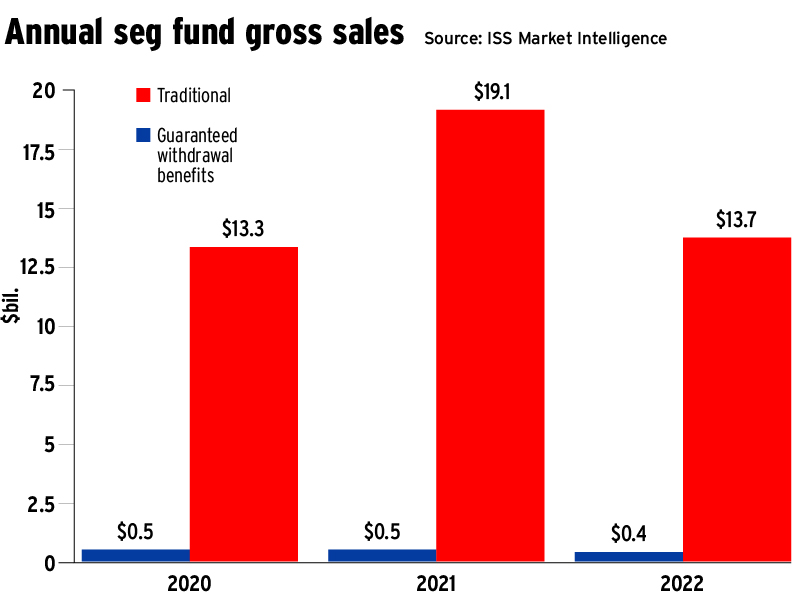

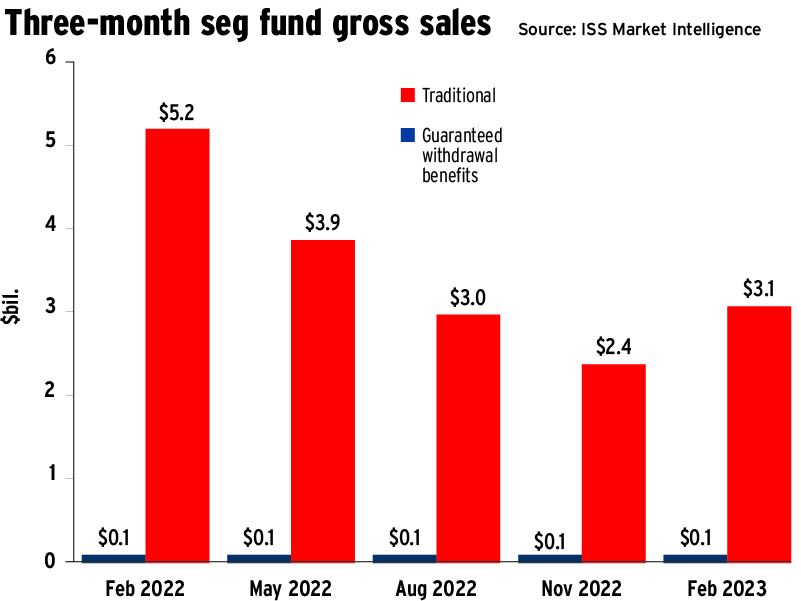

Still, insurance advisors continue to make hefty seg fund sales. Life insurers recorded gross seg fund sales of $14.1 billion in Canada in 2022, down from $19.6 billion in 2021, although 2021 sales were higher than the normal annual range of $12 billion–$14 billion, according to ISS Market Intelligence, said Carlos Cardone, senior managing director with Investor Economics, a unit of ISS.

New seg fund content could be coming to the Life Licence Qualification Program (LLQP) curriculum. The Canadian Council of Insurance Regulators (CCIR) and the Canadian Insurance Services Regulatory Organizations(CISRO) are drafting new seg fund guidance and, on the basis of that guidance, may consider updating the LLQP material, CCIR policy manager Tony Toy stated in an email to Investment Executive.

Toy added that the organizations are considering know-your-product requirements similar to those governing securities reps as part of broader work on the design, distribution, issuance, sale and administration of seg funds. But in public consultations on seg fund guidance, CCIR and CISRO have not received any comments on the seg funds portion of LLQP training, Toy said.

As it stands, topics in the LLQP curriculum include the advantages of seg funds, seg fund types (e.g., money market, equities, dividend, fixed income), and, on the client side, investment objectives, financial goals, time horizons and risk tolerances. The material also covers topics such as financial statements, taxation, fund facts, guarantees, reset rules and taxes. Limitations (such as age restrictions and penalties) and advantages (such as reset options, creditor protection and Assuris coverage) also are included.

“The amount of training is wildly insufficient,” Balaneski said, adding there is no mandatory mentoring for seg fund reps similar to the concept of articling at a law firm. Balaneski relies heavily on her training as a securities rep and chartered investment manager when advising on seg funds. She voluntarily advises clients on seg funds as if advising them on mutual funds, but a life insurance agent does not have to do so, she said.

The insurance industry has a “multi-faceted approach to ensuring advisors are knowledgeable about the sale of seg funds, with the LLQP being a strong component,” stated Kevin Dorse, assistant vice-president of strategic communications and public affairs with the Canadian Life and Health Insurance Association Inc., in an email to Investment Executive.

Dorse added that the LLQP requires prospective agents to pass four exams administered by regulators — including one dedicated to seg funds. Agents also are subject to ongoing oversight by insurers, managing general agents and regulators. Further, agents receive product-specific training and must complete subsequent continuing education (CE).

In Ontario, life insurance agents must earn 30 CE credits every two years. These credits must be “related to the technical aspects” of life insurance, such as legal, legislative and regulatory matters, risk management principles, client needs analysis, and accounting and actuarial considerations, among other topics. Sales techniques and company-specific training, for example, would not apply.

A life insurance agent seeking to improve their qualifications could get additional training by pursuing designations such as chartered life underwriter, professional financial advisor or certified financial planner, said Laurent Munier, partner with Safe Pacific Financial Inc. in Vancouver: “You should definitely try to upgrade your education past the minimum entry.”

While agents selling seg funds should not necessarily have to be registered to sell mutual funds, they should have to receive training beyond the LLQP to understand how investments work, said Sunny Kochar, founder and CEO of Hexavision Enterprise in Guelph, Ont. This training could take the form of an additional module in the LLQP or a mini-investment course.

Balaneski suggested the insurance industry could run a portfolio planning course for seg funds. Another solution could be offering a basic LLQP licence that would not allow the sale of seg funds, and an optional supplement that would be required to sell them.

A self-regulatory organization (SRO) that merges insurance regulators with mutual funds and securities regulators would be “super cool,” but not necessarily practical, Balaneski said. She added that she is not necessarily in favour of a rule requiring advisors who only sell seg funds to be licensed to sell mutual funds.

The Financial Services Regulatory Authority of Ontario stated that it continues to work with other members of the CCIR and the CISRO to create seg fund guidance “that will support a consistent standard of care for insurers and those who advise customers about these products that reflects current industry best practices, in support of fair outcomes for customers.”

Click image for full-size chart