Image © Bank of Canada

There has been some interesting price action in the Pound to Canadian Dollar exchange rate (GBP/CAD) already this week, with the pair breaking down by 0.40% on Monday.

The move was one of the bigger moves in FX on an otherwise lacklustre day. It was not reflected in any other major GBP exchange rates but was also echoed in the Euro-Canadian Dollar, which implies that the two European currencies had a poor start to the week against their Canadian peer.

No major news events drove these GBP/CAD and EUR/CAD losses, which suggests that some technical selling was behind the moves. With this in mind, we wonder if the recent rise in GBP/CAD above 1.7820 was a false break.

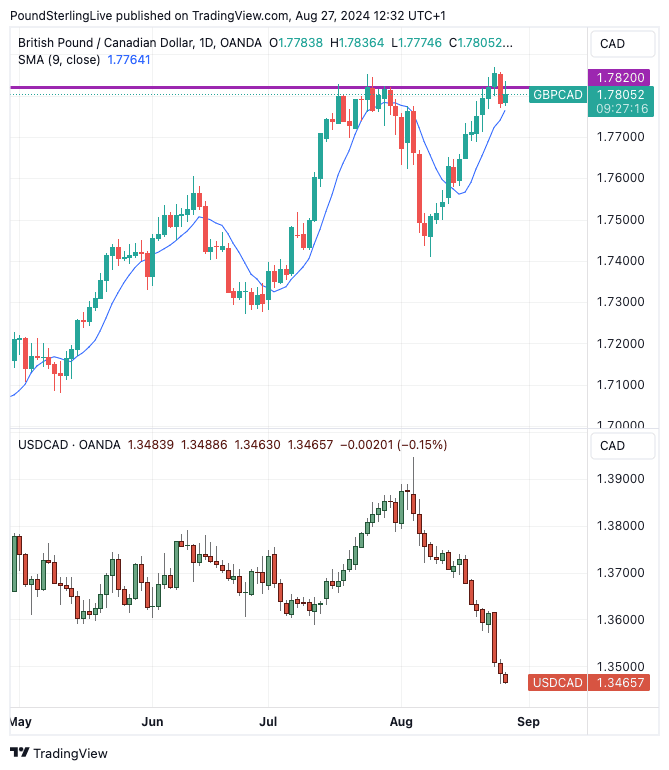

A look at the chart below reveals our thinking:

Above: GBP/CAD (top) and USD/CAD.

As can be seen, 1.7820 forms the late July peak that ultimately thwarted the Pound’s advance, resulting in a deeper pullback. Last Friday, we saw the exchange rate record a daily close above here, suggesting resistance had been broken. But, the recent retreat suggests this could have been a false break.

Our expectation, however, is that this pair is still trending higher and will continue to do so.

As such, we won’t read too much into the pullback and think this is a natural and healthy development within the context of an exchange rate that is trending higher.

A retest of the 2024 high at 1.7869 is our favoured play on GBP/CAD for the coming days and further 2024 highs can be painted in the coming weeks. That said, we should allow the pullback to potentially extend further, with the nine-day moving average at 1.7763 being an initial target.

We note the Canadian Dollar was a clear loser among its G10 peers from last week’s Jerome Powell speech, which saw the Federal Reserve Chair raise the prospect of a 50 basis point interest rate cut in September.

The price action is understandable, with markets reckoning that aggressive rate cuts at the Fed will encourage the Bank of Canada (BoC) to follow suit and continue cutting and weighing on CAD exchange rates.

With this in mind, we would imagine BoC rate cut bets will rise again if Friday’s Canadian GDP undershoots expectations. Markets are currently expecting a flat 0% monthly reading, which would highlight why the central bank has reason to cut rates again.

Although GBP/CAD looks as though it wants to go higher, the Canadian Dollar is looking more constructive against the U.S. Dollar (USD/CAD).

“The charts don’t lie. This time last week, a push to the upper 1.36s, perhaps even a test of 1.36 at a stretch, looked feasible. The CAD had settled into a range in the low 1.37s but that big, bearish key weekly reversal from the start of August loomed over the broader outlook for USDCAD and clearly tilted technical risks to the downside,” says Shaun Osborne, Chief FX Strategist at Scotiabank.

“Now, with USD losses stretching under retracement support in the mid/upper 1.35s, spot looks to have a date with major trend/retracement support at 1.3475 in the next week or two. USDCAD rebounds from here may not be able to make it much above 1.3575/1.3625,” he adds.