- The Pound Sterling failed another attempt above 1.3400 versus the US Dollar.

- The Fed and the BoE stuck to their cautious rhetoric amid US tariff uncertainties.

- Technicals show that bullish potential remains intact for the pair whilst above 1.3165.

The Pound Sterling (GBP) erased weekly gains versus the US Dollar (USD) after the GBP/USD pair breached the critical 1.3290 support.

Pound Sterling wilted as the King Dollar regained poise

The bearish momentum around the GBP/USD pair regained traction in the second half of the week as demand for the US Dollar re-emerged following a weak start.

The Greenback remained on the defensive against its currency rivals ahead of the US Federal Reserve (Fed) policy announcements. Despite US President Donald Trump stating last weekend that he would lower tariffs on Chinese imports ‘at some point’, uncertainty remained high over a thaw in US-Sino trade relations.

Additionally, doubts over a potential US-Japan trade deal intensified after Japanese Finance Minister Katsunobu Kato walked back comments made last Friday that seemed to suggest Japan might threaten selling some of its Treasury holdings as part of trade negotiations with the White House.

Fresh questions lingering on the trade front revived the USD’s downside in the early part of the week, allowing GBP/USD to briefly challenge the 1.3400 threshold again. However, the tide turned in favor of the US currency after the Fed kept the federal funds rate unchanged in the range of 4.25% to 4.50% on Wednesday, maintaining a cautious stance on the policy outlook. The Fed’s policy statement read that risks of higher inflation and unemployment had risen, further clouding the US economic outlook.

However, the Fed’s concerns over the heightened economic uncertainties in the face of Trump’s erratic trade policies were offset by renewed optimism surrounding potential US trade deals with some of its major trading partners.

The USD climbed to fresh monthly highs across the board after risk sentiment received a boost on the announcement of a “breakthrough deal” by US President Trump and British Prime Minister Keir Starmer on Thursday.

The US-UK trade deal raised hopes that US trade agreements with other countries are in the offing, especially as the US and China begin their first high-level trade talks in Switzerland on Saturday. US Treasury Secretary Scott Bessent and Chief Trade Negotiator Jamieson Greer will meet with China’s Vice Premier, He Lifeng, over the weekend.

The pair tumbled to three-week lows below 1.3250 in the aftermath, unable to capitalize on the Bank of England’s (BoE) communication to maintain a gradual and cautious approach towards further easing.

The UK central bank lowered the Bank Rate by 25 basis points (bps) on Thursday as widely anticipated. However, five Monetary Policy Committee (MPC) members voted to cut rates by 25 bps, two members favoured a 50 bps reduction (Dhingra and Taylor), and two members voted to keep rates unchanged (Mann and Pill).

Heading into the weekend, the USD stood tall as elevated geopolitical risks in the Middle East, and between India and Pakistan, drove safe-haven flows into the buck, leaving the pair mired in multi-week troughs.

Week ahead: Trade updates and US/UK data on tap

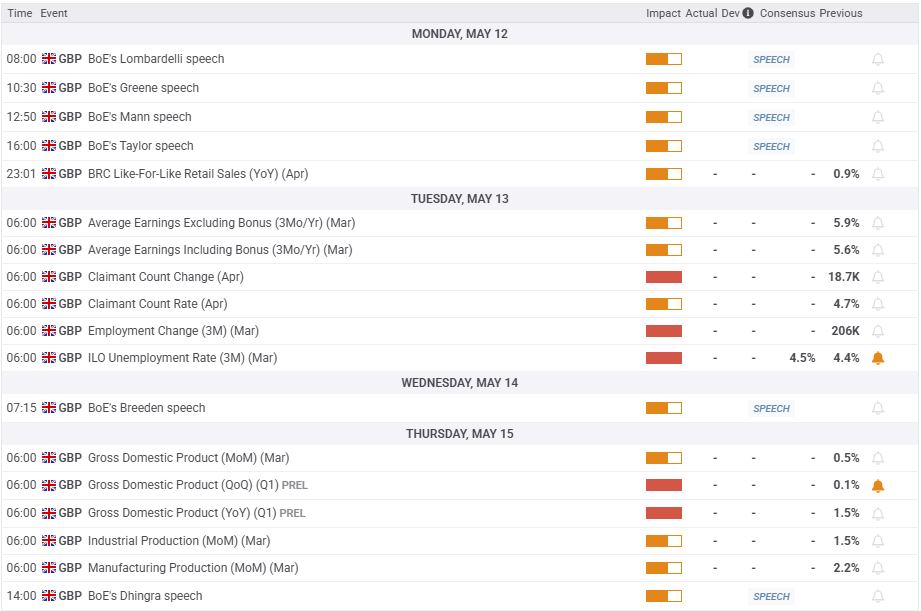

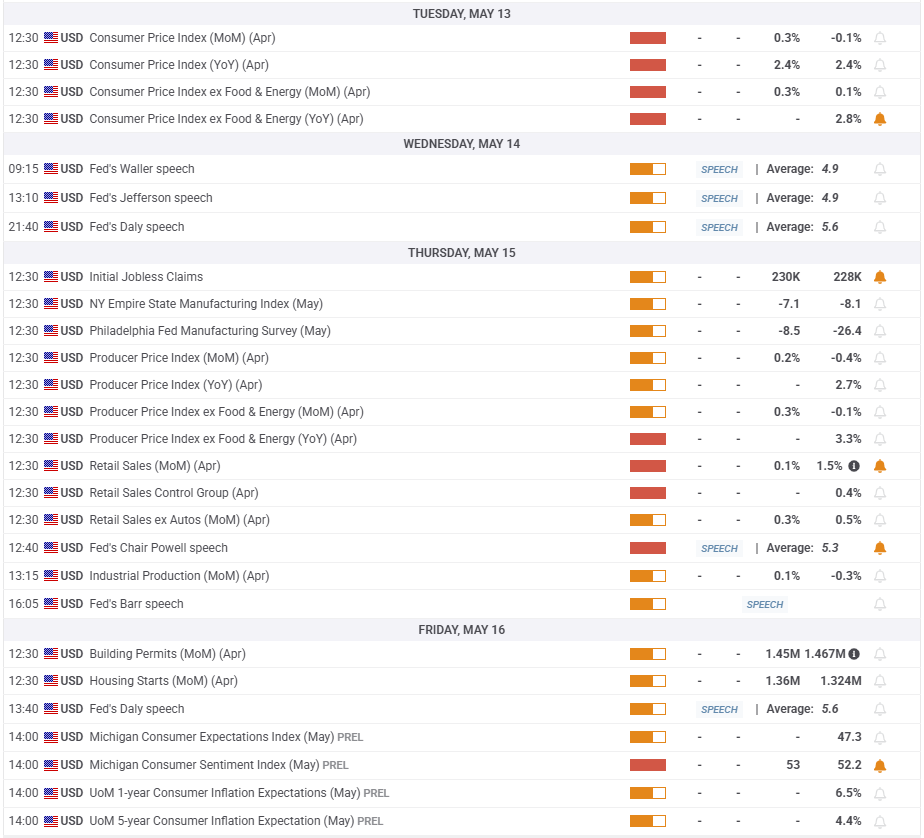

With the Fed and BoE monetary policy decisions out of the way, attention shifts back toward the high-impact economic data releases from both sides of the Atlantic as an eventful week unfolds.

Monday is a quiet day in terms of macro releases, as investors prepare for Tuesday’s US Consumer Price Index (CPI) data. Ahead of the US inflation test, the UK labor data will provide some trading incentives to Pound Sterling traders.

It’s another data-dry docket on Wednesday, shifting the attention to the UK’s preliminary Gross Domestic Product (GDP) for the first quarter due on Thursday. Later that day, the US Producer Price Index (PPI) inflation data and the weekly Jobless Claims data will also entertain traders.

On Friday, only the preliminary University of Michigan (UoM) Consumer Sentiment and Inflation Expectations data will be noteworthy.

Apart from the economic statistics, potential trade deals between the US and its major trading partners and developments on the tariff front will continue playing a pivotal role in the week ahead.

Speeches from Fed and BoE policymakers will be closely scrutinized on fresh hints on the central banks’ policy outlooks.

GBP/USD: Technical Outlook

The daily chart shows that the 14-day Relative Strength Index (RSI) has eased its descent, currently trading near 52, indicating that dip-buying could emerge.

However, buyers remain cautious as the pair closed Thursday below the critical short-term 21-day Simple Moving Average (SMA) support at 1.3290.

Recapturing the latter on a weekly closing basis is required to revive the uptrend toward the three-year high of 1.3445.

Ahead of that, the 1.3400 mark will offer stiff resistance. If buyers regain control and overcome the aforementioned hurdles, the next target will be the February 2022 high of 1.3644.

If the selling pressure remains unabated, the 1.3200 round level will be initially tested, below which the 50-day SMA at 1.3072 will be threatened.

The line in sand for buyers is aligned at the 1.3000 psychological level.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data.

Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates.

When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money.

When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP.

A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.