Image © Adobe Images

Will the Pound continue to move higher against the Dollar and potentially hit fresh 2024 highs? A new analysis warns of a potential near-term setback.

Pound Sterling might have entered a ‘bull trap’ against the Dollar, which could mean its retreats from its recent peak and fresh attempts at fresh 2024 highs are ultimately delayed.

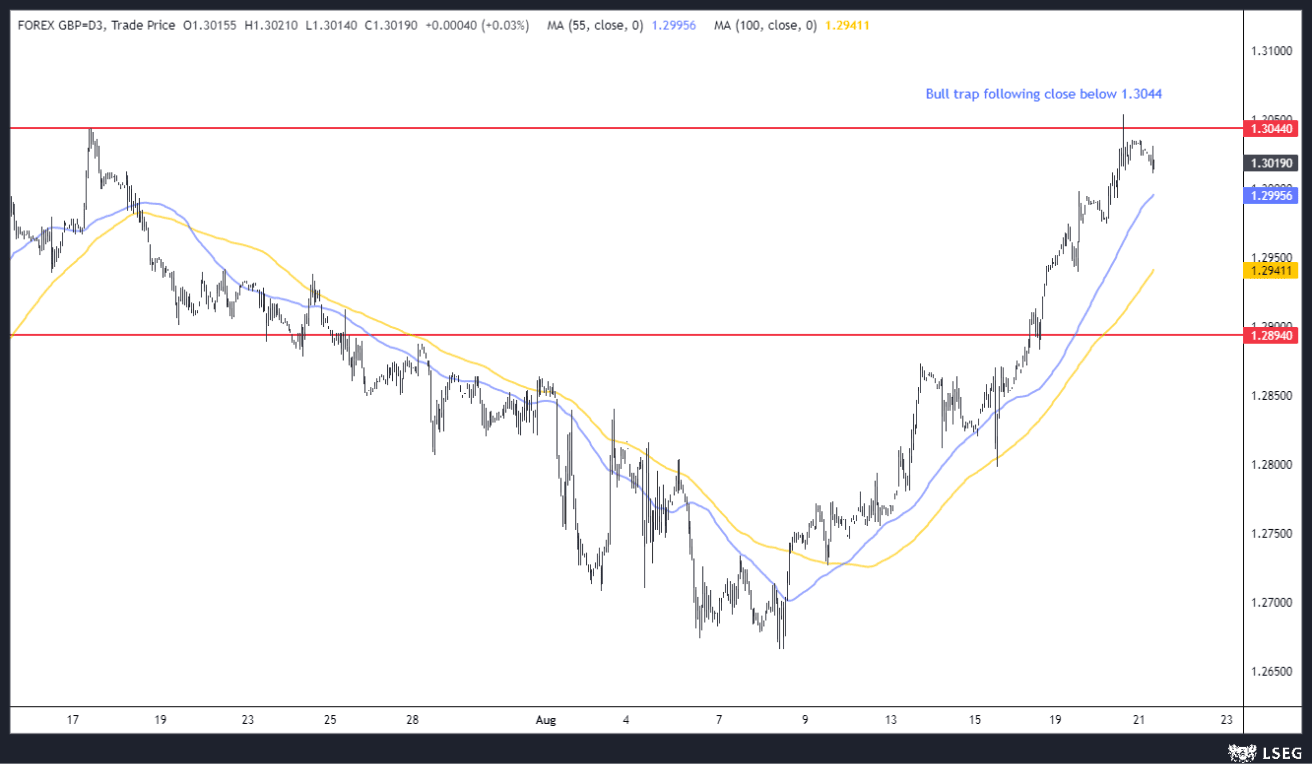

According to Justin McQueen, a Reuters market analyst, the Pound to Dollar exchange rate might have entered a bull trap; “Tuesday’s false break of prior YTD high (1.3044) signals topside exhaustion.”

A bull trap happens when traders are drawn into a rally thinking a long-term trend is evolving when, in fact, it is a spike within a broader long-term downtrend.

The Pound has been rising against the Dollar since August 07 and reached its previous 2024 high (1.3052) on August 20. This generated a slew of headlines in popular media outlets detailing the UK currency’s newfound strength.

Above: GBP/USD chart, courtesy of Justin McQueen at Reuters.

However, McQueen says Tuesday’s false break of prior YTD high signals topside exhaustion.

“This is a warning for GBP/USD bulls given the risk of a reversal,” says McQueen. “A false break occurs when a key level is breached but quickly reverses.”

The Dollar is the driving force behind GBP/USD’s rally, with markets ramping up bets that September will see the start of a protracted interest rate cutting cycle at the Federal Reserve, which would boost stocks and weigh on the Dollar.

“While it appears difficult to fight this recent dollar downtrend, there are signs warning over chasing dollar lower from current levels. For cable to negate the bull trap risk, a close above 1.3044-54 is required,” says McQueen.