wdstock

If you’re like me, your income from money-market funds has been rising in recent years. The funds investing in low-risk short-term notes have benefited from Fed rate hikes, making them a comfortable place to park proceeds from stock sales and dividends.

U.S. money market funds hold more than $6 trillion in assets, double what they were in 2018. The recent seven-day yield in the one my broker offers was 5.14%, up from close to zero a few years ago.

Alas, this parking place is about to get a lot narrower. Fed rate cuts appear likely to begin in September. Money-market rates track closely. Investors who want to maintain the same level of income, let alone raise it, likely will have to switch to the riskier world of longer-term corporate securities.

My longtime investment Wells Fargo 7.5% Preferred Series L (WFC.PR.L) fits the bill. I first wrote about it in one of my first Seeking Alpha articles in January 2016, right after retiring from my newspaper job. I’ve been collecting quarterly dividends ever since.

The non-cumulative convertible preferred has an unusual history and $1,000 base value (Quantum description). It was issued by Wachovia Corp. near the start of the 2008 financial crisis and taken over by the more solid Wells Fargo at the end of that year in the government-forced sale of Wachovia. As a result, the terms are more favorable to investors than usually offered by money-center banks.

It pays a quarterly dividend of $18.75, or $75 annually. It qualifies for the preferential tax rate of 15% for most taxpayers. At the recent price around $1,208, it yields about 6.2%.

Unlike most preferreds, it can never be called, though in unlikely circumstances it could be converted to common stock. If Wells Fargo (NYSE:WFC) closed over $203.72 for 20 out of 30 consecutive trading days, the company could convert WFC.PR.L into 6.2814 shares of WFC.

However, WFC only trades for around a quarter of the conversion price, and for practical purposes the market views this preferred as having no maturity. Thus, if rates decline as expected, the price should go up, without being constrained by call risk.

Comparative Analysis

Let’s compare it to another fixed-rate Wells preferred, WFC.PR.Y (Quantum description). The 5.625% coupon issue is selling for about $24, for a lower yield of 5.86%. In addition, it could be called immediately if rates were to go down and Wells could refinance cheaper, and the company has never been shy about doing this.

The yield gap of up to 60 basis points is shown in this spreadsheet of Wells preferreds:

| Ticker | Coupon | Dividend | Recent Price | Yield | Call Date |

| WFC-L | 7.50% | $75 | $1,208 | 0.0621 | Convertible |

| WFC-A | 4.70% | $1.18 | 20.74 | 0.0569 | 12/15/2025 |

| WFC-C | 4.38% | $1.09 | 19.45 | 0.056 | 3/15/2026 |

| WFC-D | 4.25% | $1.06 | 18.83 | 0.0563 | 9/15/2026 |

| WFC-Y | 5.63% | $1.41 | 24.1 | 0.0585 | 9/15/2022 |

| WFC-Z | 4.75% | $1.19 | 20.66 | 0.0576 | 3/15/2025 |

Source: Author’s research, Charles Schwab

Over the years, I’ve wondered why the yield gap persists. It seems to be a combination of attracting less retail interest because of its high price, confusion over the difficult-to-parse conversion terms, and the volatility inherent in a long-duration security.

Another comparison is to Bank of America’s similar $1,000-base rate preferred, the 7.25% BAC.PR.L. This recently yielded slightly less than WFC.PR.L, 6.01%. It also carries more conversion risk because BAC common is selling for about 60% of the conversion price, versus about 25% for the Wells security.

Risk Factors

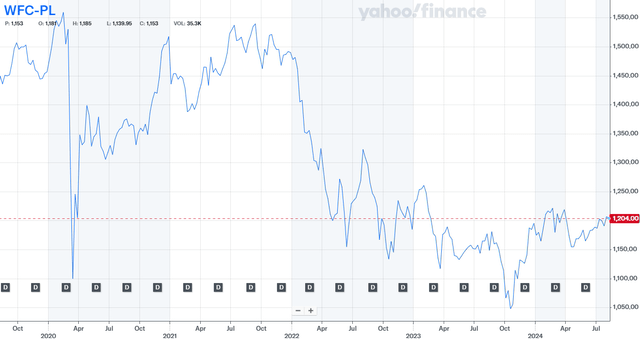

Even with a giant and well-capitalized bank, there is some risk that the dividend could be suspended. This chart shows the stock has hit speed bumps during market meltdowns, but always maintained dividends and recovered quickly.

WFC preferred L chart (Google)

A more likely risk is that an increase in interest rates during the next upward leg of the business cycle would bring the price down.

Conclusion: WFC.PR.L seems underpriced relative to other money-center bank preferreds. I recently bought more, restoring it above a trio of tech winners as the largest position in my portfolio.