U.S. equities performed exceedingly well in 2024, returning 25%. When said performance is contrasted against other notable equity markets, such as developed market equities (i.e., MSCI EAFE Index), emerging market equities (i.e., MSCI Emerging Markets Index), or even the broader global equity market (excluding the U.S.), the outperformance is further pronounced.

For even further context, as stated in JP Morgan’s (JPM) Global Asset Allocation Views 1Q 2025, the S&P 500 added USD 11.4 trillion in market capitalization, the equivalent of the entire market cap of the eurozone, Switzerland and Australia combined. As noted by JPM, valuation expansion explains half of this year’s gains; the other half was driven by strong earnings growth – a trend that is expected to continue and broaden across the economy in 2025.

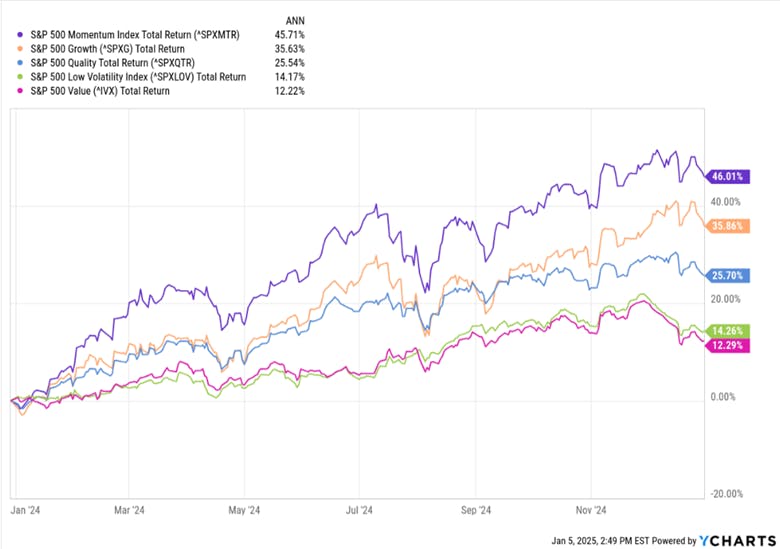

Looking below the surface, investment factors provide insight into the characteristics that help explain the performance of U.S. equity markets for the year. For the S&P 500 Index, momentum had the most significant influence, followed by growth and quality.

The strong performance of these investment factors is not particularly surprising at this juncture, given the current economic expansion, lowered rate environment, and increasing capital flows toward artificial intelligence and semiconductors, led by some established and significant firms.

As illustrated by research done by JP Morgan, capital spending on artificial intelligence is expected to increase exponentially in the coming years, propelling further U.S. industrial production in the high-tech industry.

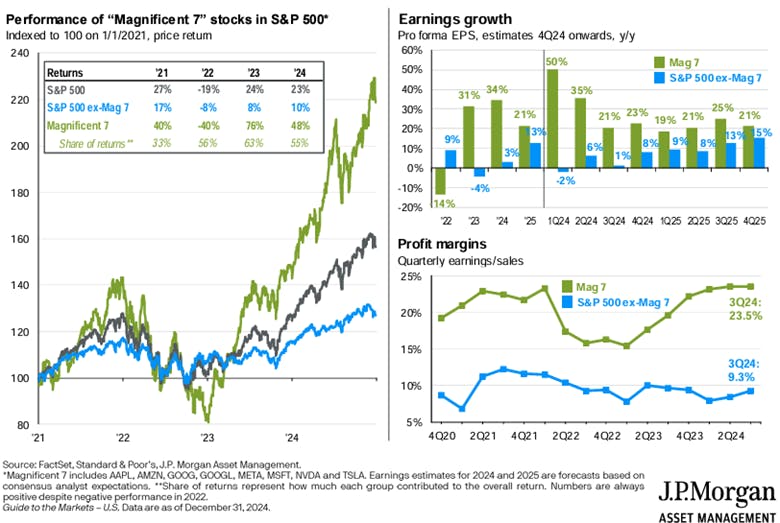

This is important as many firms within the tech sector, most notably the Magnificent Seven, continue to be the primary contributors toward the performance of the U.S. equity asset class and, by most indications, will continue to do so in the near future.

Looking Forward

With the weight of the U.S. within global equity markets now being approximately two-thirds and increasing concentration within the U.S. equity class, the performance of a select few firms will continue to have an outsized influence.

Given the incoming U.S. Presidential administration’s ‘America First’ agenda and the enactment of ‘pro-growth’ policies (i.e., deregulation, tax cuts, etc.) that will support the furtherance of the U.S. business cycle and propel the U.S. equities asset class forward.

A Look At U.S.-Focused ETF

For Canadian investors looking for ETF solutions that provide exposure to U.S. equities, Trackinsight’s ETF Screener can be utilized to research and identify ETF offerings that provide both broad and niche market exposure. Using the platform to identify some of the top-performing U.S. equity-focused ETFs for the past year, the following ETFs were identified.

Evolve FANGMA Index ETF (Tickers: TECH/TECH.B/TECH.U) is a concentrated portfolio providing exposure to six of the most notable big-tech firms: Meta Platforms (formerly Facebook), Amazon Inc., Netflix, Alphabet Inc. (formerly Google), Microsoft, and Apple.

As of December 2024, the 1-year returns for the respective tickers were TECH: 43.72%, ECH.B: 57.51%, and TECH.U: 45.17%.

Fidelity U.S. Momentum Index ETF (Ticker: FCMO) provides single-factor exposure to companies that exhibit positive momentum signals. As mentioned previously, the momentum investment factor performed strongly in 2024.

As of December 2024, the ETF’s 1-year return was 53.18%. As a point of note, there is also a U.S.-dollar version of the solution, FCMO.U, which returned 41.20% for the same period.

TD Active U.S. Enhanced Dividend ETF (Ticker: TUED) provides exposure to dividend-paying equity securities of issuers in the United States. The manager selects securities through the use of an active fundamental methodology that considers an issuer’s ability to generate and grow free cash profitably. Non-dividend-paying companies may make up to 30% of the overall portfolio.

As of December 2024, the fund’s 1-year return was 48.11%. As a point of note, there is also a U.S.-dollar version of the solution, TUED.U, which returned 36.69% for the same period.

Please note this article is for information purposes only and does not in any way constitute investment advice. It is essential that you seek advice from a registered financial professional prior to making any investment decision.