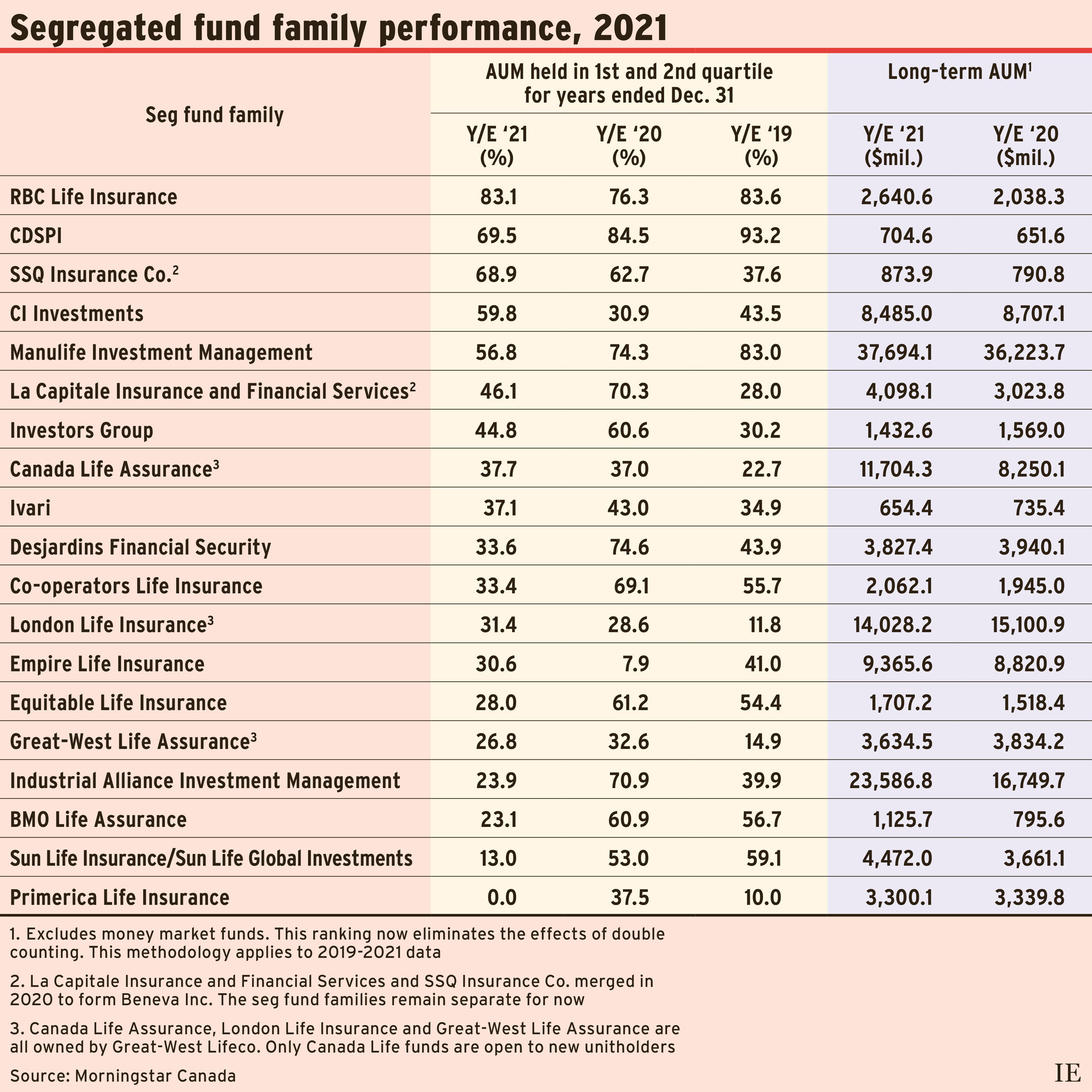

These conditions helped some segregated fund families while hindering others.

RBC Life Insurance posted strong investment performance in 2021, with 83.1% of its assets under management (AUM) held in first-or second-quartile seg funds, according to Morningstar Canada. Among the larger funds that did well were the RBC Select Conservative Fund, the RBC Select Balanced Fund and the RBC Canadian Dividend Fund. (All firms are based in Toronto unless otherwise indicated.)

The small seg fund families of CDSPI — a non-profit organization that serves dentists — and Quebec City-based SSQ Insurance Co. also performed well, with almost 70% of their AUM held in above-average performing funds. Meanwhile, 59.8% of CI Investments’ AUM was held in above-average funds.

Manulife Investment Management’s was the only one of the three large seg fund families with good performance, at 56.8%. The trio of Canada Life Assurance, Great-West Life Assurance and London Life Insurance seg funds, owned by Winnipeg-based Great West Lifeco Inc., had less than half of their AUM held in above-average funds. Quebec City-based Industrial Alliance Investment Management Inc.’s and Kingston, Ont.-based Empire Life Insurance Co.’s seg fund families were well below 50%.

Here’s a look at some of the seg families in more detail:

Manulife Investment Management

The seg fund family is the largest in Canada. Its 56.8% of AUM in funds ranked in the first or second quartile is lower than 74.3% in 2020 and 83% in 2019, but is still a good performance.

“Equity markets continued to reward growth companies with low leverage, and this aligned with [the approach of] Manulife Investment Management’s essential equity team, which manages the Manulife Monthly High Income Fund,” said Catherine Milum, head of wealth sales, in a statement. That fund has $4 billion in AUM and 22 of its 23 versions were in the first quartile in 2021.

Canada Life

The three seg fund families under this brand are all managed by Canada Life. Only the Canada Life funds are available to new investors, although existing unitholders in the other two families can purchase additional units and/or switch within the family in question.

Brent MacLellan, vice-president for portfolio construction and analysis with Canada Life, said 2021 equities markets were in “risk-on mode, rewarding higher-beta, cyclical types of investment strategies.” The Canada Life shelf focuses on long-term investing and “is designed to be very competitive through a full market cycle.”

Despite those challenging conditions, some funds continued to do well in 2021. MacLellan pointed to the Canada Life Global Growth Opportunities Fund, the Canada Life Pathways Global Multi Sector Bond Fund and the Canada Life Global Multi Sector Fixed Income Fund, which were all in the first or second quartile.

Empire Life Insurance Co.

This seg fund family is value-oriented but not “deep value,” said Ashley Misquitta, senior portfolio manager, U.S.and global equities, with Empire Life. “We’re sensitive to valuations but are open to buying great businesses with intrinsic value and good management.”

Three of Empire Life’s stock picks that did well in 2021 were Israel-based InMode Ltd., a medical device company; Indiana-based Anthem Inc., a health benefits company; and North Carolina-based Lowe’s Cos. Inc.

Misquitta said 2022 could be a difficult year, with interest rates rising, inflation remaining high, continuing supply chain issues, possible Covid-19 surges and the war in Ukraine. A major worry is that inflation will become embedded in wages, producing further upward price pressure.

Misquitta said he anticipates companies will begin sourcing more components closer to home. This could favour California-based Intel Corp., which is constructing two semiconductor plants that are expected to open in 2024. He added that companies involved in automation could also do well as firms look to cut costs.

Industrial Alliance Investment Management Inc.

Pierre Payeur, senior vice-president for fund management and oversight with Industrial Alliance, said two factors pulled down returns for some key funds. One was the challenges for growth stocks in the first half of the year, and the other was the lack of high-flying fossil-fuel investments in their responsible investing Inhance seg funds, which have mandates forbidding such stocks. These funds are subadvised by Vancouver-based Vancity Investment Management Ltd.

Payeur noted that some previously strong performers struggled in 2021, including the Global Dividend Dynamic Fund with $1.5 billion in AUM. The fund was fourth-quartile for the year, but Payeur said it “remains a top-rated global equity fund with first-quartile returns over several periods.”

Beneva Inc.

This company is the result of a merger between SSQ Insurance Co.and La Capitale Insurance and Financial Services in 2020. Their seg fund families remain separate for now.

Mathieu Roy, investment product development and strategy advisor with Beneva, said SSQ’s funds are “heavily tilted to value” and benefited from value stocks’ strength early in 2021. Two SSQ funds that did particularly well were the SSQ Triasima Canadian Equity Fund, which returned 23.5% for the year, thanks to more energy exposure than many of its peers, and the SSQ Hillsdale U.S. Equity Fund, which is 67% large-cap equities and 33% small-cap.

Roy said the SSQ AlphaFixe Bond and Bank Loans Fund (which is not ranked by Morningstar) returned 2.7% above its benchmark. This was due to the fund’s shorter duration, which is the result of its maximum of 40% exposure to bank loans.

As well, Roy noted that the SSQ Fiera Capital U.S. Equity Fund “continues to offer high returns in both up and down markets.” Its 2021 return was 32.9%.

Beneva added four funds to its SSQ lineup in June 2021: a global and an international equity fund, both subadvised by Florida-based GQG Partners LLC; the SSQ Fisher ESG U.S. Small Cap Equity Fund; and the SSQ CI Global Real Estate Fund.

Jean-François Pakenham, also an investment product development and strategy advisor with Beneva, said that instability and high volatility could help value investing in 2022.

Click image for full-size chart