Poilievre said that he’ll allow Canadians to put in an additional $5,000 into their TFSAs each year

Article content

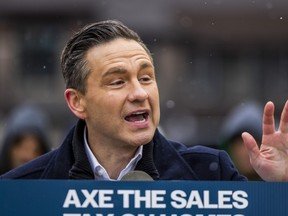

OTTAWA — Conservative Leader Pierre Poilievre wasted no time doubling down on his attacks against Mark Carney’s use of offshore tax havens as a business executive, opening a video pitch for boosting Canada’s tax-free savings account (TFSA) limit with an unsubtle dig at the Liberal leader’s creative tax planning.

“When greedy, globalist corporate insiders profit by moving money out of Canada, they avoid paying Canadian tax,” said Poilievre in the video, posted to social media on Thursday morning.

Advertisement 2

Article content

“But when patriotic Canadians invest in our country, they pay more.”

The words “greedy, globalist corporate insiders” were set to a progression of still images of Carney speaking at the World Economic Forum in Davos, Switzerland, to hammer home the point.

“Instead of rewarding people for taking jobs and money out of Canada, we need a tax cut for those who bring it home,” said Poilievre, segueing to his pitch for a $5,000 a year “Canada First” top-up to the TFSA contribution limit.

Poilievre said that, if he becomes prime minister, he’ll allow Canadians to put in an additional $5,000 into their TFSAs each year, currently capped at $7,000, on the condition they invest the top-up into a basket of government-approved “Canadian investments.”

Advertisement 3

Article content

“My government will create a definition (of Canadian investments) that will let financial institutions and advisers tell you which investments can go into your Canada First TFSA top-up.”

A Conservative source said on background that direct real estate holdings wouldn’t be eligible investments for the top-up, but Real Estate Investment Trusts (REITs) would.

Some fiscal conservatives say they’re worried about the condition that the top-up be put in approved Canadian investments.

“It would be better to leave TFSA holders free to chose whatever investments, Canadian or foreign, they think would bring them the most return,” said Renaud Brossard, vice president of communications at the right-leaning Montreal Economic Institute.

Article content

Advertisement 4

Article content

Renaud said that he doesn’t think the investment pool created by the proposed ‘Canada First’ rule would be big enough to distort Canada’s capital market but said that the government would need to put forward an appropriately broad definition of what counts as a Canadian investment.

“The risk with putting in these sorts of rules is that a government will come in and try to skew them to funnel investments to things that help them politically,” said Renaud.

Renaud added that the changes proposed by Poilievre would still be an improvement to the existing TFSA system.

“Is it perfect? No. Is it better than what we have now? Certainly.”

A source with the Liberal campaign said that Poilievre’s choice to release the pre-taped announcement video just hours after U.S. President Donald Trump said he’ll impose 25 per cent tariffs on all auto imports, including Canadian ones, shows he’s incapable of meeting the perilous moment.

Advertisement 5

Article content

“Mr. Carney is holding off on announcements today because he’s busy acting in his capacity as prime minister to deal with the trade crisis,” said the source.

“Why is Mr. Poilievre prattling on about TFSAs when tariffs are all anyone else is talking about?”

The source noted that just 15 per cent of TFSA holders max out their annual contributions under the current cap and said they were skeptical that the proposed Canada First top-up would do much to actually help Canadian workers.

“(Poilievre) can argue that he is meeting the moment by allowing for certain Canadian companies to get the top-up money, but we all know what he really wants to do by bumping up the TFSA limit… which is allow more wealthy people to get tax breaks,” said the source.

Advertisement 6

Article content

“We know this because that’s what he did in (Stephen) Harper’s government.”

The Liberal campaign wouldn’t say if Carney is planning to make any changes to the TFSA program.

The announcement comes on the heels of revelations that Carney used Bermuda tax havens while head of transition investing at Brookfield Asset Management, registering two green transition funds in the offshore territory, a well-known destination for tax dodgers.

The video was made before the news broke, but reinforces the narrative that Carney and other financial elites use such offshore schemes to avoid paying their fair share of taxes.

Carney told reporters on Wednesday this was a common way of structuring such funds to avoid double taxation.

Advertisement 7

Article content

But Poilievre said Carney’s explanation didn’t pass the smell test.

“(Carney) claims that somehow this money gets funnelled through a Bermuda tax haven, only to come back to Canada. Well, why wouldn’t he just leave it in Canada in the first place?” said Poilievre.

Poilievre also said the Conservative platform will include measures to crack down on “the types of tax havens that Mark Carney has used to cheat the system.”

TFSAs are registered savings accounts that may hold both cash and investments.

In most cases, interest, dividends and capital gains earned on investments in a TFSA are not taxable, either when held in the account or withdrawn.

The Harper government brought in TFSAs in 2009 with an initial cap of $5,000, later increasing the cap to $10,000.

Advertisement 8

Article content

The Liberal government reduced the contribution limit to $5,500 in 2016.

The cap has since been raised incrementally, currently sitting at $7,000.

National Post

rmohamed@postmedia.com

Get more deep-dive National Post political coverage and analysis in your inbox with the Political Hack newsletter, where Ottawa bureau chief Stuart Thomson and political analyst Tasha Kheiriddin get at what’s really going on behind the scenes on Parliament Hill every Wednesday and Friday, exclusively for subscribers. Sign up here.

Our website is the place for the latest breaking news, exclusive scoops, longreads and provocative commentary. Please bookmark nationalpost.com and sign up for our daily newsletter, Posted, here.

Article content