North American equities have spiraled in the week following Donald Trump’s tariff announcements, with the S&P 500 falling to a low of 12.1%.

The US index rebounded 9.5% on the news that higher tariffs had been delayed for 90 days, but most of those holding US equity funds are still seeing their returns in the red.

Only two IA North America funds made a positive return in the week following the announcement, with Seilern America and the AB American Growth Portfolio up 3.3% and 0.6% respectively.

Lindsell Train North American Equity broke even, but all 251 of the remaining funds made losses – some worse than others.

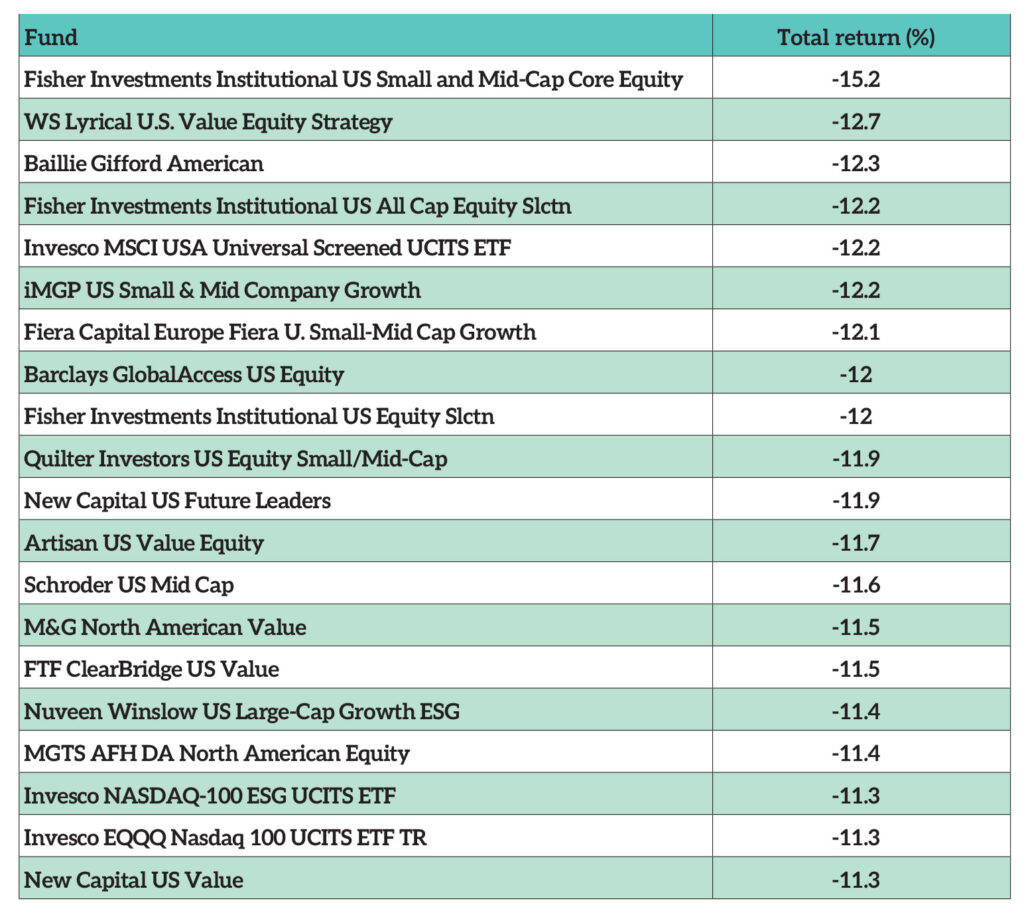

IA North America funds that were down the most following Trump’s tariffs

The most sizable decline came from the Fisher Investments Institutional US Small and Mid-Cap Core Equity fund, which was down 15.2% over the week.

This $661m fund invests in mid and small-cap stocks on the Russell 2500, with the average holding having a market capitalization $12.2bn.

It appears these stocks were the worst hit, with numerous other mid and small-cap specialist funds among the biggest loss makers.

The iMGP US Small & Mid Company Growth, Fiera US Small-Mid Cap Growth, Quilter Investors US Equity Small/Mid-Cap, and Schroder US Mid Cap funds were down 12.2%, 12.1%, 11.9% and 11.6% respectively.

See also: The defensive US funds that outperformed in market downturns

However, some large-cap funds were among the worst hit. Lyrical US Value Equity Strategy had the second-worst drop, falling 12.7% throughout the week.

It holds concentrated positions in 33 of the US’ largest companies, with its highest allocations to financials (29.6% of the portfolio) and industrials (22.6%). This gives it a differentiated composure to the S&P 500, which has just 14.7% and 8.5% in these sectors.

Other large-cap investors such as the £2.4bn Baillie Gifford American fund also fell the furthest following Trump’s tariffs, with returns down 12.3% in the week after.

Yet analysts at RSMR noted that its high-growth approach means it is bound to undergo greater volatility. They said the fund was “not suitable for investors concerned about relative performance over short timescales”.

See also: The 15% of US funds that beat the S&P 500 over the past decade

Baillie Gifford American delivered some of the highest returns in its peer group over the past decade, soaring 257.8%, yet performance has waned in recent years.

It was a bottom-quartile performer over the past five years with a total return of 44.1% and lost investors 4.3% over the past three years.

Nevertheless, researchers at RSMR said: “The investment process adopted by the long-term growth team has always embraced risk and encouraged managers not to be put off by the fear of losses. This has always been explicitly stated by the team.

“The focus of the process is to invest early and hold for the longer term with the objective of holding market outliers from an early stage through to maturity. For stocks to deliver these outlier returns, there will generally be an element of controversy holding market outliers from an early stage through to maturity.

“There will always be periods when stock selection can be exceptionally good or poor. The fund offers investors a differentiated approach in a market where many funds struggle to add value against passive options.”