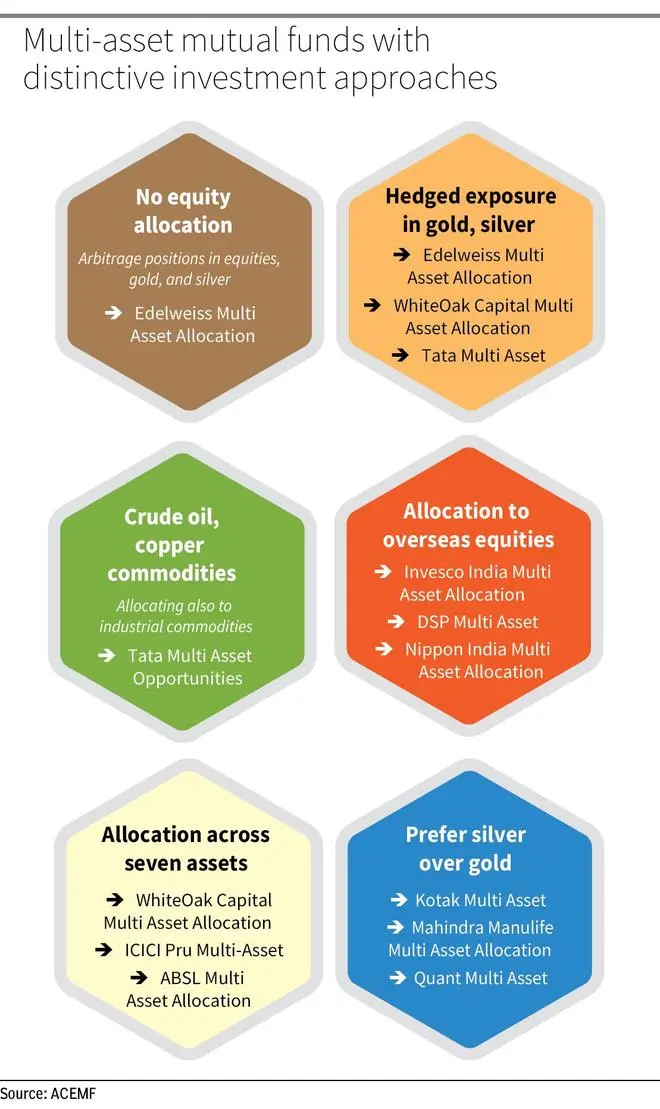

Multi-Asset Allocation Funds (MAAF) have surged in popularity over the last 15-18 months, outperforming many equity and hybrid categories. Currently, 28 funds in this category aim to deliver portfolio diversification across asset classes. While the common objective is to balance risk and returns, their investment approaches vary widely in terms of asset allocation strategies and risk profile.

These are some of the variations that investors need to watch out for:

No equity allocation

All funds in the category mandatorily allocate to unhedged equities except the Edelweiss Multi Asset Allocation Fund. It is a debt-oriented fund employing arbitrage positions in equities, gold, and silver along with accrual income from fixed-income instruments. This fund generates returns similar to debt and arbitrage funds. Over the last one year, it delivered 8.9 per cent while arbitrage and short duration funds categories clocked an average return of 7 per cent and 9 per cent respectively.

Exposure to gold and silver derivatives

While most funds allocate to gold ETFs or physical gold, funds like Edelweiss Multi Asset Allocation, WhiteOak Capital Multi Asset Allocation, ICICI Pru Multi-Asset and Tata Multi Asset Opportunities Fund prefer taking positions through commodity derivatives. Gold and silver derivatives offer leverage and flexibility with lower capital requirements than ETFs in India. WhiteOak Capital Multi Asset Allocation and Tata Multi Asset Opportunities delivered an annualised return of 16 per cent and 8 per cent over the last one year.

Exposure to crude oil, copper, zinc and aluminium commodities

Tata Multi Asset Opportunities Fund stands unique in the industry by investing also in crude oil, copper, zinc, and aluminium through exchange-traded commodity derivatives. It maintains an overall commodity allocation ranging from 10 to 20 per cent of the portfolio. ICICI Pru Multi-Asset has too allocated less than one percent to copper derivatives. This may allow investors to take advantage of gains in these industrial commodities to which they may not have direct access. Tata Multi Asset has a five-year track record, delivering an average one-year rolling return of 18 per cent since inception, with the lowest return being 1 per cent.

Allocation to overseas equities

Seven funds in the category allocate to overseas equities, adding another layer of diversification. Funds with higher overseas allocations include Invesco India Multi Asset Allocation (17 per cent), DSP Multi Asset Allocation (15 per cent), and Nippon India Multi Asset Allocation Fund (10 per cent). While Invesco India Multi Asset primarily allocates to US equities, DSP Multi Asset Allocation and Nippon India Multi Asset Allocation offer exposure across global markets. DSP Multi Asset Allocation and Nippon India Multi Asset Allocation posted annualised returns of 12 per cent and 10.5 per cent, respectively, over the past year. Invesco India Multi Asset Allocation, on the other hand, has been in operation for less than a year.

Allocation across seven assets

Three funds provide well-diversified exposure by allocating to as many asset classes as permissible for the industry. WhiteOak Capital Multi Asset Allocation, ICICI Pru Multi-Asset, and Aditya Birla SL Multi Asset Allocation Fund have invested across seven assets: domestic equities, arbitrage positions, debt, gold, silver, overseas equities, REITs & InvITs. Among these schemes, ICICI Pru Multi-Asset stands out with a long track record, having delivered annualised returns of 25 per cent over the past five years.

Mid & small-cap heavy equity portfolio

Some funds focus heavily on mid and small-cap stocks. The top three funds with higher exposure to this segment are Motilal Oswal Multi Asset (31 per cent), LIC MF Multi Asset Allocation (30 per cent), and HSBC Multi Asset Allocation Fund (27 per cent), compared to the category average of 15 per cent. This may lead higher equity returns than for peers but with higher volatility and downside risks. This was evident in their performance during the recent market downturn, with Motilal Oswal Multi Asset posting a negative return of 9 per cent and HSBC Multi Asset Allocation managing only a 4 per cent return over the past year. LIC MF Multi Asset Allocation, however, has a track record of less than a year.

Higher exposure to unhedged equities

Currently, 16 funds invest at least 65 per cent in equities. UTI Multi Asset Allocation and Sundaram Multi Asset Allocation Fund have consistently maintained unhedged equity levels above 65 per cent. Conversely, Motilal Oswal Multi Asset and Quant Multi Asset fund demonstrate dynamic asset allocation practices. UTI and Sundaram Multi Asset Allocation returned 8 per cent and 12 per cent annually over the past year.

Silver over gold

Some funds prefer silver over gold. According to latest portfolio data, Kotak Multi Asset Allocation, Mahindra Manulife Multi Asset Allocation, and Quant Multi Asset hold higher allocations in silver than gold. Silver functions more as an industrial commodity than a safe haven and may add higher volatility along with return potential to the portfolio. Over the last one year, Kotak Multi Asset Allocation, Mahindra Manulife Multi Asset Allocation and Quant Multi Asset delivered 7 per cent, 10 per cent and 3 per cent respectively.

Published on April 19, 2025