Inflows into equity mutual funds schemes dipped 9 per cent last month to ₹37,113 crore against ₹40,608 crore logged in June despite 3 equity NFOs mopping up ₹14,370 crore through new fund offer.

Two thematic NFOs – ICICI Prudential Energy Opportunities and Edelweiss Business Cycle Fund – together raised ₹9,790 crore. In all, 15 NFOs raised ₹16,565 crore last month.

Backed by robust NFOs, thematic funds registered the highest inflow of ₹18,386 crore (₹22,352 crore) and it was followed by multi-cap and flexi-cap funds which recorded inflow of ₹7,085 crore (₹4,709 crore) and ₹3,053 crore (₹3,059 crore), respectively.

Equity linked savings schemes and focused funds registered net outflow of ₹638 crore (-₹445 crore) and ₹620 crore (-₹287 crore).

Led by arbitrage opportunities, hybrid funds recorded a healthy inflow of ₹17,436 crore (₹8,855 crore) as arbitrage and multi-asset funds saw an inflow of ₹11,015 crore (₹3,837 crore) and ₹3,125 crore (₹3,453 crore), respectively.

Swarup Mohanty, Vice-Chairman & CEO, Mirae Asset Investment Managers (India), said there is a clear shift in investors preference which is evident from the fact that in the last two years there were heavy inflows into small -caps and this is now shifting to sectoral funds.

SIP contribution increased 10 per cent to hit an all-time high of ₹23,332 crore last month against ₹21,262 crore in June. SIP assets also scaled a new high to ₹13.09 lakh crore (₹12.43 lakh crore).

Shift in preference

Venkat Chalasani, Chief Executive, AMFI, said while thematic investment is gaining ground, investors should understand their risk profile as these schemes are slated for matured investors who can take a strong call on investment opportunities in a growing economy.

The consistent increase in SIP contribution reflects the growing financial discipline among retail investors to build wealth systematically over time, he added.

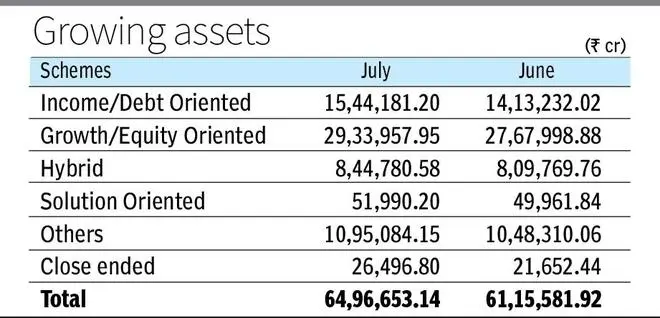

Debt funds inflows turned positive to ₹1.20 lakh crore against net outflow ₹1.07 lakh crore logged in June. Overall, industry AUM increased to ₹64.97 lakh crore (₹61.16 lakh crore in June).

Hitesh Thakkar, Acting CEO, ITI Mutual Fund, said retail investors have now understood that volatility is part of the long-term wealth creation journey and the industry will surpass the milestone of ₹100 lakh crore in AUM through 100 million investors in next 3-4 years.