Understanding the root causes of this volatility and developing robust investment strategies has never been more crucial.

Global Economic Headwinds and Indian Market Volatility

The current economic environment is undoubtedly challenging for investors. The confluence of multiple headwinds has created a high degree of uncertainty, making it difficult to predict market direction with any degree of confidence.

-

The Looming U.S. Recession Fears

The spectre of a U.S. recession looms large, driven by a combination of rising interest rates, persistent inflation, and slowing economic growth. The Federal Reserve’s efforts to curb inflation through aggressive rate hikes have raised borrowing costs, dampening consumer spending and business investment. Consequently, economic growth has slowed, and fears of a recession have intensified.

A U.S. recession would have profound implications for global markets, including India. The U.S. is a major trading partner for many countries, and a slowdown in its economy can reduce demand for exports, impacting industries ranging from technology to manufacturing. Additionally, investor risk aversion typically rises during recessions, leading to capital outflows from emerging markets like India, further exacerbating market volatility.

[Read: Why Are Markets Turning Volatile and Risks to Watch Out For]

-

A Surge in Japanese Yen

In August 2024, the Japanese yen experienced significant fluctuations due to several key factors. The Bank of Japan (BOJ) unexpectedly raised interest rates by 15 basis points, which marked a departure from its long-standing ultra-dovish monetary policy. This rate hike strengthened the yen, leading to a surge in its value.

This shift caused a major unwinding of the yen carry trade. The carry trade involves investors borrowing at low interest rates in Japan to invest in higher-yielding assets elsewhere. As the yen appreciated, investors faced margin calls and were forced to liquidate their positions, resulting in a global sell-off in stocks and other assets

Prior to the surge, the yen had been trading at around ¥145 per US dollar, with the 4.8% increase, this would mean the yen strengthened to approximately ¥138 per US dollar. The yen’s appreciation is expected to continue, with some analysts predicting it could rise as much as another 10%, potentially reaching ¥120 per US dollar. This movement reflects a broader adjustment in global financial markets as investors reassess their strategies in light of the BOJ’s policy changes and the potential for shifts in US Federal Reserve policies

Moreover, Japan’s Nikkei 225 index plunged nearly 12.4% on August 05, 2024, this sharp decline was the worst since the Black Monday crash of October 1987. The drop was largely attributed to the Bank of Japan’s interest rate hike on July 31, 2024, which led to a sudden sell-off in the market.

However, despite this dramatic fall, the Nikkei 225 index rebounded the following day, rising as much as 10.5%. This quick recovery was supported by swift actions from the Japanese government and central bank, which implemented stimulus measures and monetary easing policies to stabilize the economy and boost investor confidence.

-

Geopolitical Tensions and Wars

Geopolitical tensions and conflicts have been a persistent source of market volatility. In 2024, several flashpoints have garnered global attention:

Any disruption in oil supply from these regions can have immediate and severe repercussions on global energy prices. Additionally, the conflict can lead to heightened volatility in commodity markets, particularly oil, given the region’s strategic importance in global energy supply.

-

Russia-Ukraine Conflict: The ongoing conflict between Russia and Ukraine continues to disrupt global energy supplies, leading to elevated oil and gas prices. This not only fuels inflation but also strains the economies of energy-importing countries.

-

Middle East Instability: The Middle East remains a volatile region, with conflicts in countries like Syria and Yemen, Israel and Palestine, contributing to uncertainty in global oil markets, affecting global trade routes, and leading to increased defence spending.

-

China-Taiwan Relations: Tensions between China and Taiwan have escalated, raising concerns about potential military conflict in the region. Such an event could disrupt global supply chains, particularly in the technology sector, and have a cascading effect on markets worldwide.

Geopolitical tensions introduce a high degree of uncertainty, causing investors to adopt a risk-off approach. Safe-haven assets like gold and U.S. Treasury bonds tend to benefit, while equities and riskier assets face downward pressure.

-

-

Other Economic Challenges

Beyond these major issues, several other economic challenges are contributing to market volatility:

-

Inflationary Pressures: Inflation remains a significant concern globally. Rising costs of raw materials, energy, and labour have led to higher prices for goods and services. Central banks are grappling with the challenge of curbing inflation without stifling economic growth.

-

Climate Change: Extreme weather events and the transition to a low-carbon economy are creating both risks and opportunities. Industries reliant on fossil fuels face regulatory and reputational risks, while renewable energy sectors present growth potential but also face technological and market challenges.

-

Impact on Indian Equity Markets

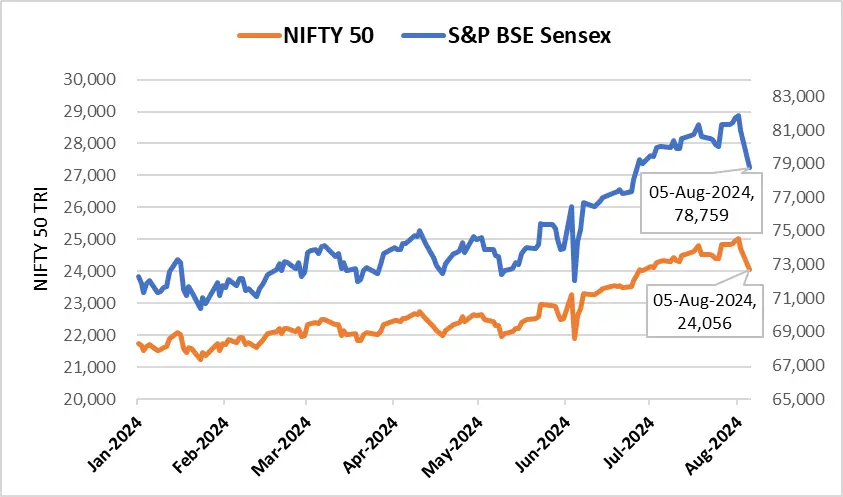

The Indian equity benchmarks, the S&P BSE Sensex and Nifty 50 have been experiencing significant volatility in response to these global challenges. While the Indian economy has demonstrated resilience in the face of adverse global conditions, the domestic market is not immune to the impact of external factors.

(Source: ACE MF, data collated by PersonalFN Research)

On August 5, 2024, the S&P BSE Sensex slumped by 2,223 points to 78,759 from 80,982, and the Nifty 50 dropped by 662 points to 24,056 from 24,718. This volatility was influenced by several factors, including fears of a recession in the US, disappointing job statistics, the unwinding of the yen carry trade, and escalating tensions in the Middle East.

[Read: Sensex at 80,000! How to Approach Equity Mutual Funds Now]

Sectoral indices, including Auto, Metal, IT, and Banking, faced loss and broader market indices also saw declines ranging from 3% to 5%. Analysts advise caution and suggest that this correction could be an opportunity to accumulate quality stocks for the long term while navigating through the current volatile environment.

Additionally, the unveiling of the Modi 3.0 budget on July 23rd, 2024, has left the financial markets in a state of heightened volatility. The budget introduced significant reforms and tax policy changes, which had a profound impact on investor sentiment and market dynamics.

The equity market’s price fluctuations over the past six months of 2024 reflect a complex interplay of domestic and global factors, including economic data, interest rates, policy changes, and investor’s interest. Keeping an eye on these factors and understanding their impact can help investors navigate the current market conditions more effectively.

[Read: From Volatility to Opportunity: Reviewing Portfolios Amid India’s 2024 Market Trends]

Core & Satellite Strategy: A Solution for Navigating Market Volatility Amidst Global Headwinds

In the face of unprecedented market volatility, investors are constantly seeking strategies to balance risk and return. The current landscape-marked by significant currency fluctuations, fears of a U.S. recession, escalating geopolitical tensions, and persistent inflationary pressures-demands a strategic investment approach that balances stability with flexibility.

The Core & Satellite strategy addresses these needs by combining a stable core portfolio with targeted satellite investments, enabling investors to effectively manage risk and seize opportunities amidst economic turbulence.

The Core & Satellite strategy offers a solution by providing a balanced approach to managing investment risk and capturing growth opportunities.

-

Core Holdings: The term ‘Core’ refers to more stable and long-term holdings that could potentially multiply your wealth with stability. These core holdings offer diversified exposure to major asset classes such as equities, bonds, and real estate, providing a stable foundation amidst market volatility.

For instance, one may consider adding diversified equity large-cap mutual funds, as they make perfect sense in an overheated market, some of the best Value/Contra Funds and Flexi-cap Funds as the core part of your mutual fund portfolio.

This stability is crucial during periods of heightened uncertainty, as it helps mitigate the impact of market swings on the overall portfolio. Your allocation to the aforementioned types of equity schemes could be around 65%-70% of the equity mutual fund portfolio, and the investment time horizon of at least around 5 years in all these funds.

-

Satellite Holdings: The satellite portion of the portfolio allows for more targeted investments that can take advantage of specific market opportunities or provide protection against particular risks. In the current environment, investing in defensive sectors such as healthcare, FMCG or utilities may offer stability. These sectors tend to be less sensitive to economic downturns and inflationary pressures.

Consider investing in regions or sectors that are less affected by geopolitical tensions or that might benefit from shifts in global trade patterns. For instance, mutual funds holding stocks of companies with diversified supply chains or those operating in politically stable regions might present attractive opportunities.

Allocate a portion of your satellite investments to high-growth sectors or emerging markets poised to benefit from specific economic trends or recovery phases. This might include sectors such as technology, clean energy, infrastructure, or manufacturing. However, be aware that sectoral or thematic funds carry high concentration risk due to their limited exposure to a single sector, so it’s prudent to suitably limit the allocation to these funds.

[Read: Best Mutual Funds for the Next 10 Years]

For the satellite part, one may consider including a top-performing mid-cap fund or small-cap fund along with a couple of aggressive hybrid funds. Both small-cap and mid-cap funds generally require a longer investment horizon, ideally around 7 to 8 years. This extended time frame can help mitigate downside risks, especially if the broader markets experience corrections due to macroeconomic or geopolitical uncertainties.

The ‘Satellite’ portion could be around 30%-35% of the equity mutual fund portfolio. This portion would help push up the overall returns of the portfolio with relatively high risk. Thus, make sure you have the stomach for high risk and a longer investment horizon.

Additionally, strategically allocating across asset classes such as equity, debt, and gold is crucial for building a mutual fund portfolio that can smoothly navigate market volatility. Different asset classes don’t always move in the same direction, so adopting a multi-asset approach is particularly beneficial during periods of heightened volatility.

To summarise…

By staying informed about global economic developments and adjusting investment strategies accordingly, investors can position themselves to capitalize on opportunities and safeguard their portfolios against the uncertainties of 2024.

Ultimately, the key to success in volatile markets lies in a disciplined and informed approach, balancing risk management with the pursuit of growth opportunities.

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing.

This article is for information purposes only and is not meant to influence your investment decisions. It should not be treated as a mutual fund recommendation or advice to make an investment decision in the above-mentioned schemes.