Deposit and investment growth in the country’s Islamic banks fell to a four-year low in the first quarter of 2025, apparently driven by rising public concerns over the financial stability and governance practices of the commercial lenders.

Industry people say customer confidence in Shariah-based banks has waned due to growing controversies, financial scandals, and issues over transparency and governance standards.

There are ten full-fledged Islamic banks in Bangladesh. Before the political changeover in August last year, many of the banks were controlled by a few big and politically influential business groups.

Following the changeover, as political influence lost its grip on the industry, long-buried toxic assets began to surface, exposing the fragile financial health of many lenders. Although the boards of these banks were reshuffled subsequently, industry insiders say rebuilding trust will take time.

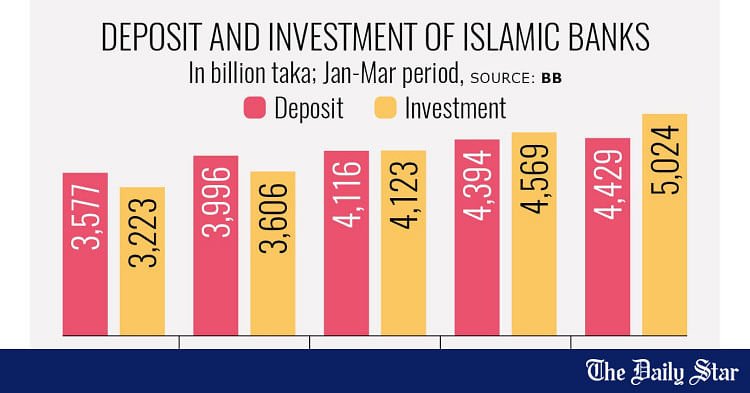

The year-on-year deposit growth rate of Islamic banks was 11.71 percent in the first quarter of 2022, according to Bangladesh Bank (BB) data.

In the first quarter of 2023, it dropped significantly to 3 percent and then slightly recovered, rising to 6.75 percent in the first quarter of 2024.

However, in the first quarter of 2025, it dropped to around 0.80 percent, the BB data showed.

Meanwhile, an analysis of central bank data for the same period showed another trend of decline in the investment growth rate.

The investment growth rate was 11.88 percent in the first quarter of 2022.

It increased to 14 percent in the first quarter of 2023.

It then dropped to 10.82 percent in the first quarter of 2024 and further declined to 9.96 percent in the first quarter of 2025.

COST OF DEFYING GOOD GOVERNANCE

Mohammad Abdul Mannan, chairman of First Security Islami Bank PLC, said the bank began deviating from the basic principles of good governance in 2017.

Over time, this erosion of standards significantly weakened the institution. As confidence declined, depositors gradually moved their funds elsewhere, ultimately contributing to the bank’s current challenges, he said.

They have undertaken various initiatives to overcome the current situation, he added.

Shafiuzzaman, managing director of Social Islami Bank PLC, said that due to a crisis of customer confidence, deposit growth has been declining—a continuation of last year’s trend.

He added that the decline in their deposit growth in the first half of this year has not been as sharp as it was during the second half of last year.

He mentioned that the deposit erosion was now at a relatively manageable level, and the panic withdrawal trend seen last year had significantly subsided. Customer confidence was also being regained.

Since deposit growth has declined, it has had an overall impact on investments as well, he said.

That said, he added, it would still take more time for customer confidence to recover fully.

Mohammed Nurul Amin, chairman of Global Islami Bank PLC, said that in 2024, several banks that were identified as weak or reportedly controlled by a specific group revealed their true state in various official reports following the political changeover in August last year.

These reports showed that large amounts of money had been siphoned off from these banks—either laundered abroad or used for unauthorised purposes, he said.

As a result, crowds of depositors rushed to bank counters to withdraw their funds, he added.

Banks struggled to meet customer demands, leading to widespread panic among depositors, which ultimately triggered the current situation, he added.

This rush of withdrawals continued until December last year, after which the situation began to turn around. People are no longer crowding bank counters to withdraw cash as they did before, he mentioned.

However, while customer confidence in certain Islamic banks has weakened, overall trust in the banking system has not diminished—a fact evident in various indicators, he said.

Many depositors have shifted their funds to the Islamic banking windows of conventional banks, he said, adding that high inflation is another factor contributing to the slowdown in deposit growth.

Apart from the ten full-fledged Islamic banks, 16 conventional lenders have Islamic banking branches, while 11 offer Shariah-based banking solutions through Islamic windows.

WHAT REGULATOR, EXPERTS ARE SAYING

Areif Hussain Khan, spokesperson of the Bangladesh Bank, said deposit growth across the banking sector has slowed due to the country’s overall situation, accompanied by a decline in investment momentum.

He said that after the August political changeover, several businesses either shut down or scaled back operations—many of which had received significant financing from Islamic banks.

This has contributed to a slowdown in those banks’ deposit and investment activities and overall growth, he mentioned.

Khan also pointed out that major irregularities reported in two Islamic banks in 2022 had a lasting impact on the sector, significantly undermining public confidence.

Shah Md Ahsan Habib, a professor at the Bangladesh Institute of Bank Management, said the credit flow in the country’s Islamic banks had remained unusually high since 2021, driven by aggressive lending practices.

“At one point, the central bank appointed observers due to irregularities and scams in some Islamic banks—an indication that underlying problems had emerged,” he said.

Consequently, deposit growth began to slow, Habib mentioned.

“Following August 5 last year, multiple reports have exposed the severity of the crisis facing these banks,” he said, adding that both deposit and investment growth have since declined.

For all latest news, follow The Daily Star’s Google News channel.

For all latest news, follow The Daily Star’s Google News channel.