Overall equity asset increased to ₹32.05 lakh crore (₹30.58 lakh crore) largely due to mark-to-market gain of ₹1.28 lakh crore.

| Photo Credit:

wutwhanfoto

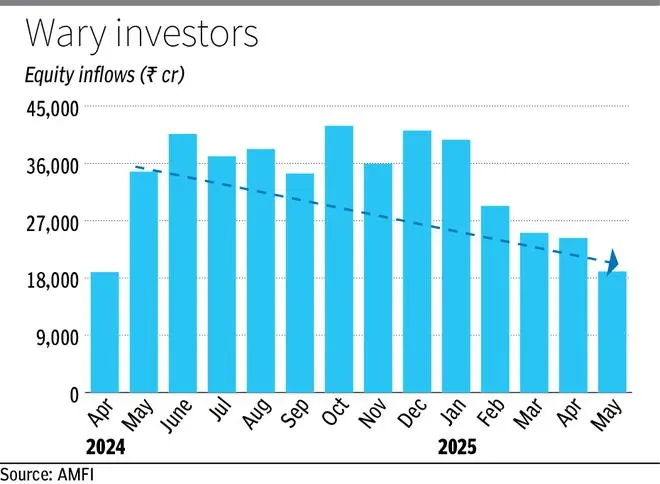

Fresh investment in equity mutual funds has dipped to a 13-month low of ₹19,013 crore last month against ₹24,269 crore in April as investors preferred to book profit on relief rally in market. It was down 22 per cent month-on-month.

Given the economic uncertainty, investors preferred hybrid over equity funds. The inflows into hybrid funds were up 33 per cent at ₹20,765 crore (₹14,248 crore).

Arbitrage funds registered the highest inflow of ₹15,702 crore (₹11,790 crore), followed by multi asset funds at ₹2,927 crore (₹2,106 crore), while dynamic asset allocation recorded fresh investment of ₹1,136 crore (₹881 crore).

Redemptions from equity funds increased 16 per cent to ₹37,591 crore (₹32,479 crore) as markets bounced back after long pause. Among equity funds, flexi and small cap funds registered the highest inflow of ₹3,841 crore (₹5,542 crore) and ₹3,214 crore (₹4,000 crore). Multi and mid-cap funds also received healthy inflow of ₹2,999 crore (₹2,552 crore) and ₹2,809 crore (₹3,314 crore).

Overall equity assets increased to ₹32.05 lakh crore (₹30.58 lakh crore) largely due to mark-to-market gain of ₹1.28 lakh crore.

Venkat N Chalasani, Chief Executive, AMFI, said the lower inflows into equity schemes were quiet natural given the economic uncertainty and geopolitical issues.

In this phase, retail investors often reallocate funds to hybrid and arbitrage schemes, offering a more balanced approach during uncertain times, he added.

SIP inflows

Inflows through the systematic investment plans (SIP) hit a new high of ₹26,688 crore (₹26,632 crore) in May, with the number of contributing accounts increasing to 8.56 crore (8.38 crore).

The industry opened 59 lakh (46 lakh) new SIP accounts, while 43 lakh (1.62 crore) were closed last month.

Himanshu Srivastava – Associate Director-Manager Research, Morningstar Investment Research India, said the broader slowdown in equity inflows can be attributed to concerns around global economic headwinds and possible profit-booking in domestic equities, following sharp rallies in the previous months amid stretched valuations.

Heightened global volatility due to geopolitical tensions with India launching Operation Sindoor against Pakistan and concerns around global inflation, contributed to a risk-off sentiment among some investors, he added.

Suranjana Borthakur, Head of Distribution, Mirae Asset Investment Managers, said investor confidence remains strong with SIP contributions holding steady, even while equity inflows have moderated.

The dip in large-cap and flexi-cap inflows reflects near-term caution, but attractive valuations in large-caps could lead to renewed interest, she said.

Sanjay Agarwal, Senior Director, CareEdge Ratings, said despite the outflow in debt funds, the overall AUM was at ₹17.54 lakh crore, roughly at similar levels compared with April due to mark-to-market gain.

Published on June 10, 2025