Markets are near historic highs as all positives have been factored into share prices with only a small margin for error.

In the broader market, investors must monitor earnings growth (which is only modest), and pricey valuations amidst an uncertain and volatile global environment.

At this point, defensive earnings growth offered by the healthcare sector should interest investors. But even within healthcare, pharmaceuticals are again under a cloud with Trump tariffs reaching a feverish pitch recently. Despite having long-term drivers firmly in place, pharma investors will have to deal with the short-term noise. The current dynamics in the sector may present a better entry point for long-term investors with a risk appetite that tides over the impending tariff volatility in the near term.

Among mutual funds operating in healthcare, ICICI Pru’s Pharma Healthcare & Diagnostics Fund has delivered strong benchmark beating returns, and can be considered for healthcare exposure.

Sector noise

Firstly, US President Donald Trump’s tariff announcements have started targeting pharmaceuticals again. Trump announced that unless companies start producing pharmaceuticals in the US in a year’s time or more, imports to the US will have to face 200 per cent tariffs.

India primarily exports generics to the US; close to half of the generics consumed in the US are sourced from India. Given the dependency on imported generics, the lower size of the market (generics are 90 per cent by volume and 20 per cent by value), and a probable uniform impact on all importers, except the ones based in the US, the impact of tariff will largely be borne by consumers and only partially by manufacturers. Nifty Pharma index has gained 8 per cent in the last one year, a period marked by tariff discussions, as investors have assessed the impact of the same.

The sector could be in for a volatile period on the product front. Generic Revlimid opportunity comes to a halt in early January 2026, a product which benefitted several players in India. Diabetes opportunity could open around the same time and will have to be monitored which player is geared to leverage this.

The other sectors in the segment, such as hospitals and diagnostics, offer diversification benefits. Hospitals have rerated to higher valuations. As healthcare is increasingly a private service in India as opposed to government-provided, the industry can consistently expand volumes and maintain pricing growth. Listed diagnostic chains are benefitting from the unorganised to organised transition, which is driving volumes, but price-based competition is pressuring the sector.

Fund performance and holdings

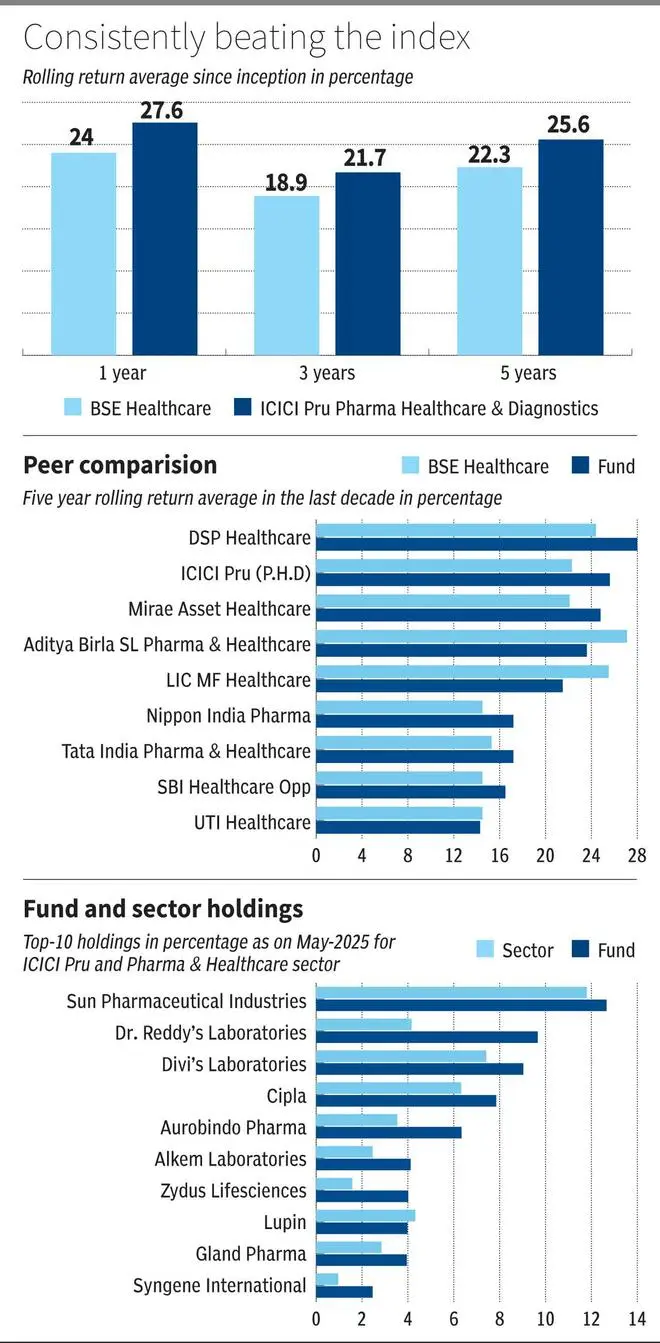

The fund has an average rolling five-year returns of 25.6 per cent against BSE Healthcare index returns of 22.3 per cent since its inception in 2018. Even in one- and three-year periods, the fund outperformed the index as shown in the table.

The fund holds up well when compared across healthcare funds as illustrated. Investors must note that while, ICICI Pru, DSP Healthcare or Mirae have higher returns compared to Nippon, SBI and UTI, it can be attributed to the fund legacy period. The former three started operations in the 2018-19 period, when Pharma stocks turned around negative growth, and valuations started increasing, while the other three funds have been operating for nearly 20 years.

The fund is overweight on pharmaceuticals with 77 per cent as on May 25 compared to the segment average of 69 per cent. Hospitals and labs are underweight at a combined 6.7 per cent compared to sector weight of 15 per cent which could be attributed to higher valuations in the segments.

Within Pharmaceuticals, Sun Pharma holds the biggest weight at 12.7 per cent and has come off from 16 per cent in January 2024. In the period thereafter, Divi’s Labs weight increased from 2 per cent to 9 per cent now. The prospects of contract research and manufacturing that Divi’s is into have improved on the back of US Bio secure act; this is reflected in fund holdings. The funds are also overweight on Dr Reddy’s at 9 per cent compared to the sector average of 4 per cent. This could be attributed to impending diabetes franchise the company is aiming at which has been the basis of our hold call on the stock recently.

Published on July 12, 2025