- The European Commission and Germany plan to boost defence investment.

- US President Donald Trump’s trade war triggered unimaginable global uncertainty.

- EUR/USD rally may continue towards the 1.1000 psychological threshold.

The EUR/USD pair reached levels not seen since last November, settling not far below 1.0888, the Friday high. The US Dollar’s (USD) sell-off was the result of tepid United States (US) data and mounting fears President Donald Trump’s tariffs will result in an economic setback.

Germany proposes to boost EU defence

On the other hand, German headlines boosted the Euro (EUR) as the upcoming Chancellor, Friedrich Merz, announced plans to increase military and infrastructure spending while pushing for the European Union (EU) to do the same. Merz, the leader of the Christian Democratic Union (CDU), still has to form a government before March 25, but has already struck a deal with the Social Democratic Party (SPD) and Bavaria’s Christian Social Union (CSU) to boost spending by establishing a proposed €500 billion special fund to finance infrastructure projects outside normal budgetary spending over the next decade.

The decision came in response to US President Donald Trump’s threatening to retrieve support for Kyiv, which he finally did on Tuesday, freezing aid to Ukraine.

Additionally, European Commission President Ursula Von der Leyen presented a plan to mobilize around 800 billion EUR for Europe’s defence and help provide immediate military support for Ukraine after Washington suspended aid. The EU would issue bonds and loosen its regulations to free up such an amount of Euros.

European Central Bank monetary policy announcement

The European Central Bank (ECB) announced its monetary policy decision on Thursday, and as widely anticipated, European policymakers trimmed the three key benchmark rates by 25 basis points (bps) each. The interest rates on the deposit facility, the main refinancing operations and the marginal lending facility, were decreased to 2.50%, 2.65% and 2.90%, according to the accompanying statement. Officials said, “Our monetary policy is becoming meaningfully less restrictive,” but also highlighted increased uncertainties.

ECB President Christine Lagarde repeated in her press conference that officials remain data-dependent and future decisions will continue to be made meeting by meeting. Nevertheless, she also hinted at the possibility of keeping rates on hold, which ended up pushing the EUR even higher.

Finally, Lagarde mentioned that the ECB’s Governing Council believes that the massive spending plans proposed by Germany and the European Commission would inevitably boost the EU economy.

US Dollar revolves around Trump

Meanwhile, the US Dollar collapsed as President Trump battles neighbours Canada and Mexico. The US government effectuated 25% tariffs on imports from both countries on Tuesday, only to start reversing such measures 24 hours later. Trump spared carmakers from such levies for a month on Wednesday, while rolling back additional tariffs on Thursday.

Trump eliminated or reduced tariffs on goods under the North American free trade pact, the US-Mexico-Canada Agreement (USMCA), which includes potash, a key ingredient for fertilizer needed by US farmers, televisions, air conditioners, avocados and beef, among other goods. Still, the White House noted that roughly 50% of Mexican imports and around 62% of Canadian ones still face levies.

Concerns about the negative impact of tariffs on US growth and inflation sent the Greenback into a selling spiral.

Macroeconomic data fuels pessimism

Throughout the week, the focus was on growth and US employment-related data, although its relevance diminished by trade-war headlines.

The Hamburg Commercial Bank (HCOB) and S&P Global released the final estimates of the February Purchasing Managers’ Index (PMI). EU and US manufacturing output was upwardly revised, but the European indexes held within contraction territory. The EU Services PMI was downwardly revised in the same month, while the US index resulted at 51.0, better than the 49.7 anticipated.

The US official ISM Manufacturing PMI contracted to 50.3 in February from 50.9 in January, while the ISM services index improved from 52.8 to 53.4.

As per US employment data, the ADP report on Employment Change showed that the private sector added 77K new jobs in February, much worse than the 140K expected. Additionally, Q4 Unit Labor Costs declined to 2.2% from 3% in the previous quarter, although Nonfarm Productivity improved in the same period to 1.5% from 1.2% in Q3.

Last month, US-based employers announced plans to slash 172,017 jobs, a 103% increase from January and the highest February total since 2009, according to the Challenger Job Cuts report.

Finally, the Nonfarm Payrolls (NFP) report released on Friday showed that the economy added 151K new jobs in February, below the 160K anticipated. Additionally, the Unemployment Rate edged higher to 4.1% from 4% in January, while the Participation Rate declined to 62.4% from 62.6% in the same period. Average Hourly Earnings, in the meantime, rose to 4% from 3.9% (revised from 4.1%).

Tepid US employment-related data maintained the US Dollar on the back foot ahead of the weekly close and helped EUR/USD reach the aforementioned multi-week peak.

What’s next in the docket

In the upcoming days, US and Ukrainian officials will meet in Saudi Arabia to discuss a peace framework to end the Russia-Ukraine war. US President Trump and his Ukrainian counterpart, Volodymyr Zelenskyy, clashed in the White House last week, yet Zelenskyy moved to patch up the relationship with the US. Meanwhile, Trump pressures to clinch a deal on rate metals with the battered country.

The fact that the US is separately negotiating with Ukraine and Russia adds a big question mark to a potential peace deal.

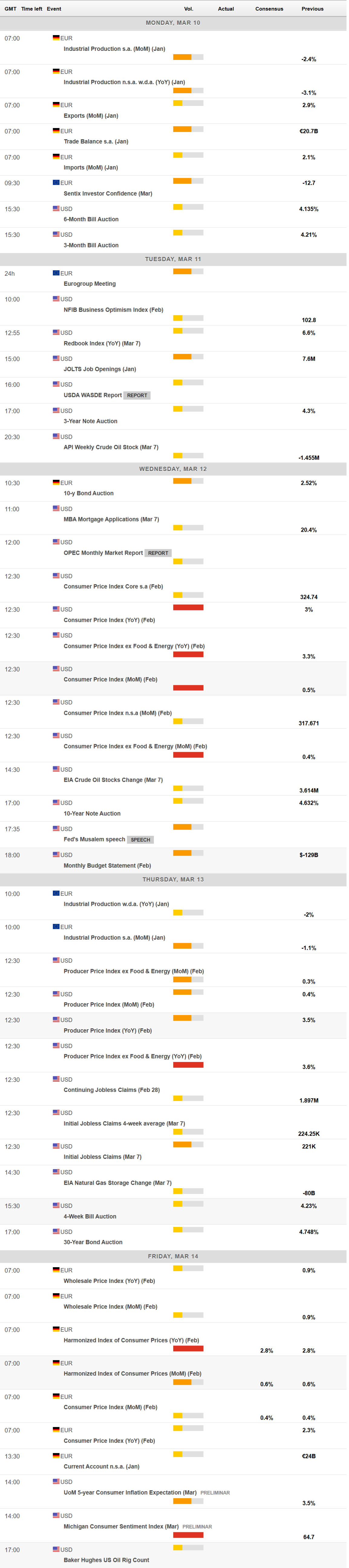

Data-wise, the US will publish the February Consumer Price Index (CPI) on Wednesday, followed by the Producer Price Index (PPI) on Thursday. By the end of the week, the country will release the preliminary estimate of the March Michigan Consumer Sentiment Index, while Germany will unveil the final estimate of the February Harmonized Index of Consumer Prices (HICP).

EUR/USD technical outlook

The EUR/USD pair added roughly 460 pips in the last five days, its best weekly performance in decades. Technical readings in the weekly chart support additional advances, moreover, if the pair surpasses the mentioned high, where a bearish 200 Simple Moving Average (SMA) provided resistance. The same chart shows the pair rallied past still flat 20 and 100 SMAs, with the shorter one losing its downward strength. Finally, technical indicators crossed their midlines into positive levels, maintaining almost vertical slopes, in line with higher highs ahead.

The daily chart for EUR/USD shows it is extremely overbought, yet technical indicators keep heading north, suggesting the rally may continue before a relevant corrective decline takes place. At the same time, the pair ran past all its moving averages, with the 20 SMA turning north below the longer ones. The 200 SMA now provides dynamic support at around 1.0725.

The 1.0800 threshold is the immediate support ahead of the aforementioned 200-day SMA, followed by December’s peak at 1.0629. A run beyond 1.0890, on the other hand, exposes the psychological 1.1000 mark, ahead of the 1.1080 region. Further gains should open the door for a test of the September 2024 high at 1.1213.

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.