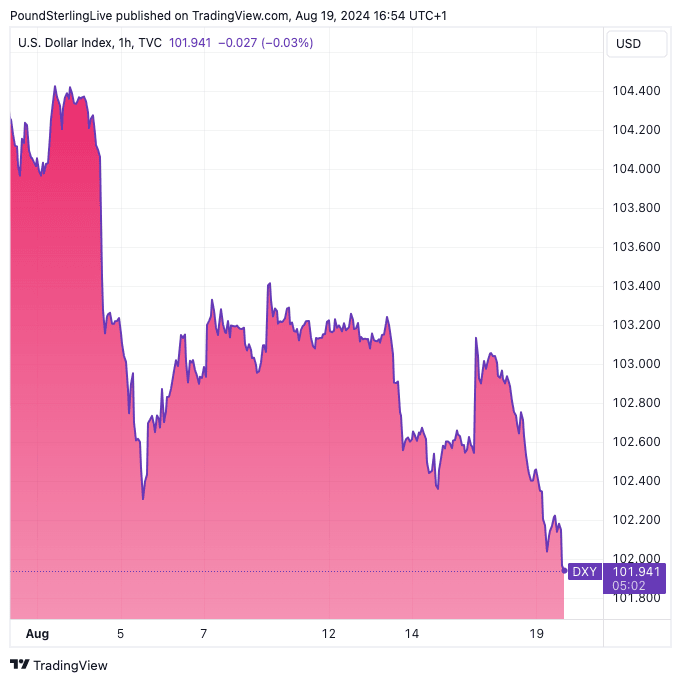

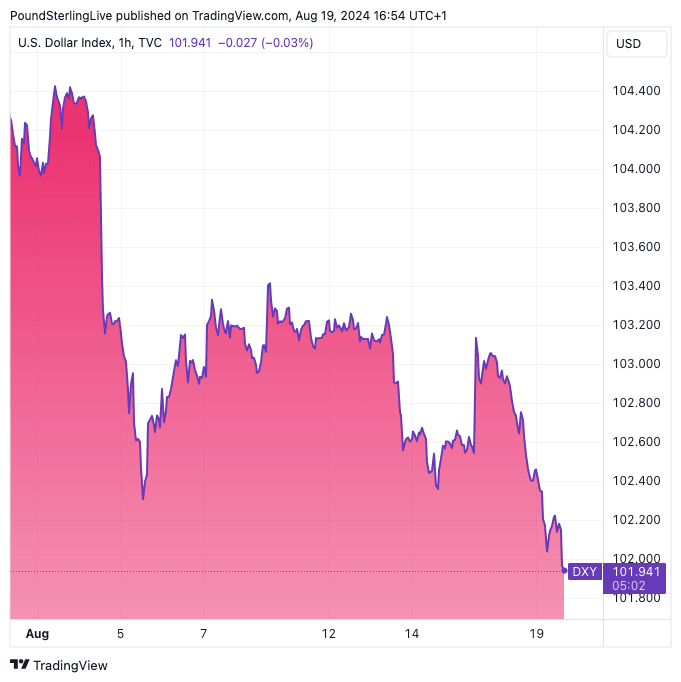

The Dollar has fallen to a seven-month low amidst a build-up in expectations for a September interest rate cut at the Federal Reserve.

“Rate cut expectations of at least 25 basis points at the Fed’s September meeting and 94 basis points before year-end continue to put pressure on the US dollar with it depreciating to a seven-month low against a basket of major currencies,” says Axel Rudolph, an analyst at IG.

GBP/USD is trading a third of a per cent higher on the day at 1.2984, and EUR/USD cements itself above 1.10 by advancing a further 0.34% to 1.1066. The Dollar index – a broad measure of overall USD performance – is down 0.40% at 101.99 (see main chart).

Markets are ramping up expectations for a steady run of interest rate cuts, which they think will be confirmed in a keynote address to the Jackson Hole Symposium by Fed Chair Jerome Powell on Friday.

“A key event risk for this calendar cycle is Jackson Hole on August 22-24. Fed pricing could be volatile during those days,” says Francis Yard, a strategist at Deutsche Bank.

Currently, the market is pricing between 25 bps and 50 bps of cuts for September, and a little under 100 bps of total cuts for the year.

The lick for the Dollar will be whether or not these expectations are reinforced by Powell’s comments.

Economists at Deutsche Bank warn the Fed will only deliver 75 bps of cuts this year, with 25 bps at each meeting. This would disappoint current market expectations, potentially slowing the USD’s descent or even reversing recent losses.

The Jackson Hole Symposium is the main focus of a data-light week for currency markets, with investors looking for confirmation of a September interest rate cut at the Fed.

Fed Chair Jerome Powell and the Bank of England’s Andrew Bailey are scheduled to talk, which hints at volatility from both ends of the GBP/USD equation.

“We expect Powell’s message and the sideline interviews will be close to what we have been hearing over the past few weeks – that the Fed is now close to cutting interest rates but the degree of easing will depend on incoming data,” says Lexi Kanter, an economist at Goldman Sachs.

Goldman Sachs expects three consecutive 25bp cuts starting in September and thinks the market has moved too far towards pricing a 50bp cut at the next meeting following the weaker-than-expected July employment data.

If Powell pushes the market to lower rate cut bets, the Dollar can recover into the weekend.