- The Pound Sterling rebounded slightly after hitting monthly lows against the US Dollar.

- GBP/USD looks to Powell’s and Bailey’s testimonies ahead of US PCE inflation data next week.

- Technically, the daily RSI flips bullish as the Pound Sterling defends 50-day SMA support.

The Pound Sterling (GBP) staged a late recovery against the US Dollar (USD) after the GBP/USD pair corrected sharply to monthly lows below 1.3400.

Pound Sterling buyers fight back control

The price action around the GBP/USD pair in the past week was mainly dictated by the ongoing developments surrounding the Israel-Iran geopolitical escalation even as trade uncertainties continued to linger.

The US Dollar received a double booster shot amid reviving safe-haven demand, courtesy of the Middle East conflict, and the hawkish hold decision by the US Federal Reserve (Fed).

This USD resurgence weighed heavily on the Pound Sterling, fuelling steep declines in the pair until mid-Thursday’s trading as markets digested the Bank of England’s (BoE) dovish policy outcome.

Last Sunday, Israel and Iran launched fresh attacks, raising concerns of a broader regional conflict that could hit trade flows under risks through the Strait of Hormuz.

Risk sentiment deteriorated and the Greenback gathered strength in the first half of the week, following speculations that the US could initiate an offensive operation against Iran, supporting its ally, Israel.

US President Donald Trump called for Iran’s unconditional surrender and held an emergency National Security Council (NSC) meeting earlier in the week.

Meanwhile, the US and Japan failed to reach a trade deal on the sidelines of the G7 Summit, curbing risk flows further as investors continued to run for cover in the US currency.

Midweek, the Fed announced that it held policy rates in the range of 4.25%-4.5%, as widely expected, while keeping the projections for two interest rate cuts this year intact.

However, it trimmed expectations for further cuts in 2026 and 2027. The Fed also slashed growth forecasts while revising the inflation outlook higher.

Markets quickly looked past the Fed verdict after several media outlets reported that the US was considering an attack on Iran as early as this weekend, with President Trump particularly weighing strikes on Iran’s heavily fortified Fordow nuclear facility.

However, the chatter quickly died down after Trump said late Thursday that he would delay his final decision on launching strikes for up to two weeks.

Early Friday, a US Senate Intelligence Committee Chair reported Trump as saying, “I will give Iran a last chance to make a deal before we strike.”

Ebbing Middle East fears diminished the USD’s safe-haven appeal, allowing GBP/USD to build on the rebound from four-week troughs of 1.3383.

Against this backdrop, the Pound Sterling stood resilient to the BoE’s dovish shift. The UK central bank kept interest rates steady at 4.25%, meeting the expectations. However, Governor Andrew Bailey hinted at cutting rates in the future.

The voting composition came out dovish. Six out of nine of the BoE’s Monetary Policy Committee (MPC) members opted to hold rates while three voted in favor of a 25 basis points (bps) cut. This compares with the 7-2 split that analysts had expected.

However, the recovery gains appeared capped amid a weak UK Retail Sales report and looming Middle East and trade uncertainty heading into the weekend.

The UK Retail Sales dropped by 2.7% in May, data from the Office for National Statistics (ONS) showed Friday, a much sharper decline than the 0.5% contraction expected. The core Retail Sales figure also fell short of market expectations.

Central banks’ talks and Middle East updates to dominate

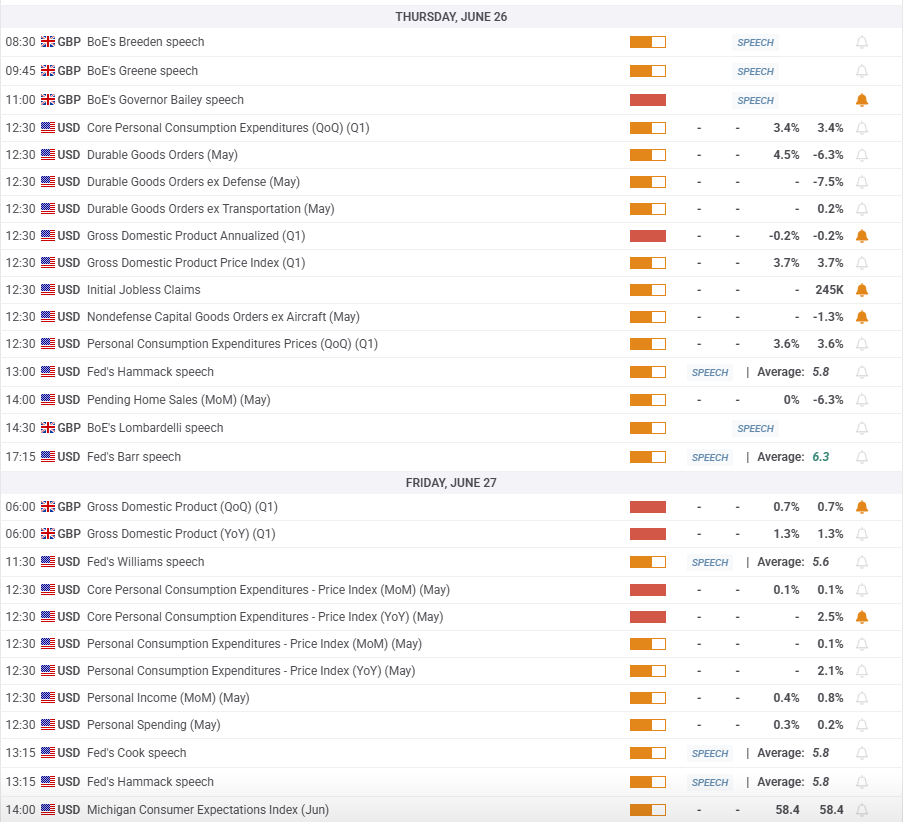

Even though the Fed and the BoE policy announcements are out of the way, testimonies by Fed Chair Jerome Powell and his counterpart Andrew Bailey will be keenly awaited in the week ahead.

The week opens with a bang as the S&P Global preliminary Purchasing Managers’ Index (PMI) data from the US and the UK will be reported.

The business PMI data is critical to gauging the state of the economies on both sides of the Atlantic.

Bailey will testify before the Lords Economic Affairs Committee on Tuesday.

Powell’s testimony on the semi-annual Monetary Policy Report before the House Financial Services Committee also on Tuesday, followed by the hearings before the Senate on Wednesday.

Tuesday will also feature the US Conference Board (CB) Consumer Confidence data.

Moving on into the second half of the week, Governor Bailey is scheduled to speak at the British Chambers of Commerce, in London, on Thursday.

The focus will be also on the US Durable Goods Orders, Jobless Claims and final Gross Domestic Product (GDP) data on Thursday.

The week’s main highlight will drop on Friday – the Fed’s preferred inflation gauge, the core Personal Consumption Expenditures (PCE) Price Index, wrapping up another busy week.

Apart from the central bank speak and statistics, the developments on the trade front and geopolitical updates from the Middle conflict will continue to drive Pound Sterling markets during the week.

GBP/USD: Technical Outlook

Having faced rejection above the 1.3600 threshold on several occasions, GBP/USD finally caved into the bearish pressures and corrected sharply, breaching strong support levels on its way to challenging the critical 50-day Simple Moving Average (SMA) support at 1.3398.

Heading into the weekend, the bullish potential is back in play as the GBP/USD pair defended the mentioned demand zone.

The 14-day Relative Strength Index (RSI) has recaptured the midline, currently near 52, justifying the renewed upswing.

On its road to recovery, the pair scaled the powerful support-turned-resistance at 1.3445, the April 28 high.

The next topside barrier is the 21-day SMA at 1.3521. A sustained break above that level will open the door for a retest of 1.3600.

Further up, the monthly top of 1.3633 and the February 2022 high at 1.3643 will provide stiff resistance to buyers on the way to the 1.3700 round figure.

On the flip side, if the 21-day SMA acts as a tough nut to crack, Pound Sterling sellers will likely return to take on the 50-day SMA support of 1.3398 once again.

A sustained move below that level will trigger a fresh downtrend toward the 1.3260 static support.

The last line of defense for buyers is seen at the May 12 low of 1.3140.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data.

Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates.

When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money.

When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP.

A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.