- The Pound Sterling refreshed 39-month highs against the US Dollar.

- The Fed and BoE policy verdicts will drive the next GBP/USD price direction.

- GBP/USD’s positive outlook remains intact amid a Bull Pennant in play on the daily chart.

The Pound Sterling (GBP) stood tall for the third consecutive week against the US Dollar (USD) as the GBP/USD pair refreshed 39-month highs above 1.3600.

Pound Sterling maintained the bullish undertone

Following a phase of upside consolidation in the first half of the week, GBP/USD regained traction in the latter part and hit the highest level since February 2022, near 1.3635.

The choppy price action seen earlier on was mainly attributed to the rangebound movement seen in the US Dollar as markets assessed the progress in the US-China trade talks.

Following a two-day talk in London, the United States (US) and China decided to ease export controls, including the ones on rare earths, and agreed on a framework to keep the tariff truce effective.

The Greenback gained briefly but returned to the red in a familiar range amid a lack of specifics on the trade framework.

Additionally, a surprise cooldown in the US consumer inflation data revived the selling interest around the buck on increased dovish US Federal Reserve (Fed) expectations.

The US Consumer Price Index (CPI) increased 0.1% for the month, putting the annual inflation rate at 2.4%. Both prints undermined expectations of 0.2% and 2.5%, respectively. Core figures also came in below estimates across the time horizons.

Meanwhile, geopolitical tensions between Israel and Iran started brewing up on Thursday after CBS News senior White House reporter Jennifer Jacobs reported early Thursday that US officials have been told Israel is fully ready to launch an operation into Iran.

Middle East tensions helped the Greenback hold ground, but disappointing US Producer Price Index (PPI) and Jobless Claims data triggered USD’s fresh leg down, providing the much-needed boost to the pair.

As a result, the major reclaimed the 1.3600 level and renewed over three-year highs. However, sellers quickly jumped in on Friday after the US currency regained safe-haven status on an intense global flight to safety, induced by Israel’s pre-emptive strike on Iran’s nuclear facility.

The strikes likely killed members of Iran’s general staff, including the chief of staff and several senior nuclear scientists, an Israeli defence official said.

Iran’s Armed Forces General Staff warned that Israel and the US will “pay a very heavy price”.

US President Donald Trump noted that Iran cannot have a nuclear bomb while reiterating that he hopes for a peaceful end to the tensions.

With risk-off sentiment at full steam, the higher-yielding Pound Sterling came under heavy selling pressure, posing a double-whammy for the GBP/USD pair. Ahead of the weekend, the data from the US showed that the University of Michigan’s Consumer Sentiment Index improved to 60.5 in June’s flash estimate from 52.2 in May. This reading came in better than the market expectation of 53.5 and helped the USD preserve its strength.

All eyes on Fed and BoE policy announcements

After an action-packed week, attention turns to central banks’ policy announcements.

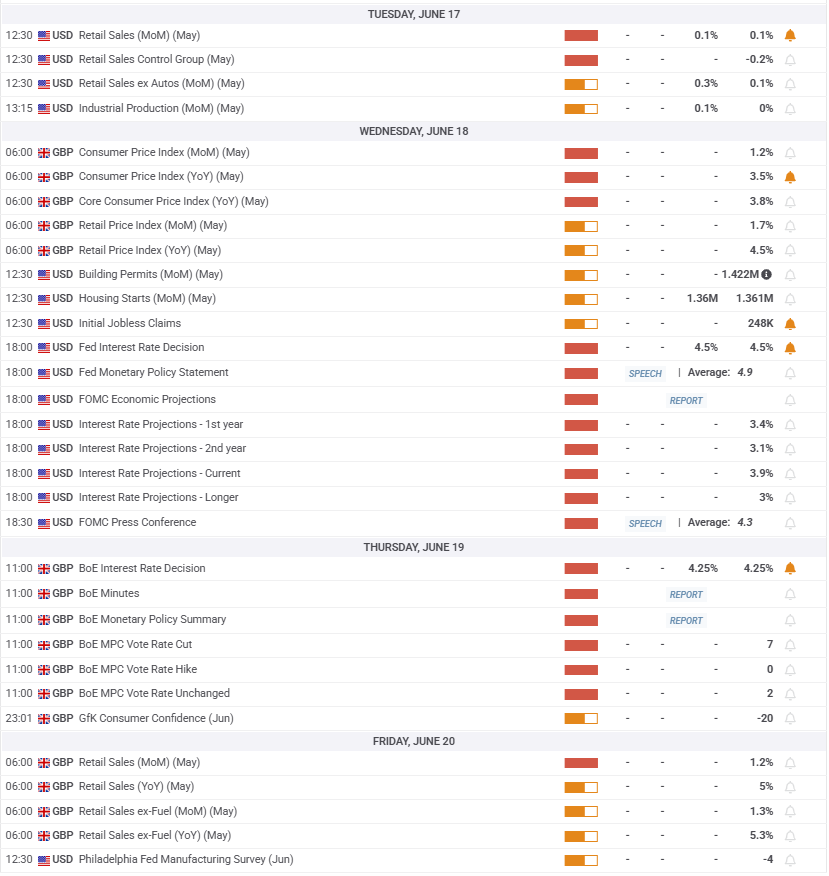

Pound Sterling traders keenly await the interest rate decisions from the Fed and the Bank of England (BoE) due on Wednesday and Thursday, respectively.

The Fed is widely expected to keep the policy rate unchanged in the range of 4.25%-4.5%. The BoE is also expected to keep rates on hold at 4.25% this month.

In the first half of the week, the US Retail Sales will entertain traders on Tuesday after a data-light Monday.

While on Wednesday, the UK CPI inflation and US weekly Jobless Claims data will draw attention ahead of the Fed event risk.

The UK Retail Sales on Friday will wrap up the central banks’ dominated week.

Also, of note will remain the developments on the trade front and geopolitical updates from the Middle East and the Ukraine conflict.

Fed policymakers will return on Friday, and their speeches will be closely scrutinized for further clarity on the central bank’s June policy decision.

GBP/USD: Technical Outlook

The daily chart shows that the constructive outlook remains intact even though GBP/USD has pulled back sharply from multi-year highs.

The previous week’s Bull Pennant confirmation continues to remain supportive of the bullish bias.

Strengthening the bullish potential, the 14-day Relative Strength Index (RSI) holds firm above the midline, currently near 57.

The 100-day Simple Moving Average (SMA) and the 200-day SMA bullish crossover continue to favor buyers.

The pair must find acceptance above the 1.3600 threshold on a daily closing basis to take on the February 2022 high at 1.3643.

The next stiff resistance aligns at the $1.3700 round figure.

Fresh buying interest could emerge above the latter, opening the door toward the January 2022 high at 1.3749.

Alternatively, rejection once again above the 1.3600 barrier could fuel a fresh correction toward the 21-day SMA at 1.3495.

Sellers will then challenge the April 28 high of 1.3445.

If the downside gathers steam, the 50-day SMA support at 1.3372 could rescue buyers.