- The Japanese Yen continues to benefit from US tariffs-inspired global flight to safety.

- Hopes for a US-Japan trade deal further underpin the JPY amid sustained USD selling.

- The divergent BoJ-Fed expectations support prospects for deeper USD/JPY losses.

The Japanese Yen (JPY) retains its bullish bias for the second straight day against a broadly weaker US Dollar (USD) and drags the USD/JPY pair back closer to the 145.00 psychological mark during the Asian session on Wednesday. Investors continue to take refuge in traditional safe-haven assets, including the JPY, amid concerns about a tariffs-driven global recession. Adding to this reports that US President Donald Trump has agreed to meet Japanese officials to initiate trade discussions fuel optimism about a possible US-Japan trade deal, which further underpins the JPY.

Meanwhile, investors now seem convinced that the Bank of Japan (BoJ) will raise interest rates further in 2025 on the back of broadening domestic inflation. This marks a big divergence in comparison to bets that a tariffs-driven US economic slowdown might force the Federal Reserve (Fed) to resume its rate-cutting cycle soon. This continues to exert downward pressure on the US Dollar (USD) and suggests that the path of least resistance for the lower-yielding JPY remains to the upside. Traders now look forward to the release of FOMC meeting minutes for a fresh impetus.

Japanese Yen is underpinned by sustained safe-haven demand, hawkish BoJ expectations

- Mounting worries that US President Donald Trump’s sweeping tariffs would push the US, and possibly the global economy, into recession this year have led to an extended sell-off in equity markets worldwide. In fact, the S&P 500 registered its steepest four days of losses since the 1950s after Trump unveiled sweeping reciprocal tariffs late last Wednesday.

- Japan’s Prime Minister Shigeru Ishiba and Trump agreed to keep dialogue open to address the pressing levy issues. Moreover, Trump told reporters that we have a great relationship with Japan and we’re going to keep it that way. This fuels optimism about a possible US-Japan trade deal, which lends additional support to the safe-haven Japanese Yen.

- Investors have pared their bets that the Bank of Japan will hike interest rates at a faster pace amid concerns about the potential economic fallout from Trump’s trade tariffs. However, BoJ Deputy Governor Shinichi Uchida said last Friday the central bank will keep raising interest rates if the chance of underlying inflation achieving its 2% target heightens.

- Meanwhile, investors now seem convinced that a tariffs-driven US economic slowdown would put pressure on the Federal Reserve to resume its rate-cutting cycle. According to the CME Group’s FedWatch Tool, the markets are currently pricing in over a 60% chance that the US central bank will lower borrowing costs at the next policy meeting in May.

- Moreover, the Fed is expected to deliver five interest rate cuts by the end of this year despite expectations that Trump’s tariffs will boost inflation. This, in turn, weighs on the US Dollar for the second straight day and keeps the USD/JPY pair within striking distance of its lowest level since October 2024 touched last Friday.

- Traders now look forward to the release of FOMC meeting minutes, due later during the US session this Wednesday. Apart from this, the US Consumer Price Index (CPI) and the Producer Price Index (PPI) on Thursday and Friday, respectively, might provide cues about the Fed’s rate-cut path. This, in turn, will drive the buck and USD/JPY.

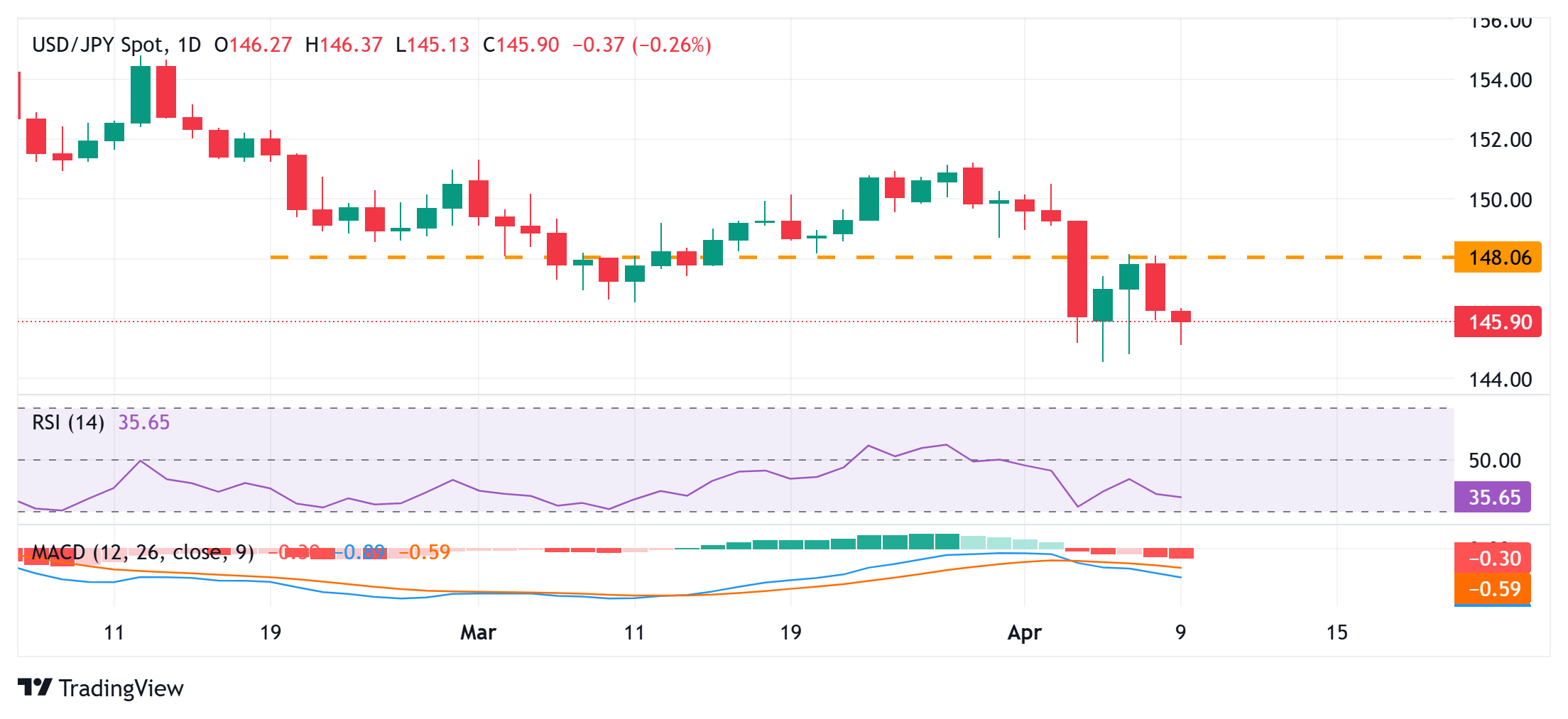

USD/JPY could accelerate the fall towards a multi-month low once the 145.00 mark is broken

From a technical perspective, this week’s failure to find acceptance above the 148.00 mark and the subsequent fall favors bearish traders. Moreover, oscillators on the daily chart are holding deep in negative territory and are still away from being in the oversold zone, suggesting that the path of least resistance for the USD/JPY pair is to the downside. Some follow-through selling below the 145.00 psychological mark will reaffirm the negative outlook and expose the year-to-date low, around the 144.55 region touched on Monday, before spot prices eventually drop to the 144.00 round figure.

On the flip side, the 146.00 mark now seems to keep a lid on any attempted recovery. This is followed by the Asian session high, around the 146.35 region, above which a bout of a short-covering could lift the USD/JPY pair to the 147.00 round figure en route to the 147.40-147.45 area. The subsequent move-up should allow bulls to reclaim the 148.00 mark and test the weekly top, around the 148.15 zone. A sustained strength beyond the latter might shift the near-term bias in favor of bullish traders and pave the way for some meaningful appreciating move.

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.