USD/JPY

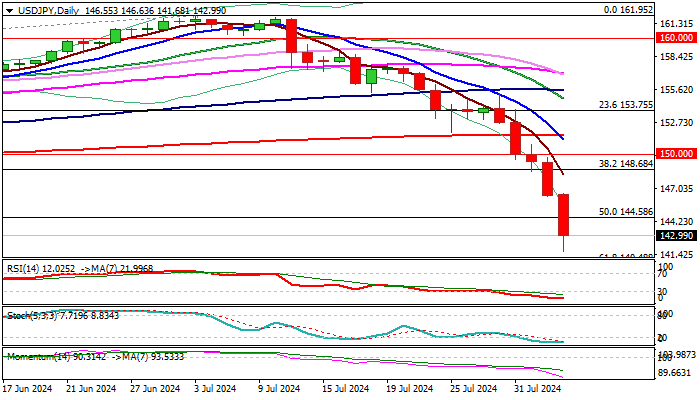

USDJPY fell sharply overnight, hitting the lowest since early January, extending steep bear-leg off 155.21 lower top into fifth consecutive day.

The pair was down 3.3% in Asian session on Monday, remaining under increased pressure after downbeat US NFP data further soured dollar’s sentiment.

Large bearish candle of last week (USDJPY was down 4.7% for the week, in the biggest weekly drop since the second week of November 2022) weighs heavily on near-term action, in addition to firmly bearish daily studies (the latest formation of 5/200 and 10/200DMA death-cross) reinforcing negative near-term outlook.

Key supports at 140.25/00 (Dec 28 low / psychological) are coming in focus), though strongly oversold conditions on daily chart may spark a partial profit-taking.

Bounce is likely to be limited and ideally capped under today’s peak at 146.63, to provide better levels for re-entering bearish market, for push towards 140 zone, violation of which to generate another strong bearish signal.

Res: 144.58; 146.48; 146.68; 148.68.

Sup: 141.68; 141.00; 140.25; 140.00.