- Dollar remains firm post-NFP as strong jobs data reinforces a hawkish Fed stance.

- EUR/USD and GBP/USD continue to trade under pressure below key resistance zones.

- All eyes on Wednesday U.S. CPI, which could confirm or challenge current rate expectations and price trajectory on EUR & GBP.

CPI to set the next big move

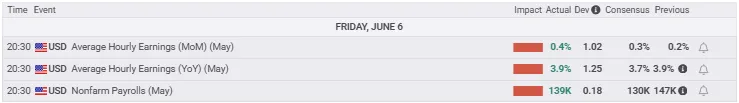

The U.S. dollar has steadied ahead of a pivotal week. After a modest Non-Farm Payrolls beat last Friday, traders are now focused on tomorrow’s U.S. CPI release (June 11) and what it means for Fed policy and interest rate expectations.

Both EUR/USD and GBP/USD remain capped below key resistance levels, with price action suggesting indecision-likely a reflection of anticipation for what could be the biggest data-driven catalyst of the month.

NFP recap

The data supports a “soft landing” narrative-slower hiring but still steady. The Fed has no urgent reason to pivot dovish just yet, keeping the U.S. dollar relatively supported.

Dollar holding its ground

With last week’s positive print, Dollar managed to hold its ground. Unless we see a break on either side of the range, a continued sideways will still pro-long until CPI release tomorrow.

US CPI tomorrow: What you need to know

Tomorrow’s CPI numbers could make or break the dollar’s range. A hotter-than-expected reading will likely reinforce Fed hawkishness and push the dollar higher.

EUR/USD on the edge

As long as EUR/USD remains under 1.1450, the path of least resistance is lower. A stronger dollar on CPI could break the current floor and open a move to 1.1220.

Key levels to watch:

- A break of 1.15 level with CPI favoring a weaker dollar, could send Euro to a break of resistance.

- If CPI print goes positive, we could expect Euro to trader lower.

GBP/USD support level breaking

As Dollar gains traction and a stronger Euro dominates Pound, GBP/USD is now trading below the current 4-hour range, showing signs of crack and dollar resilience.

Key levels to watch:

- A break of 1.34 support level could further weaken Pound ahead of CPI release tomorrow.

- As long as 1.34 is still in-tact, GBP/USD still has room for dips.

Be cautious of fake-outs during CPI volatility. Let the dust settle and trade confirmed structure with momentum.