Dollar continues to face broad-based selling pressure as the markets move into US session. Fed Governor Christopher Waller is set to speak, but he is expected to maintain his consistent view that Fed is nearing a rate cut while the economy remains on track for soft landing. The market’s primary focus, however, is squarely on Fed Chair Jerome Powell’s speech at the Jackson Hole Symposium later this week, where traders hope for more definitive guidance on the Fed’s next steps.

In the upcoming Asian session, attention will turn to China, where it is widely expected to keep one-year and five-year loan prime rates unchanged. This follows a modest 10 basis point cut in July, signaling a cautious approach to monetary easing. Meanwhile, RBA will release the minutes from its August meeting. Given the RBA’s firm stance that a rate cut is not on the horizon, the minutes are unlikely to offer any surprises, though traders will still comb through them for any hints of policy shifts.

Overall, Dollar is currently the day’s weakest performer, pressured by a mix of cautious sentiment and positioning ahead of Powell’s speech. Canadian Dollar and British Pound are also underperforming. In contrast, Japanese Yen has strengthened considerably, making it the strongest currency of the day, followed by Australian and New Zealand Dollars. Euro and Swiss Franc are trading in the middle of the pack.

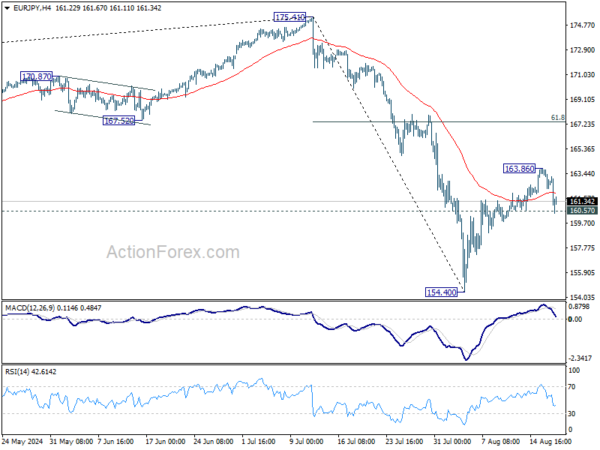

Technically, a major immediate focus is whether Yen’s rebound will gain further momentum. Key levels to watch include 160.57 minor support in EUR/JPY and 187.84 minor support at 187.84. USD/JPY has already broken corresponding level of 146.06 already. Firm break of these levels would argue that Yen’s near term pull back has completed, and these Yen crosses might then be ready to revisit the lows set earlier in the month.

In Europe, at the time of writing, FTSE is up 0.18%. DAX is up 0.37%. CAC is up 0.54%. UK 10-year yield is up 0.0094 at 3.941. Germany 10-year yield is down -0.001 at 2.250. Earlier in Asia, Nikkei fell -1.77%. Hong Kong HSI rose 0.80%. China Shanghai SSE rose 0.49%. Singapore Strait Times rose 0.08%. Japan 10-year JGB yield rose 0.0145 to 0.890.

Fed’s Kashkari: Appropriate to discuss rate cut in September

Minneapolis Fed President Neel Kashkari indicated that Fed’s focus is increasingly shifting toward concerns in the labor market, moving away from the inflation side of its dual mandate.

In an interview with WSI, Kashkari emphasized that “the balance of risks has shifted more towards the labor market,” making the debate over a potential rate cut in September “an appropriate one to have.”

While acknowledging that inflation is showing signs of progress, Kashkari expressed concerns about “concerning signs” in the labor market.

Despite these, he stated that there is no compelling reason to lower interest rates by more than a quarter percentage point at a time, citing the continued low levels of layoffs and unemployment benefit claims, which do not yet indicate a significant downturn in the labor market.

NZ BNZ services rises to 44.6, modest improvement, but remains under pressure

New Zealand BNZ Performance of Services Index saw a modest rise in July, climbing from 40.7 to 44.6. However, the PSI has averaged only 46.5 for 2024, a stark contrast to its historical average of 53.2.

Breaking down the details, there were slight improvements across most categories. Activity/sales increased from 36.2 to 39.1, and employment ticked up from 45.7 to 46.6. New orders/business rose from 38.9 to 45.3, and stock/inventories edged higher from 43.9 to 45.1. On the downside, supplier deliveries slipped slightly from 41.4 to 41.0.

Despite these gains, the overall sentiment remains cautious, with 67.0% of respondents expressing negative views about the current economic climate, unchanged from June. High living costs and rising interest rates were frequently cited as significant challenges.

BNZ’s Senior Economist Doug Steel provided a sobering perspective, noting that “the increase in the PSI does not even get the index back to the level it was during the depths of the GFC back in 2008/09.”

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2879; (P) 1.2913; (R1) 1.2979; More…

GBP/USD’s rise from 1.2664 is still in progress and intraday bias stays on the upside for retesting 1.3043 high. Firm break there will resume whole rise from 1.2998 to 61.8% projection of 1.2298 to 1.3043 from 1.2664 at 1.3124, which is close to 1.3141 high. On the downside, below 1.2880 minor support will turn intraday bias neutral first.

In the bigger picture, corrective pattern from 1.3141 might have completed at 1.2298 already. Rise from there could be resuming the larger up trend from 1.0351 (2022 low). Decisive break of 1.3141 will target 38.2% projection of 1.0351 to 1.3141 from 1.2298 at 1.3364 next. However, break of 1.2664 support will delay this bullish case once again and extend the corrective pattern from 1.3141.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | Business NZ PSI Jul | 44.6 | 40.2 | 40.7 | |

| 23:50 | JPY | Machinery Orders M/M Jun | 2.10% | 0.90% | -3.20% |