Clients taking the time this month to examine their equity portfolios are likely to find themselves comfortably in positive territory, with the MSCI All Country World Index up around 5 per cent in the 2025 calendar year.

But it may not have felt like that for lots of investors, with a number of dramatically volatile days interspersed within those positive returns.

US technology stocks tumbled in the middle of January after it was revealed that a Chinese product known as DeepSeek may be capable of disrupting or displacing the business models of some large US technology companies.

The stocks recovered somewhat.

The threat, or announcement of tariffs, displaced equity markets towards the end of January, before generally recovering.

But the market jitters actually began in the final months of 2024, as investors began to question the extent to which interest rates would be cut in the US – a fear that was reinforced by Federal Reserve chair Jay Powell questioning, in December 2024, the need for further rate cuts in an economy that was at full employment.

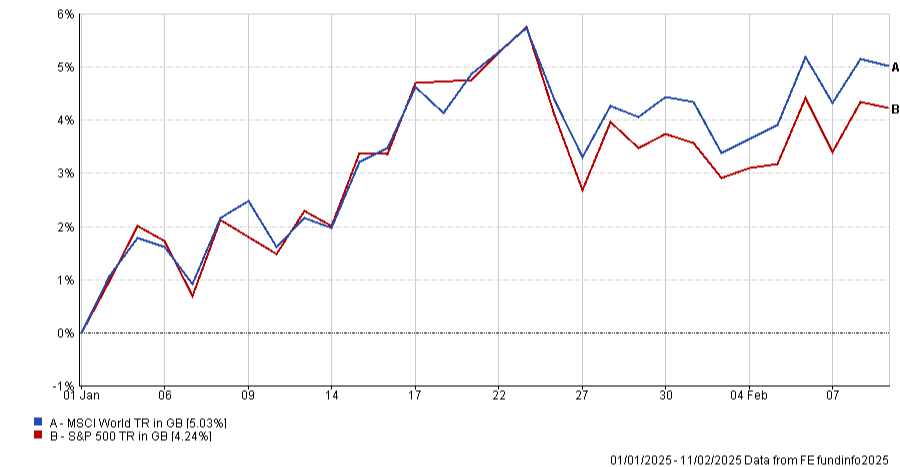

The chart below shows that from January 1 2025 to February 11 the global index outperformed relative to the US market, but given the waves of uncertainty that abound, how should one think about equity exposure in 2025?

Ben Preston, global equity fund manager at Orbis, says: “In my 25 years of being in markets, I don’t remember an environment where things felt like they were changing so rapidly, both in terms of technology and politics. Those things are of course quite difficult to predict.”

For James Sullivan, head of partnerships at Tyndall, the current volatility needs to be set against the long-term potential for equity markets to perform.

He says: “[US President Donald] Trump has thrown the proverbial cat amongst the pigeons, and if I’m permitted to be a little blasé, I’d suggest shaking things up on occasion is no bad thing; it helps reset and recalibrate, however, short term, whilst the market re-prices, it can cause a degree of discomfort. Once it all plays through, I suspect we will look back and wonder what the fuss was about – we often do.

“Companies broadly appear to be in good health, albeit still dependent on a consumer that is yet to win the fight against inflation. The one large concern remains the valuation of the US equity market that appears to be priced for perfection, which should come with a meaningful health warning. Equities ex-US, however, look great value on paper, but need earnings momentum and profitability to improve, to warrant a re-rating that makes us all some serious money.”

Michael Walsh, multi-asset solutions strategist at T Rowe Price, is a tad more cautious, his strategies are overweight to equities, and to US equities, but he has also been increasing the levels of cash in his portfolios as he feels “equities, even if not priced for perfection, are priced for something very close to that, and given the level of uncertainty in the world it is good to have a cash allocation that can then be deployed if equity markets do fall”.

James Klempster, deputy head of multi-asset at Liontrust, says the fact that equities have risen so stoutly this year to date, “despite the various market shocks, is an indication that if you stick to the fundamentals of what is happening in markets, that may be the best approach.

“But I would say that, we may be in a period where the largest US technology stocks perform somewhat less well as a result of the advent of developments in the AI technology universe, and mean that diversification by sector and geography are more important.”