Feverpitched/iStock via Getty Images

Introduction

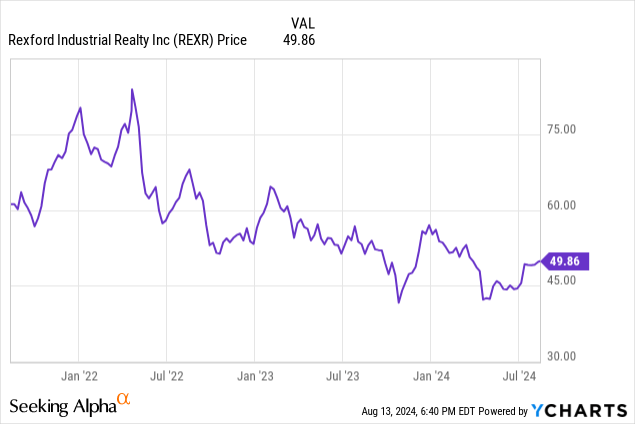

Rexford Industrial (NYSE:REXR) is one of the favorite REITs here on Seeking Alpha. And while most authors focus on the potential capital gains and dividend yield of the common units, I discussed the REIT’s preferred shares in an article last year. As the REIT has published financial results on four more quarters since my previous article was published, I thought it’s about time to review the REIT’s financial performance to see if the preferred shares still offer a decent risk/reward ratio. This article was written from the perspective of a preferred share investor.

The preferred dividends and preferred equity are very well-covered

Readers who have been following me for a while know I mainly focus on two elements when I have a closer look at preferred shares. I want to make sure the preferred dividends are fully covered while also checking the balance sheet risk to figure out how much common equity is on the balance sheet as that will be the first ‘cushion’ to absorb potential losses.

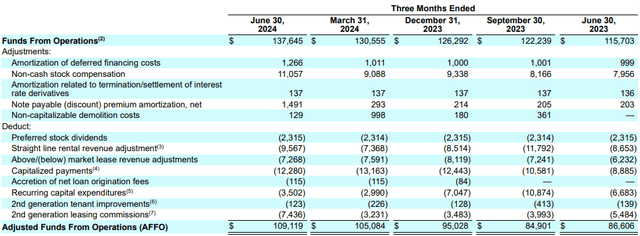

My first step is to look at the preferred dividend coverage ratio. And Rexford Industrial makes my life pretty easy. As you can see below, the REIT reported a total FFO of almost $138M in the second quarter of the year, and this resulted in an AFFO of $109M.

There currently are 219.5M units outstanding, resulting in an AFFO per share of approximately $0.50. This AFFO will likely continue to grow (and you can see the impressive evolution in the image above), but I’d like to refer you to the other authors here on Seeking Alpha that are covering this REIT and discuss the earnings potential on the common stock.

I’m mainly interested in the preferred shares, and the AFFO breakdown above clearly shows the $2.3M in quarterly preferred dividends is already included in the AFFO calculation. This means the total AFFO before taking the preferred dividends into consideration was approximately $111.5M, and the REIT needed just around 2% of the AFFO to cover the preferred dividends. I think this results in one of the best coverage ratios in the sector, and I see no issue on the preferred dividend coverage ratio front.

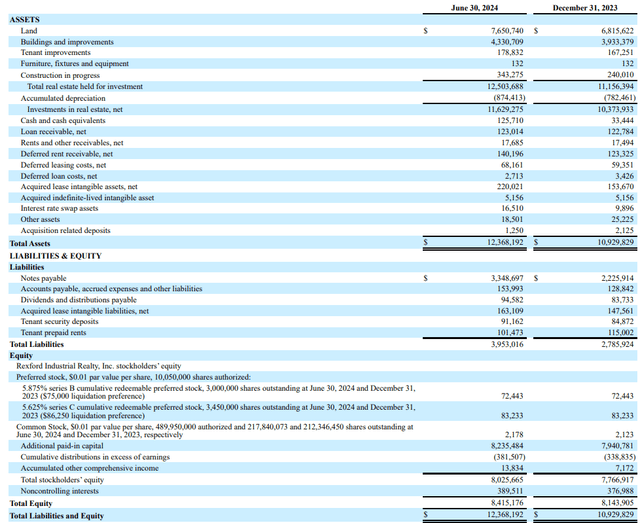

Moving over to the asset coverage ratio, as you can see below, the balance sheet is pretty strong. The total amount of assets is almost $12.4B, while the total amount of liabilities is just $3.95B. Additionally, the gross financial debt is just $3.35B, while the REIT also has $126M in cash on the balance sheet. This means the net debt level is approximately $3.22B, representing an LTV ratio of just around 28% versus the book value of the real estate assets. Using the book value of the assets, the 6.45M preferred shares with a $161M principal value appear to be very safe considering they are backed by in excess of $8B in equity. This means there’s almost $7.9B in common equity, which ranks junior to the preferred shares.

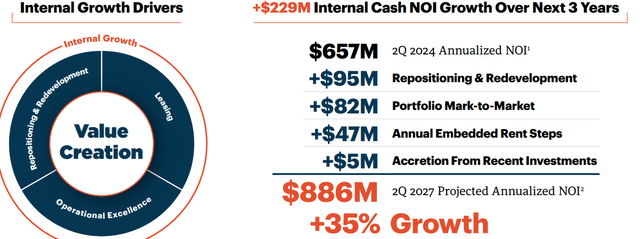

That being said, the book value may not be the best metric to use here. The Q2 cash NOI was $164M, which represents $656M on an annualized basis. This indicates a rental yield of approximately 5.6% (on a simplified basis). However, as the image below shows, the anticipated NOI in 2027 is approximately $886M (mainly due to the strong leasing spreads) and this implies a rental yield of 7.6%.

Using a required rental yield of 7%, the $886M in NOI indicates the fair value of the real estate assets is approximately $12.6B, which is $1B higher than the book value. And as the interest rates on the financial markets are decreasing, the required rental yield will likely also continue to decrease. At 6.5%, the fair value of the assets would be $13.63B, which is $2B higher than the book value.

This indeed means the cushion provided by the common equity very likely is higher than the $7.9B based on the book value of the assets.

Both issues of the preferred shares are attractive

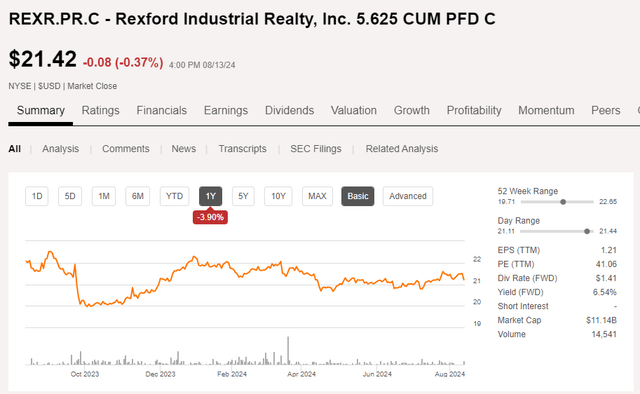

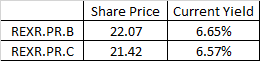

As mentioned in the previous article, Rexford Industrial has two series of preferred shares outstanding.

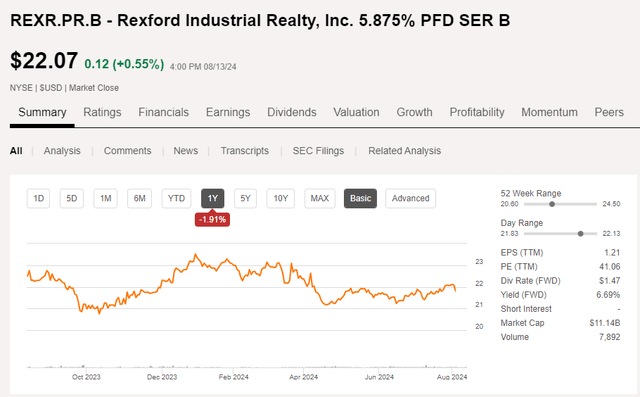

Rexford currently has two series of preferred shares outstanding. The Series B is trading with (NYSE:REXR.PR.B) as ticker symbol and has a preferred dividend of $1.46875 per year, payable in four quarterly installments. As the share price is currently just $21, the preferred dividend yield is almost exactly 7% for investors buying the preferred stock at the current share price. The Series B preferred shares can be called anytime but from Rexford’s perspective, paying less than 6% for (perpetual) equity isn’t expensive, so I can imagine the REIT just keeping the preferred shares outstanding, or perhaps it could consider buying back the preferred shares at a discount to the principal value rather than call the preferred stock.

The REIT also has a Series C outstanding, trading with (NYSE:REXR.PR.C) as ticker symbol. This series has a slightly lower preferred dividend of $1.40625 per share, which works out to 5.625% based on the $25 principal value. This series of preferred shares is currently trading at just $20.10 which means the yield has increased to approximately 7% as well. This makes sense as both preferred shares have the same rights and safety nets, so there should be no discrepancy between the current yields. The sole difference is the call date on the Series C: Rexford can only call these securities from September (of this year) on. But as the preferred dividend coupon is even lower than what it has to pay on the Series B, the likelihood of these preferred shares getting called is even lower as Rexford would obviously retire the most expensive capital first. I anticipate both series of the preferred shares will remain outstanding for the time being. And if they would get called, investors would book a 15% capital gain as the call price is $25 per share.

Based on the current respective share prices, investors are better off buying the Series B as the current yield is a bit higher than the yield on the Series C. But of course, the difference is minimal. Both series of preferred shares have the same ex-dividend date, so there is no difference in the stripped yield either, and I believe an investor should simply pick the preferred share with the highest yield at the time of making the decision.

Author’s Table

While the preferred dividend yield isn’t extraordinarily high, it handsomely beats the 4.6-5.1% yield on the secondary bond market for Rexford-related issues. The mark-up to the bonds is about 100-150 bps, and I think that’s fair, considering the REIT has a strong balance sheet.

Investment thesis

I currently have no exposure to Rexford Industrial. The sole reason why I haven’t bought the preferred shares yet is the somewhat punitive tax regime in my jurisdiction (and that of course is a personal issue, given my tax residence outside the USA). I do think the risk/reward ratio of the preferred shares is excellent, given the low leverage on the balance sheet. And as the interest rates on the financial markets are moving down, I think there is a realistic chance to generate a capital gain as the share price of the preferred shares may increase as the benchmark interest rates are going down.

I’m still watching the REIT with a lot of interest, but with a specific focus on the preferred shares.