DNY59

We have been long Gladstone Commercial (GOOD) common shares for more than a decade, so we were pleased with the August 6th release of their 2Q24 operating results. Gladstone continues to transition their portfolio away from office buildings and toward net lease industrial assets. In the long run, this transition is good for the common shareholder and reassuring right now for GOOD’s credit quality as the issuer of multiple series of preferred equities. We are long Gladstone Commercial 6.0% Series G preferred (NASDAQ:GOODO) and that is our focus here today.

The Issuer

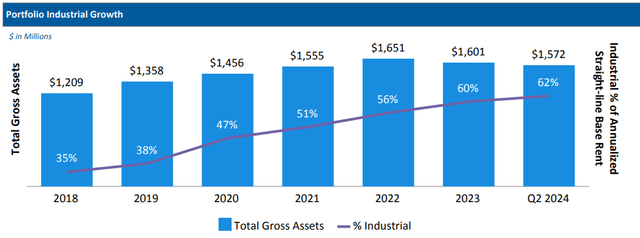

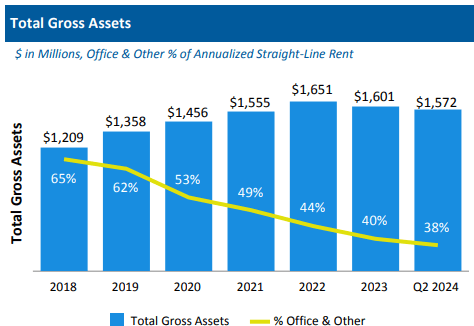

Gladstone Commercial is a $600MM market cap operator of 136 net lease properties totaling 16.8 million sq. ft. Over the last half decade or so GOOD has recycled capital to transform its profile from being mostly office assets…

GOOD

…to mostly industrial.

We meet with Gladstone management every year and back in early 2019 then CEO Bob Cutlip informed us of their intention to become an industrial REIT. Though no one anticipated the pandemic, it didn’t break GOOD’s stride in selling office buildings and accretively acquiring industrial assets.

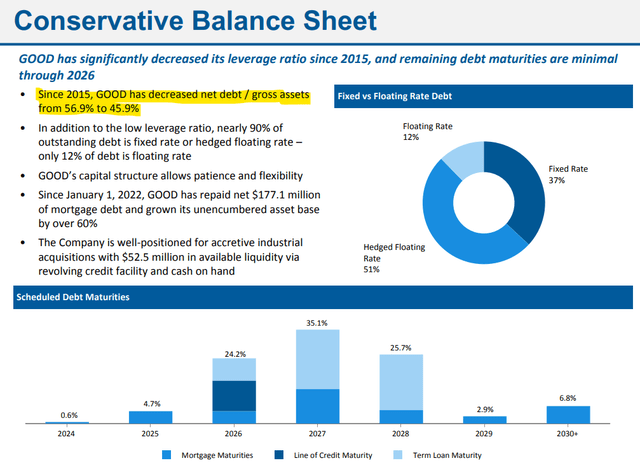

Over that same period, Gladstone has made great strides in de-levering their portfolio and hedging their floating rate debt in the rising interest rate environment.

With minimal debt maturities through 2026 and anticipated monetary easing, we feel Gladstone is a creditworthy issuer that will meet its obligations to preferred shareholders.

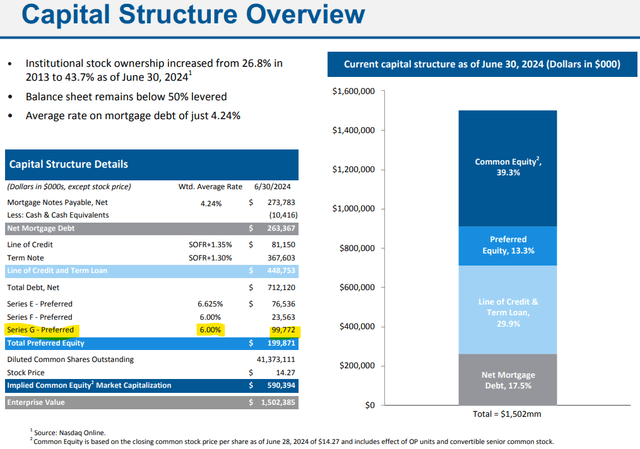

The Capital Stack

The Gladstone Companies (LAND, GOOD) have been serial issuers of preferred equities, and at today’s market pricing we find Gladstone Commercial Series G compelling on multiple levels. We always have fresh demand for fixed income and GOODO satisfies that, but it has more potential than its 6.00% coupon implies.

Betting on Yield Scarcity

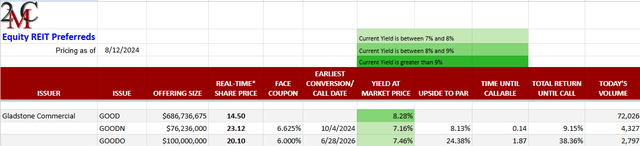

Gladstone Commercial currently has three series of preferred equities.

Series F is in the capital formation stage and does not yet trade on an exchange. The 6.625% Series E (GOODN) is callable in October of this year, but, considering where interest rates stand, we don’t anticipate the shares will be redeemed anytime soon. Trading at just over $23, GOODN produces a respectable 7.15% yield in attractive monthly dividend payments. We have previously owned GOODN, and it is a solid choice, but market pricing presents a better opportunity under the same issuer’s umbrella.

The 6.00% Series G is not callable until June of 2028, but if the higher coupon GOODN still exists, GOODO won’t be redeemed at that time. At the current market pricing of $20.00, GOODO produces a superior 7.50% yield in the same attractive monthly dividend payments. The real benefit to GOODO’s market price is it’s $5.00 discount to par value. Shares don’t have to be redeemed to capture par value; macroeconomic environments can get it for you.

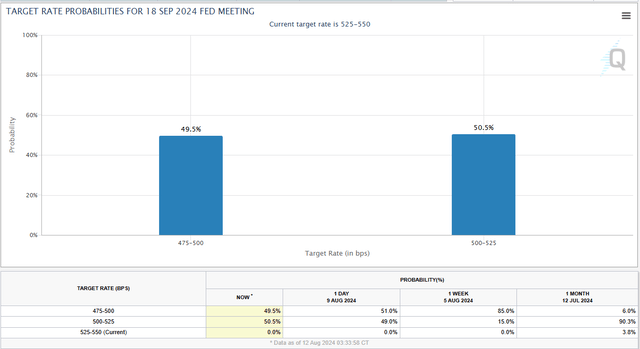

If, as expected, the Fed begins a series of rate cuts in September, yields of fixed income issues of all durations could fall in a rising bond market. We won’t speculate on the pace or extent of interest rate declines, but we can monitor broader market forecasts, and they progressively are indicating rate reductions.

Under the Fed’s current target rate of 525-550 basis points, GOODO’s 7.50% current yield is more than 350 basis points higher than that of 10Y T-Notes. Fed rate cuts could conceivably raise market prices and reduce yields on bonds of all durations, but GOODO’s 6.00% coupon is perpetual until the issue is called. If, as in the past, successive interest rate cuts create some level of yield scarcity, then GOODO’s 6.00% coupon becomes dearer, and its share price will rise toward par.

Price Differentiates the Opportunity

In the universe of REIT preferred equities, we can identify dozens of issues that provide current yields north of 7.0%. Most of them are from creditworthy issuers. The differentiating factor between them and GOODO’s 7% yield is the price of entry. If you buy (fictitious) ABC Corp. 7.5% series A preferred at par (or real, Global Medical REIT series A preferred (GMRE.PR.A) at $25.00 market), you will capture and lock in a 7.5% yield.

If you buy GOODO at $20.00 you lock in a 7.5% yield until the issue is redeemed. That purchase also carries a potential 25% upside to par value if yield scarcity develops sufficiently to push the share price to $25. It has happened before.