Denis Shevchuk/iStock via Getty Images

Introduction

It’s been a while since I last looked at Enbridge (NYSE:ENB) (TSX:ENB:CA), and while I definitely respect investors focusing on dividend growth when they look at Enbridge, I’m focusing on the company’s preferred shares. It adds an additional layer of safety to the fixed income portion of my portfolio. And while I fully acknowledge I’m giving up potential capital gains, I don’t mind having a “lower risk” preferred stock in my portfolio. I, of course, realize there still are risks involved with preferred shares as they rank junior to any debt and debt securities. I don’t mind investing in them if the risk/reward ratio makes sense.

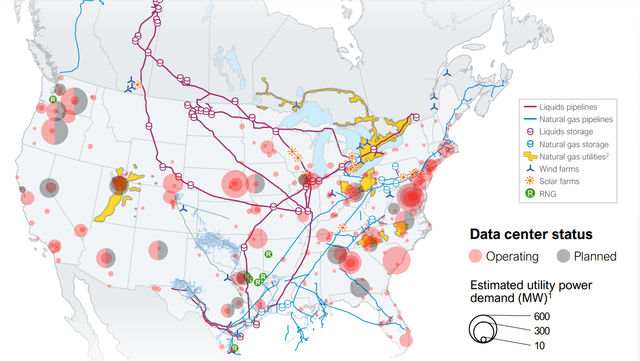

ENB Investor Relations

On Friday, Enbridge announced the terms of the preferred dividend reset of its Series Y preferred shares, and as those shares are trading at a discount to par, I’m considering initiating a long position in my fixed income portfolio. And as Enbridge recently released its Q2 results, I have the most up-to-date information to check up on the risk level of the preferred shares of the natural gas and liquids infrastructure company.

A quick look at the Q2 results

As I’m mainly focusing on the preferred equity issued by Enbridge, I will zoom in on the company’s quarterly results from the perspective of a preferred shareholder.

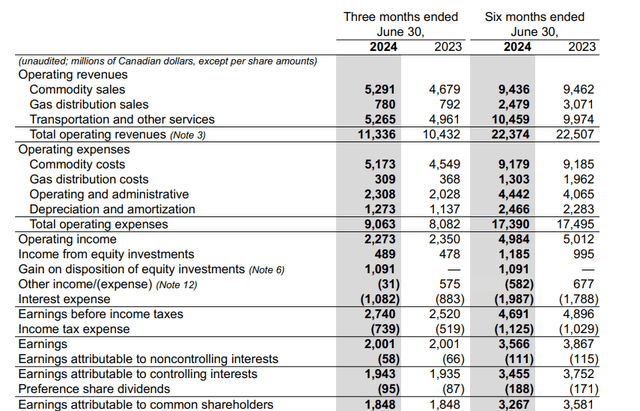

Looking at the Q2 income statement, the company posted total revenue of C$11.3B, which represents an increase of approximately 9%. A good result although the operating expenses increased by approximately 12%, resulting in a 3% decrease in the operating income on a YoY basis, as the operating income decreased to C$2.27B.

The bottom line result improved vs. the second quarter last year despite the lower operating income and the rather substantial increase in interest expenses. As you can see below, Enbridge was able to record a C$1.09B gain on the sale of equity investments, and that’s the main reason why the pre-tax income increased.

ENB Investor Relations

On an after-tax basis, however, the net profit remained exactly stable with a C$2B net profit, of which $1.94B was attributable to Enbridge’s equity holders. As shown above, the company needed approximately C$95M to cover the preferred dividend payments which means there was approximately C$0.86 per share available in earnings that were attributable to its common shareholders. In the entire first semester, the EPS came in at C$1.53B, including the positive impact from non-recurring events.

From the perspective of a preferred shareholder, the preferred dividends are very well covered, even if you’d exclude the non-recurring items in the second quarter. The company needs less than 10% of its profit to cover the preferred dividends, and that definitely is a more than acceptable payout ratio.

That being said, Enbridge should be seen as an infrastructure company, and the distributable cash flow is a more important metric than the reported net income. The explanation for that is pretty simple: Once a piece of infrastructure like a pipeline has been built, the maintenance capex is pretty low, and usually substantially lower than the depreciation expenses on an asset (which weigh on the income statement).

This traditionally means Enbridge’s DCF is higher than the reported net income, and that was exactly the case in the second quarter as well.

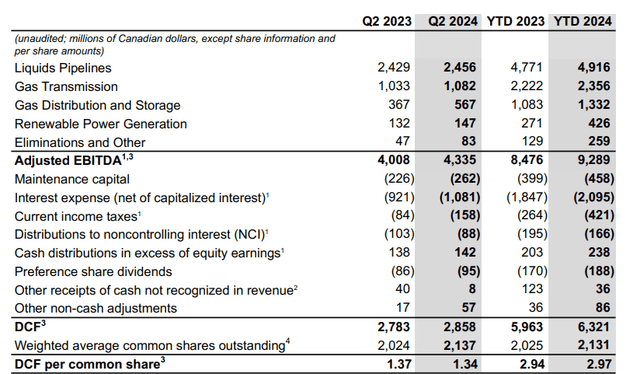

Fortunately, Enbridge publishes a detailed overview of the DCF. As you can see below, the company recorded a DCF of C$2.86B resulting in a DCF per share of C$1.34, bringing the H1 DCF to C$2.97 per share.

ENB Investor Relations

The overview above also confirms the preferred dividends are already included in the DCF calculation. This means that the Q2 DCF before taking preferred dividends into account was approximately C$2.95B and the company needed less than 4% of the pro forma DCF to cover the preferred dividends. A similar payout ratio can be observed in the first six months of the year with a payout ratio of less than 3%.

The company announced the new preferred dividend yield on one of its securities

I like the Canadian preferred share system as rather than the three-month floating rate preferred dividends – which is very common in the US – the reset periods in Canada are generally five years. This provides excellent visibility for both the company as well as the investor as everyone knows what they are getting into for an extended period of time.

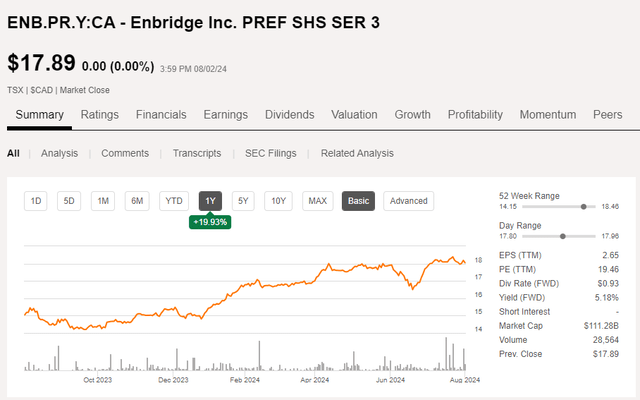

One of the series of preferred shares I had been keeping my eye on was Enbridge’s Series 3 preferred shares, which are trading with (TSX:ENB.PR.Y:CA) as the ticker symbol. The company announced on Friday the updated terms for the next five-year period. As you can see below, that series of preferred shares closed at C$17.89 per share on Friday.

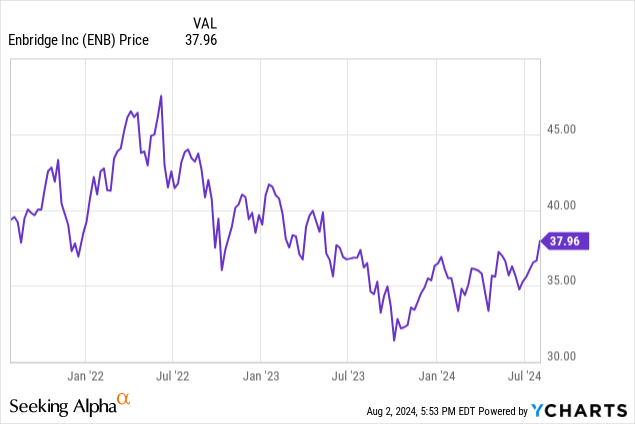

Seeking Alpha

This series of preferred shares will have a 5.288% preferred dividend rate starting on Sept. 1, until the end of August 2029. The updated preferred dividend rate is based on the 2.908% five year Canada government bond yield plus the 238 bp markup, as provided in the preferred shares’ IPO documents.

As this series of preferred shares is trading at a pretty substantial discount to par, the upcoming preferred dividend rate change means the preferred share offers a 7.39% yield on cost for the next five years.

There are two elements to take into consideration. First of all, the owners of the Series 3 preferred shares have the right to convert their stock into Series 4 preferred shares with a three-month reset. That’s irrelevant to the Series 3 preferred shares other than the fact that if there are less than 1M shares of the Series 3 outstanding, all Series 3 preferreds will be converted into Series 4. That being said, I think the risk of that happening is very low as there are 24 million shares of the Series 3 outstanding which means that 96% of the shareholders would opt to receive a 3-month floating rate.

Secondly, the new preferred dividend yield is only applicable for the next five years. In 2029, the yield will once again be reset based on the five-year Canada government bond yield plus the 238 bp markup. Should the five-year bond yield drop to 2.00%, the 4.38% preferred dividend yield would represent a yield of 6.12% (which still represents a 412 bp mark-up to the risk-free interest rate).

Investment thesis

I like preferred shares as a cornerstone portion of my income portfolio. I also enjoy the visibility offered by fixed rate preferred shares and I don’t mind the five-year reset preferred shares either. I think the Series 3 preferred shares issued by Enbridge are worth picking up at the current price, as the implied 7.39% yield represents a 448 bp mark-up to the five-year Canada government bond yield.

I currently have no position in Enbridge’s common shares (the put options I have written expired out of the money) while I have no position in any of its preferred shares either. That being said, I will likely pick up some of the Series 3 preferred shares in the next few weeks as I’ll be locking in a preferred dividend yield for the next five years.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.