The first-quarter boom in trading revenues for banks continued and even accelerated during April, but the tariff fight and market volatility that has fuelled that bonanza is also prompting banks to warn of potential hits to other revenues and a rise in bad loans.

European banks followed their US peers and reported near record trading revenues for January–March, and several said activity stepped up again after “liberation day” on April 2, when US president Donald Trump unveiled hefty tariffs on imports and sparked market turmoil.

“We saw higher spikes in client activity in the first two weeks of April, 30% above the peaks of Covid times. But in the last 10 days, there is more stability around current levels and more of a wait-and-see attitude. It’s a more normalised environment,” UBS chief executive Sergio Ermotti told analysts.

Deutsche Bank chief financial officer James von Moltke said the first two weeks of April had been even busier than the first quarter. “There were high volumes with wide bid-ask spreads,” von Moltke said. He added that activity had then settled down to a calmer phase during the second half of the month after Trump announced a 90-day pause on tariffs for most countries.

Standard Chartered said on Friday that strong trading in the first quarter had continued in April, with clients particularly active in tactically managing exposure to currencies, commodities and rates.

They echoed Goldman Sachs CEO David Solomon, who said on April 14 the second quarter had started well for trading. “I know there is a higher level of uncertainty, but at the same point, clients are active. People are shifting positions. And we still see significant activity levels,” he told analysts.

Notably, the April surge came on top of a buoyant first quarter for trading. UBS reported record equities trading revenues of US$1.81bn, up 33% from a year ago, while its foreign exchange, rates and credit trading income jumped 27%. Deutsche’s fixed income and currencies trading revenues rose 17% from a year earlier to €2.94bn. Deutsche is the biggest fixed-income house outside the big US banks, but it does not have an equities trading division.

Barclays‘ fixed-income, currency and commodities trading revenues jumped 21% to £1.7bn, its best quarter for two years. Its equities trading revenues of £963m were up 27% year-on-year after stripping out one-off items.

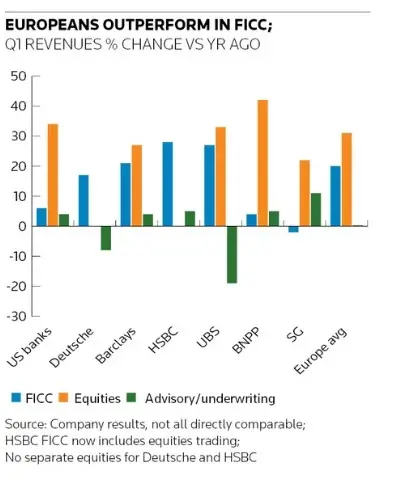

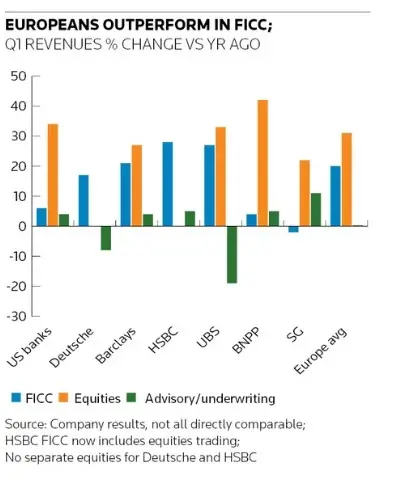

Equities trading revenues for the four major European investment banks that report them totalled US$5.65bn in the first quarter, up 31% from a year earlier and broadly in line with the 34% rise across the big five US banks. But European banks outperformed in FICC trading, with aggregate revenues of US$11.61bn across six banks, up 20% from a year earlier, compared with a 6% rise by US peers.

BNP Paribas‘ equities trading revenues in Q1 jumped 42% and FICC trading was up 4%; Societe Generale‘s equities revenue increased 22% while FICC revenues dipped 2%; and HSBC reported that combined debt, equity and FX revenues increased 28% from a year earlier.

The pickup was evident in Asia too, and Standard Chartered’s global markets income was up 14% in Q1 from a year earlier, with macro trading up 11% and credit trading income jumping 34%.

“Adverse but plausible”

But while traders may be cheering the tariff uncertainty, M&A and equity capital markets bankers and bank bosses are less impressed.

HSBC warned that its revenues could be reduced by “low single-digit” percentage points and it could take an extra US$500m hit from bad loans due to the impact of substantially higher tariffs and reduced trade.

HSBC, one of the largest trading banks in the world, said under “adverse but plausible downside scenarios” the higher tariffs could reduce GDP and have an impact on unemployment, financial conditions, stock markets and house prices, and hurt sectors including autos, industrials, retail, textiles, transport and logistics.

“We’ve seen a significant drop in volumes along the US-China corridor in the sectors that have not been given a waiver or a reduction in tariffs,” said HSBC CEO Georges Elhedery.

Barclays increased its first-quarter provisions by £74m to account for a worsening outlook for its US consumer bank and US exposures for its investment bank, while Deutsche said after assessing its loan book for how tariff-related effects might have an impact that its provisions for credit losses rose to €163m in the first quarter from €101m in the fourth quarter.

The European banks said their advisory and ECM desks continued to struggle while economic and geopolitical uncertainty persists. Revenues from advisory and debt and equity underwriting across the major European banks were flat from a year earlier while US banks reported an aggregate 4% rise. That compared with a weak start to 2024, and bankers had started the year hoping for a major rebound.

Deutsche’s von Moltke said a recovery would hinge on business confidence. “That slowed pretty dramatically in early April and may take a while to come back into focus,” he said.

Source: IFR