- Testing of Ripple stablecoin RLUSD begins on the Ethereum mainnet and XRP Ledger.

- Ripple legal head Stuart Alderoty comments on SEC appeal and final ruling in lawsuit.

- XRP adds 3% on the day, eyeing a comeback to the psychologically important $0.60 level.

Ripple (XRP) recovers on Monday, almost erasing Sunday’s losses, as the payment-remittance firm begins testing its stablecoin Ripple USD (RLUSD) on the Ethereum mainnet and XRP Ledger. Ripple is awaiting regulatory approval on its stablecoin, so RLUSD is currently in private beta.

The gains in the token came after Ripple’s Chief Legal Officer (CLO) Stuart Alderoty commented on the recent lawsuit ruling between the firm and the US Securities & Exchange Commission’s (SEC), namely over whether an appeal is likely to be filed by the regulator.

XRP trades at $0.5726 at the time of writing.

Daily Digest Market Movers: Ripple tests stablecoin, CLO comments on SEC lawsuit

- Ripple stablecoin is in private beta and the payment remittance firm has started testing the asset on the Ethereum mainnet and XRP Ledger. The firm informed in an official tweet on X that the stablecoin project has not received regulatory approval yet and RLUSD is not available for purchase or trading.

Testing, testing…RLUSD! We’re excited to share that Ripple USD (RLUSD) is now in private beta on XRP Ledger and Ethereum mainnet. RLUSD has not yet received regulatory approval and therefore is not available for purchase or trading – please be cautious of scammers who claim they…

— Ripple (@Ripple) August 9, 2024

- XRP holders and traders digested the news of the SEC vs. Ripple lawsuit ruling, in which the judge imposed a $125 million fine to the firm for violating federal securities laws. The judge ruled Ripple’s sale of XRP to institutions as a violation of the law.

- There were no comments or references about the XRP ruling from July 2023, where the altcoin gained legal clarity as a non-security in secondary markets or exchange platforms.

- Both parties considered the final verdict as their win since the fine was twelve times higher than what Ripple had proposed (making it favorable for SEC, since Ripple was willing to pay $10 million and the fine was $125 million). Ripple finds it favorable since XRP legal clarity remained intact and the fine was reduced from SEC’s ask of over $2 billion.

- It remains to be seen whether the financial regulator will appeal the final verdict or XRP security status.

- Stuart Alderoty, Ripple’s CLO said in an interview with CNBC that the SEC has sixty days to decide whether it will appeal the lawsuit ruling.

Technical analysis: XRP posts 3% gains

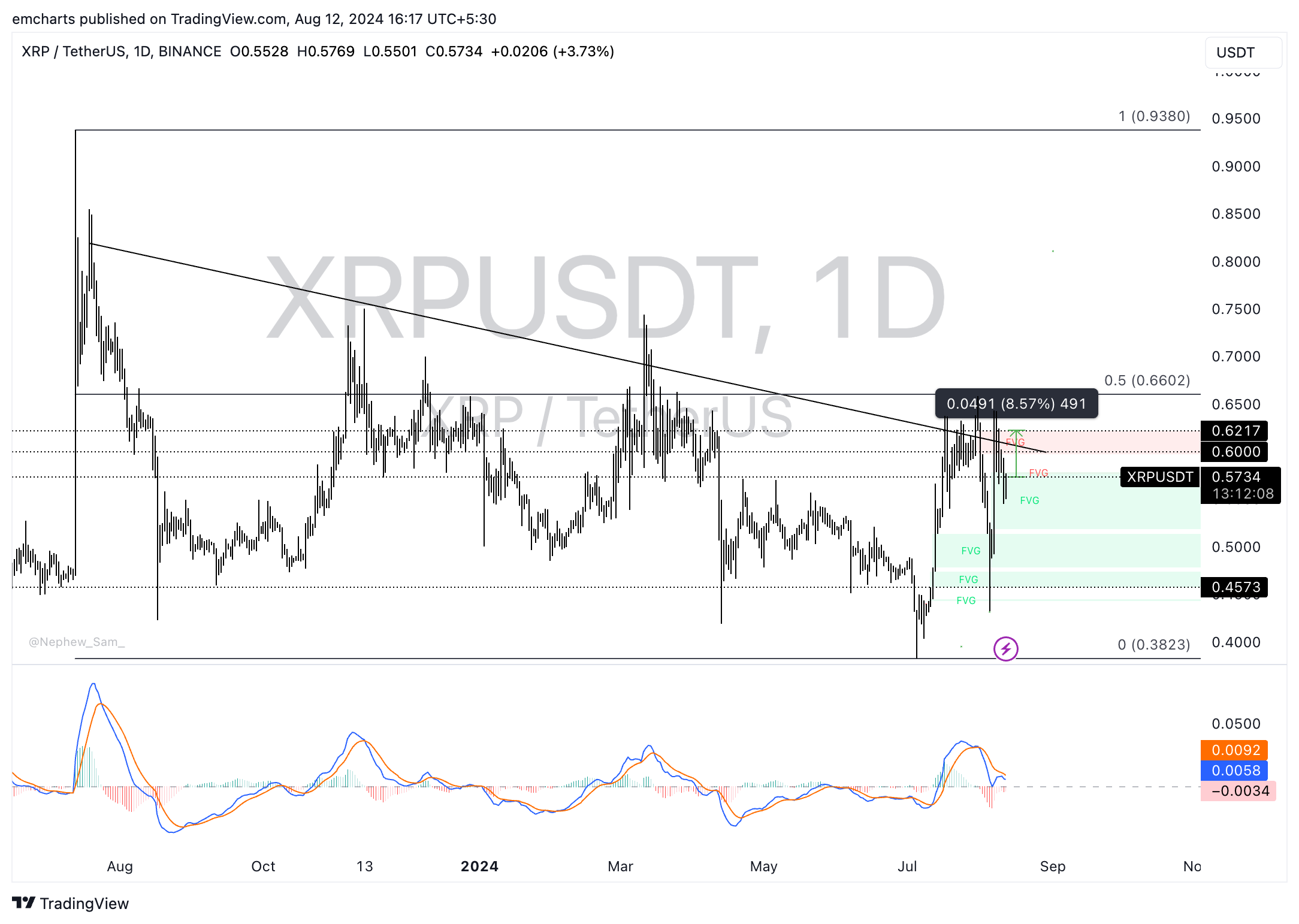

Ripple, which trades at $0.5734 at the time of writing, is in a multi-month downward trend. . If Monday’s momentum persists, XRP could rally towards $0.6217, extending its gains by 8.57% towards the July 31 low. Still, to achieve this target the altcoin faces resistance at $0.60, a psychologically important level for Ripple.

Looking down, Ripple could find support in the Fair Value Gap (FVG) between $0.5188 and $0.5785, the upper and lower boundaries of the imbalance zone.

The Moving Average Convergence Divergence (MACD) indicator shows underlying negative momentum in the altcoin’s price trend.

XRP/USDT daily chart

A daily candlestick close under $0.5785 could invalidate the bullish thesis for the altcoin. In the event of a correction, XRP could sweep liquidity in the FVG.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin’s market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.