Ethereum price today: $2,530

- Bit Digital has increased its treasury holdings above 100,000 ETH using net proceeds from a $172 million public offering and Bitcoin sale.

- CF Benchmarks predicts a ten-fold increase in the number of companies holding ETH and SOL on their balance sheets over the next 12 months.

- ETH could see a breakout as it approaches the apex of a symmetrical triangle.

Ethereum (ETH) held steady above $2,500 on Monday after Bit Digital (BTBT) announced it had splashed $172 million, alongside proceeds from a 280 BTC sale, to expand its treasury holdings to 100,603 ETH. The purchase follows CF Benchmarks’ prediction of a 10x growth in the number of companies integrating ETH and SOL on their balance sheets.

Bit Digital scoops 100K ETH amid potential expansion of ETH adoption in balance sheets

Nasdaq-listed Bit Digital said it has become one of the largest ETH treasury companies in the world after boosting its balance to 100,603 ETH. This represents over a 300% increase from its balance of 24,434 ETH at the end of the first quarter of 2025.

The company revealed that it used the net proceeds from a public offering last week — where it raised $172 million — and the sale of 280 BTC to facilitate its new ETH treasury strategy. The purchase follows the company’s announcement of a shift from Bitcoin mining to an ETH-native treasury last month.

Bit Digital’s CEO, Sam Tabar, stated that the company plans to double down on its approach in a bid to capitalize on Ethereum’s long-term potential.

“We are starting with exposure to over 100K ETH for now, but we intend to aggressively add more so we become the preeminent ETH holding company in the world,” he said.

Bit Digital now ranks alongside top ETH treasury allocator SharpLink Gaming (SBET) and BitMine (BMNR), which announced a $250 million offering last week to buy ETH.

The increased interest in ETH treasury companies aligns with the growing interest in the stablecoin sector, where Ethereum leads with a 50% market share, per DefiLlama data. This comes as banking and fintech firms are ramping up stablecoin launches in anticipation of the House approving the GENIUS Act next week, aligning with the Senate’s conclusion in June.

According to analysts at CF Benchmarks, these firms will need to hold ETH or SOL in their balance sheets to fund settlement fees for stablecoin transactions. “We also expect many payment gateways, remitters, and e-commerce platforms to accumulate balances as an operational necessity,” wrote Gabe Selby, CF Benchmarks’ Head of Research.

Coupled with the rise in ETH treasury companies, the number of institutions holding ETH and SOL could see a ten-fold increase in the next 12 months, he added.

Meanwhile, Ethereum investment products marked eleven consecutive weeks of net inflows after institutional investors scooped $226 million last week, according to CoinShares weekly report. “On a proportional basis, weekly inflows during this run have averaged 1.6% of AuM, significantly higher than Bitcoin’s 0.8%, highlighting a notable shift in investor sentiment in favor of Ethereum,” the report states.

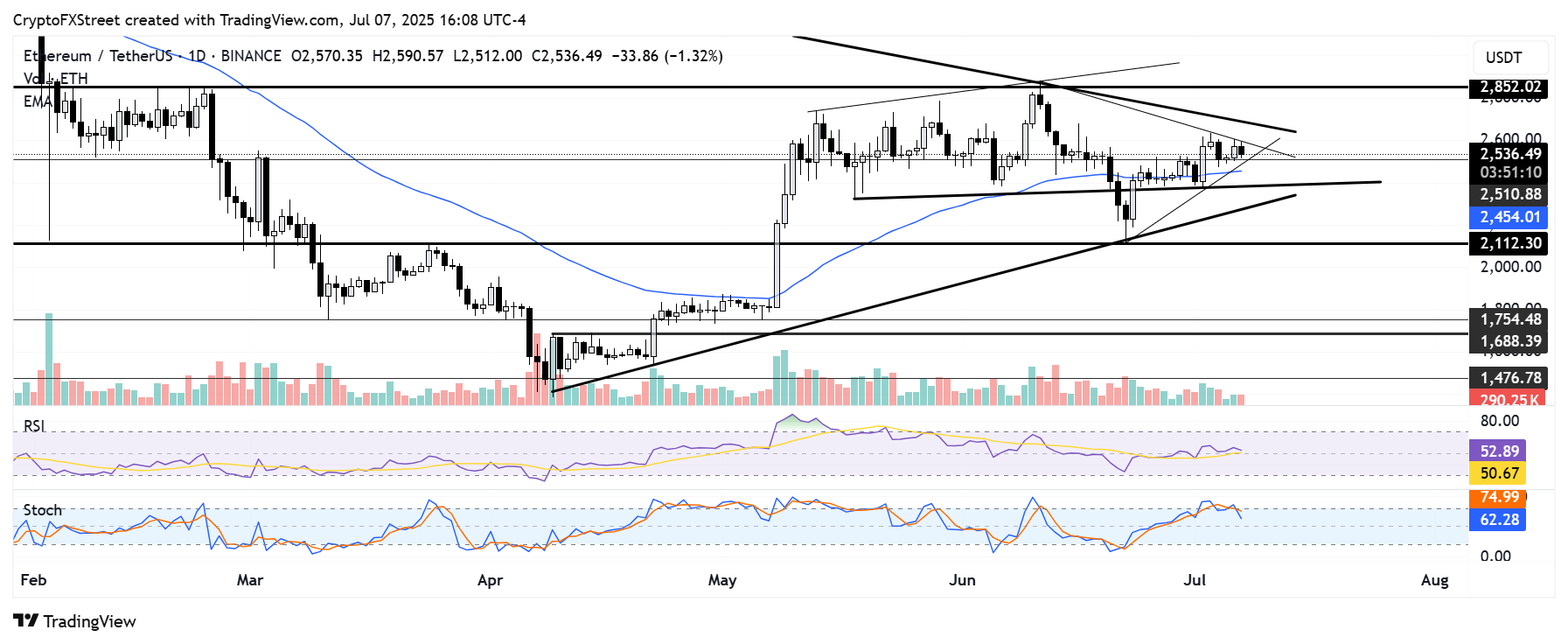

Ethereum Price Forecast: ETH nears symmetrical triangle’s apex

Ethereum saw $65.54 million in futures liquidations in the past 24 hours, compromising $26.16 million and $39.38 million in long and short liquidations, respectively, according to Coinglass data.

ETH held steady over the weekend, trading mostly above $2,500 and testing the upper boundary of a symmetrical triangle that had been in place since June 11 before experiencing a rejection. The weekend action has seen ETH move toward the apex of the triangle, signaling a potential breakout. A breakout on either side, validated by a further move outside a wider symmetrical triangle extending from April 9, could see ETH rise to test the $2,850 resistance or fall toward the $2,110 support level.

ETH/USDT daily chart

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are trending downwards toward their neutral levels, indicating a decline in bullish momentum.