- The altcoin season index continued to indicate BTC’s dominance.

- ETH’s market indicators looked bearish, but SOL’s indicators turned bullish.

Bitcoin [BTC] has been the center of attraction for quite some time, with the king coin touching its all-time high and plummeting to near $55k soon thereafter.

In fact, Bitcoin’s dominance has also moved up over the past few months. However, if the latest data is to be considered, then altcoins like Ethereum [ETH] and Solana [SOL] might soon get their chance to shine.

Altcoins to begin bull rallies soon?

World Of Charts, a popular crypto analyst, recently posted a tweet highlighting a pattern on Bitcoin dominance’s chart.

As per the tweet, Bitcoin was testing the upper limit of a rising wedge pattern, hinting at a decline in BTC dominance.

A decline in Bitcoin dominance directly translates into a rise in altcoins’ prices. However, the tweet also mentioned that altcoin’s major recovery would happen after BTC dominance slips under the pattern.

However, not everything looked in altcoins’ favor. For example, AMBCrypto’s look at the altcoin season index revealed that BTC was still dominant.

The indicator had a value of 22 at press time, suggesting that the Bitcoin season was still going on. For the uninitiated, a figure above 75 indicates the beginning of an altcoin season.

What to expect from Ethereum and Solana

AMBCrypto then planned to take a look at top altcoins like ETH and SOL’s state to better understand what to expect from them in the near term.

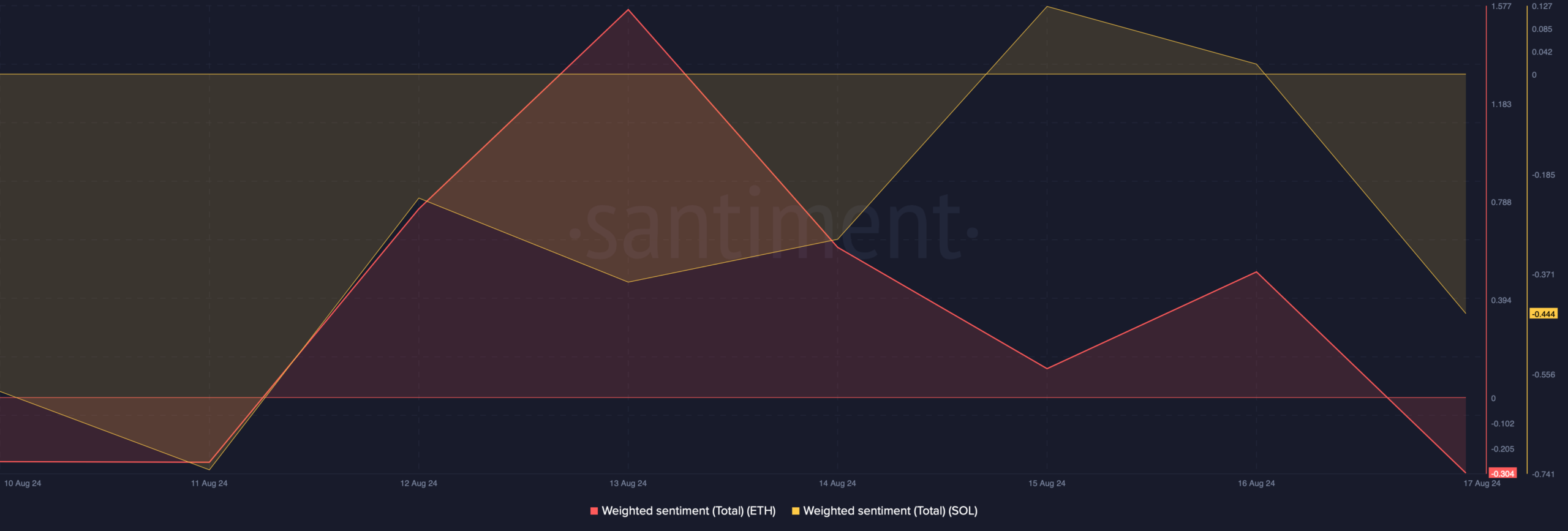

Our analysis of Santiment’s data revealed that after remaining in the positive zone, both SOL and ETH’s Weighted Sentiment went into the negative zone.

This indicated that bearish sentiment around both of these tokens increased on the 17th of August.

Coinglass’ data revealed that Solana’s Long/Short Ratio registered a sharp downtick. This suggested that there were more short positions in the market than long positions.

However, Ethereum’s Long/Short Ratio increased, which looked bullish.

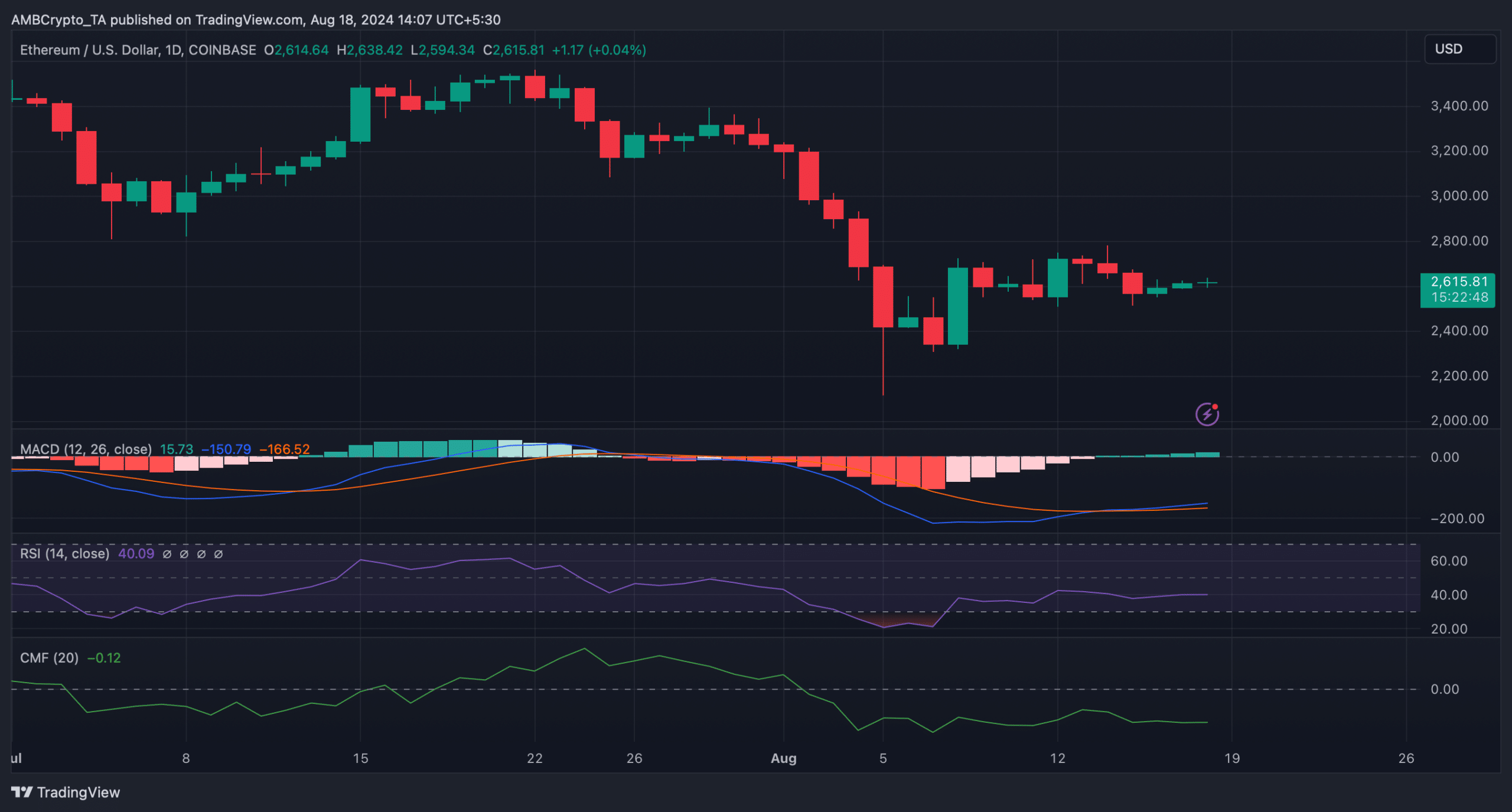

Like the long/short ratio, ETH’s MACD also turned in buyers’ favor as it displayed a bullish crossover. However, the Relative Strength Index (RSI) took a sideways path under the neutral mark.

Its Chaikin Money Flow (CMF) also followed a similar trend, indicating a few slow-moving days. At the time of writing, ETH was trading at $2,613.42 with a market capitalization of over $313 billion.

Read Ethereum’s [ETH] Price Prediction 2024-25

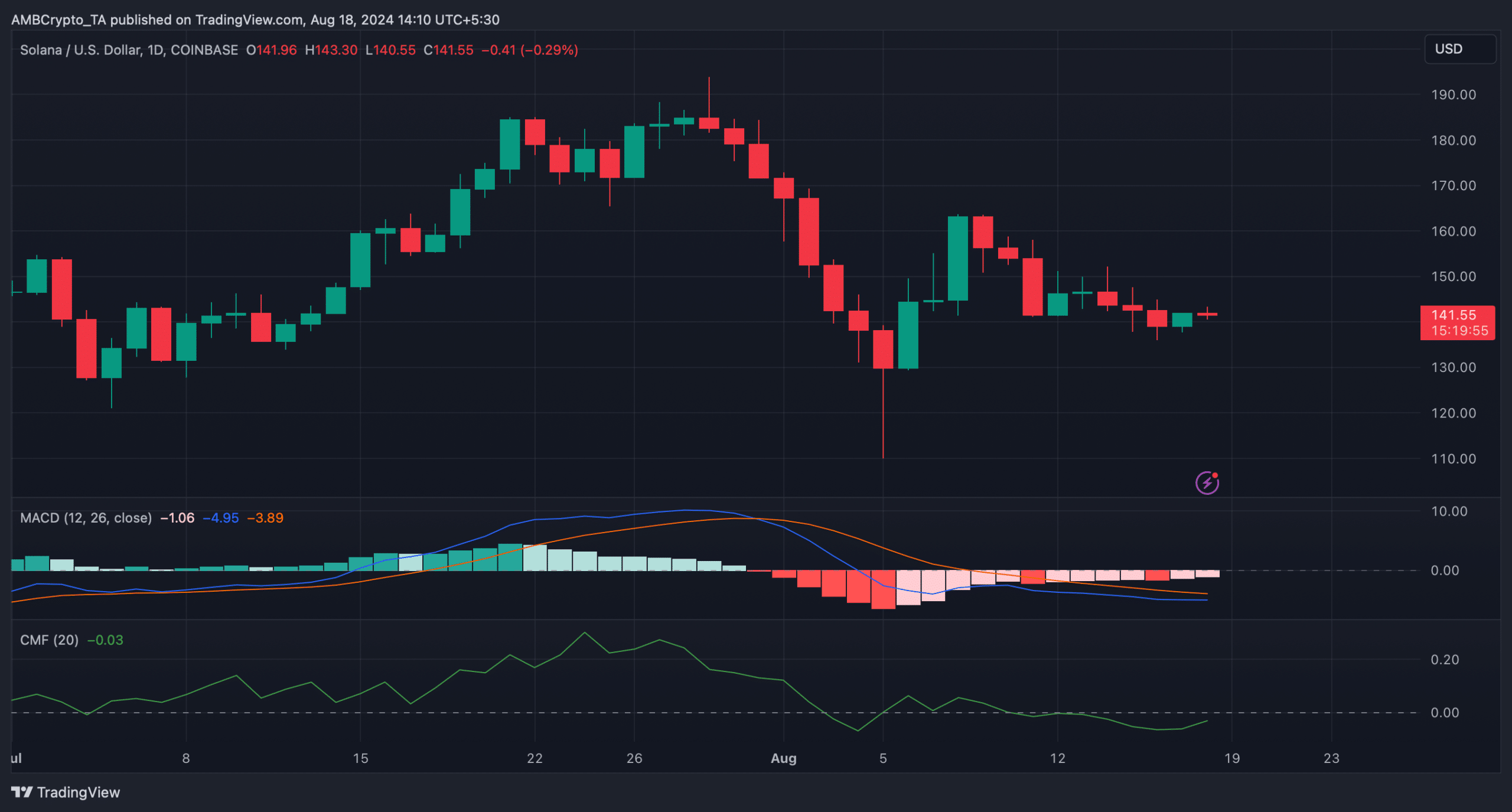

Interestingly, despite the bearish metrics, Solana’s price gained bullish momentum as it increased by over 1.5% in the last 24 hours. At press time, it was trading at $141.62 with a market cap of over $66 billion.

SOL’s CMF gained upward momentum. The MACD also displayed the possibility of a bullish crossover, indicating a continued price rise.