High-quality short dated investment grade credit is increasingly being favoured by investors of all types – from individuals to investment professionals across wealth manager groups and pension schemes – for a variety of reasons.

Firstly, interest rate volatility has picked-up meaningfully as inflation has proven stickier than expected causing central banks to tighten monetary policy more than what markets anticipated, pushing yields higher. Large drawdowns in duration-heavy asset classes ensued and prompted investors to lower their interest rate volatility via shorter-dated bonds (which are less sensitive to interest rate risk). Secondly, while cash rates have become more attractive, for a little more risk, short-dated investment grade credit can offer a yield pick-up over cash and government bonds, helping investors to increasingly sweat the cash element of their portfolio. We are seeing interest from pension and company treasurers’ for short dated credit for their treasury money. Others are also increasingly turning to short dated credit as an allocation for the penultimate stages of their de-risking journey. Finally, the inversion of the yield curve, meaning yields on shorter-dated bonds are now higher than yields on longer-dated bonds, means more yield can be achieved for less duration risk, which offers investors an attractive risk-adjusted option.

In short-dated compared to all-maturity, passives represent a greater market share

When choosing short dated corporate bond funds, UK investors often look to passive vehicles, citing the lower return potential of the broader asset class. Just over a quarter of the all-maturity sterling corporate bond market is passive (£18.7bn out of £66.1bn) compared to 40% of the short-dated market (£4.5bn out of £11.3bn) as per figure 2 below. This may seem intuitive, as investors perceive there to be little absolute return or potential excess return on offer in relatively low risk short dated corporate bonds. Therefore, why pay up for active management?

Figure 1: IA Sterling Corporate Bond sector, short-dated versus all-maturity

Passive is suboptimal in short dated corporate bonds

Despite this backdrop, we strongly believe that going passive in the short dated space is sub optimal, and this goes beyond the typical arguments for going active over passive, which include, for example, picking the winners and avoiding the losers (this certainly also applies here). Our active approach specifically exploits the forced passive buying and selling at either end of the maturity spectrum. Below we delve into this in more detail, highlighting the benefits of going active over passive in the asset class and how we specifically exploit short dated passive funds to our benefit.

As a general rule, passive funds underperform their indices on a net basis because of fees and transaction costs. We’d argue that this underperformance is more pronounced in the short dated space because the absolute level of return is more muted than in other parts of the maturity spectrum.

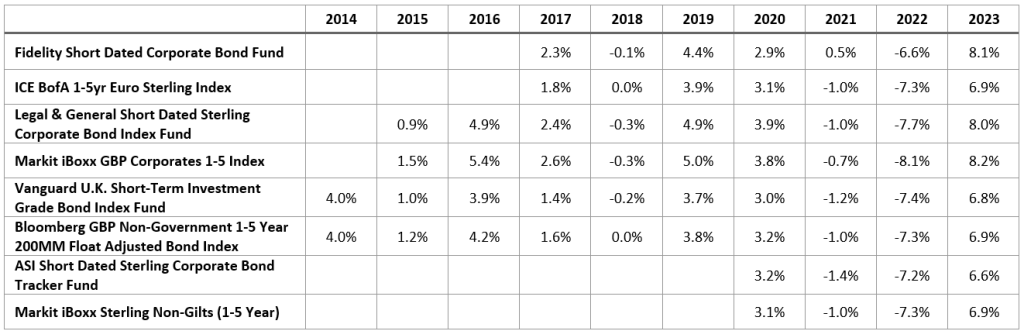

To illustrate this, we have looked more closely at all three passive short dated funds in the IA Sterling Corporate Bond sector, with the longest running track record going back to 2014. Since inception, this passive fund has delivered an average calendar year underperformance of 0.2% versus its respective index. Considering the average calendar year return from the index was 1.5% over the period (2014 to 2023), a 0.2% underperformance is just over 10% of total return lost. While some investors look to go passive in the space because the return potential is lower, paradoxically, for that same reason, it may make sense to consider going active. We would argue that 0.2% in return in the short-dated space means more than 0.2% return in higher risk asset classes, such as equities or all-maturity bonds.

Most passive funds tend to underperform their indices by more than the fees charged which we believe is due to the additional costs arising from elevated trading, associated with trying to replicate a short-dated index. All three passive funds in the IA Sterling Corporate Bond sector aim to replicate a 1-5 year index. A 1-5 year index constantly has bonds entering the index as they move from six years to five years in maturity, and constantly has bonds falling out of the index as they move below one year in maturity. This will lead to elevated trading for the passive community aiming to replicate this exposure, as they may be forced to buy and sell respectively at either end of the maturity spectrum. To illustrate this, we compare the 1-5 year index we use for our Fidelity Short Dated Corporate Bond Fund with its all-maturity counterpart, to measure how many bonds would fall into the 1-5 year index (by moving from six years to five years maturity) and out from the 1-5 year index (by moving sub-one year maturity) over the following 12 months. Based on April 2024, 82 bonds would move from six years to below five years to maturity and enter the index while 152 bonds would move to sub-one year in maturity and fall out of the index, a total 234 bonds. The 1-5 year index contains 612 bonds in April 2024, suggesting over a third (38%) the number of bonds in the index would move in the space of 12 months! And this excludes the impact from potential new issues.

This excessive and forced trading does not occur for all-maturity passive bond funds. It is notable that short dated passive funds tend to underperform their indices more (after fees) than their all-maturity counterparts, despite being offered by the same provider and therefore presumably using the same trading processes.

Exploiting the passive community

As active investors, we are happy to take out-of-index exposure across sub-one year bonds and up to six year maturity bonds. For example, we can buy a sterling investment grade bond with five and a half-years left to mature, knowing this is about to enter the 1-5 year index and therefore benefit from forced passive buying. At the other end of the maturity spectrum, we can buy bonds with sub-one year maturity to take advantage of forced passive selling. This paper has additional benefits and can prove to be an attractive hunting ground for active investors despite being so close to maturity.

At the end of Q1 2024, 9.6% of the Fidelity Short Dated Corporate Bond Fund (all off-benchmark) matured in less than one year. Somewhat remarkably, the average yield to maturity on this sub-one year paper (5.12%) is greater than the yield on the index (5.0%), despite the lower interest rate risk associated with it. Part of this yield advantage is due to forced selling by passives due to their rules-based, rather than value-based, approach. Banks are also unwilling to expend a significant amount of their risk in such instruments, allowing us to take advantage of this technical backdrop. Sub-one year paper also acts as natural liquidity as the bonds mature generating cash for the portfolio. This has further benefits in a rising yield environment as we can then deploy the cash into higher yielding securities. Investors who use the fund as a cash diversifier often like this liquidity feature.

We also selectively invest in non-sterling short dated credit and have over 36% of the portfolio in non-UK names. US Dollar or Euro-denominated bonds issued by traditionally sterling-centric companies can serve as a useful hunting ground. If our credit analysts and traders based in North America or in Asia highlight a non-sterling issue as more attractive than an in-index sterling bond (after accounting for hedging costs back to Sterling), then we are happy to own. In addition, the non-sterling market can prove useful for diversification purposes, allowing us to add exposure that may feature rarely in the sterling credit, such as names in energy or healthcare.

Time to consider an active fund?

The Fidelity Short Dated Corporate Bond Fund is primarily invested in high quality short dated corporate bonds and was launched just under seven years ago, employing a highly active approach. The Fund is managed within Fidelity’s highly experienced sterling investment grade portfolio management function, alongside our flagship Fidelity Sustainable MoneyBuilder Income Fund and Fidelity Sterling Corporate Bond Fund. The Fund has generated attractive excess returns over index (after fees) since inception and is one of Fidelity’s lowest volatility bond funds. Moreover, relative to the IA Sterling Corporate Bond Sector, the Fund is currently 1st quartile over 3 and 5 years, offers a 1st quartile yield, a 1st first quartile risk profile (in terms of 5 year volatility) and 1st quartile fees.

Fidelity Short Dated Corporate Bond Fund

Calendar year return tables

Important information

This information is for investment professionals only and should not be relied upon by private investors. The value of investments and the income from them can go down as well as up so the client may get back less than they invest. Past performance is not a reliable indicator of future returns. Investors should note that the views expressed may no longer be current and may have already been acted upon. The value of bonds is influenced by movements in interest rates and bond yields. If interest rates rise and so bond yields rise, bond prices tend to fall, and vice versa. The price of bonds with a longer lifetime until maturity is generally more sensitive to interest rate movements than those with a shorter lifetime to maturity. The risk of default is based on the issuers ability to make interest payments and to repay the loan at maturity. Default risk may therefore vary between government issuers as well as between different corporate issuers. Due to the greater possibility of default, an investment in a corporate bond is generally less secure than an investment in government bonds. Fidelity’s range of fixed income funds can use financial derivative instruments for investment purposes, which may expose them to a higher degree of risk and can cause investments to experience larger than average price fluctuations.

Investments should be made on the basis of the current prospectus, which is available along with the Key Investor Information Document (Key Information Document for Investment Trusts), current annual and semi-annual reports free of charge on request by calling 0800 368 1732. Issued by FIL Pensions Management, authorised and regulated by the Financial Conduct Authority. Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited. UKM0524/386798/SSO/NA