Singapore’s journey as a debt hub, which began in 1998, has transformed the local investment landscape. Today, Singapore Government Securities (SGS), including Treasury bills, Treasury bonds and Singapore Savings Bonds are a central feature of many Singaporeans’ retirement and savings plans.

This in turn has paved the way for increased issuance of non-sovereign and corporate bonds. In the past decade, the breadth and depth of this market have expanded significantly, with a sharp rise in 2024 as investors sought to lock in higher yields.

Here are four recent developments that show how the Singapore dollar (SGD) corporate bond market is changing:

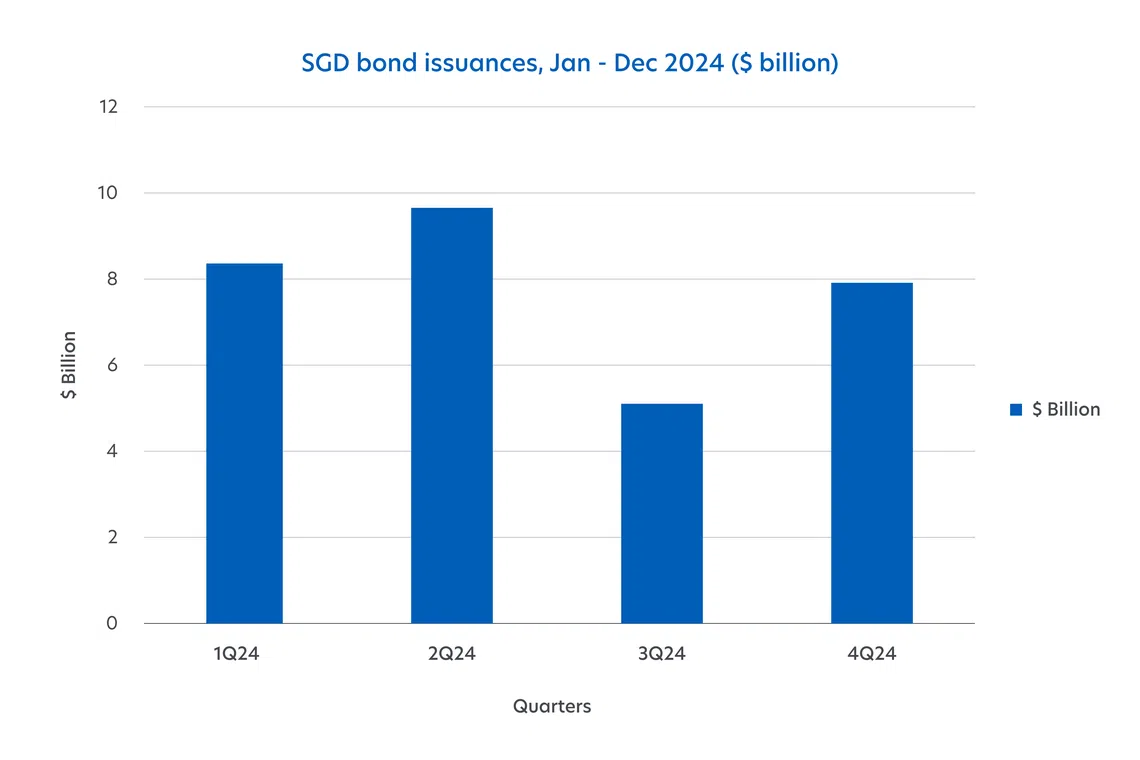

1. SGD non-sovereign bond issuances reached a decade high in 2024

The issuance of SGD-denominated non-sovereign bonds reached its highest level in over a decade during 2024. A total of 126 issuances, making up $31.2 billion of non-sovereign bonds, were offered to the market. This was a 57 per cent increase over 2023. The last time issuances reached this level was in 2012.

SGD bond issuances from January to December 2024.SOURCE: BLOOMBERG/UOB ASSET MANAGEMENT

This boom was a factor of both supply and demand. Greater stability in interest rates and the need for financing drove corporate issuers to the debt market. At the same time, global investors looking for yield favour SGD corporate bonds for their defensiveness amid Singapore’s relatively stable economy and strong company fundamentals. As of end-2024, the SGD corporate bond market was worth close to $200 billion, an increase from $150 billion in 2017.

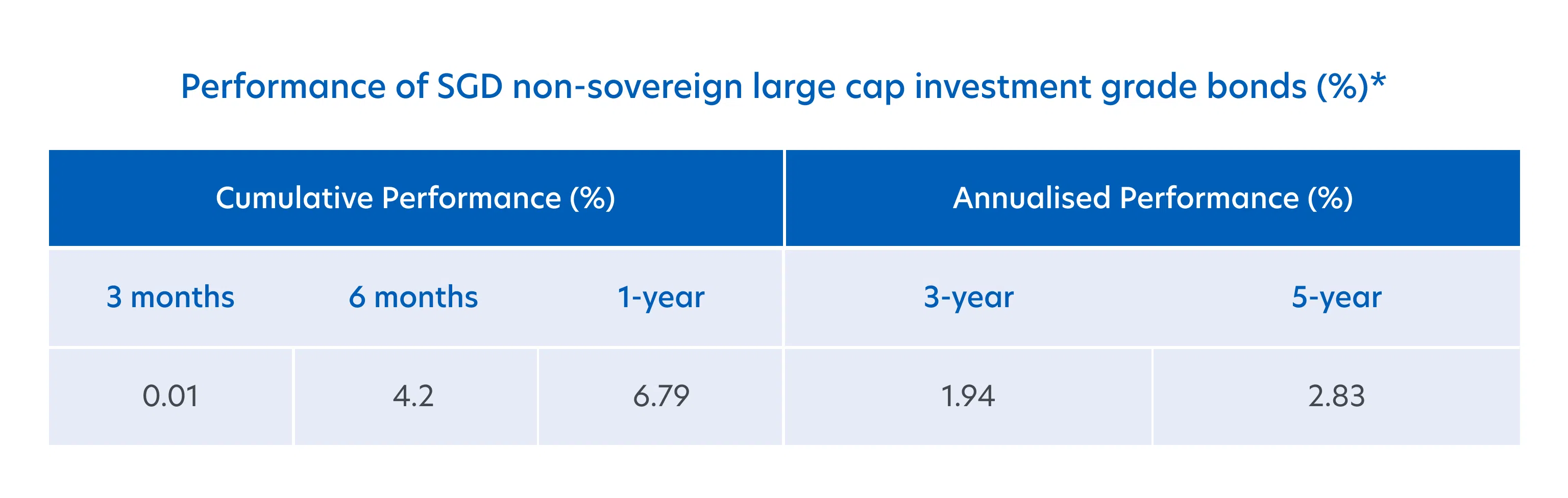

2. SGD non-sovereign bonds achieved high single digit returns last year

The iBoxx SGD Non-Sovereigns Large Cap Investment Grade Index, one of the most closely tracked indexes in the industry, returned 6.8 per cent in 2024. The index includes bonds issued by Singapore corporates and quasi-government entities, including the Housing Board (HDB), Temasek Financial, Land Transport Authority and Singapore Airlines.

*Based on the performance of the iBoxx SGD Non-Sovereigns Large Cap Investment Grade Index up till Dec 31, 2024. SOURCE: BLOOMBERG / UOB ASSET MANAGEMENT

The market’s strong performance was driven by investors’ anticipation of easing sovereign bond rates and tightening credit spread. This led investors to make the leap from sovereign to non-sovereign bonds. Over the past five years, the index has delivered average annual returns of 2.8 per cent, with 2024 standing out as a particularly strong year for SGD non-sovereign bond performance.

3. There were nine new issuers in 2024, more to follow

SGD issuances in 2024 were driven both by new entrants to the market, as well as the re-entry of previous issuers. New issuers include Toronto-Dominion Bank, another in a long line of global banks keen to tap the SGD market. In fact, the top four SGD corporate bond issuers in 2024 were major banks such as HSBC, UBS, BNP and Standard Chartered, with issuances totaling about $6 billion. Given their profitability in a higher rate environment, banks’ domination of the SGD corporate bond market has helped to support the market’s resilience and stability.

New entrants to the Singapore market in 2024.SOURCE: BLOOMBERG / UOB ASSET MANAGEMENT

Developers Ho Bee Land also entered the SGD market for the first time in 2024. The company joined the likes of City Development and CapitaLand Group, both of which rank among the top 10 biggest issuers of SGD bonds. As investor interest continues to grow, the emergence of new names is expected, which in turn could stimulate more demand in the market.

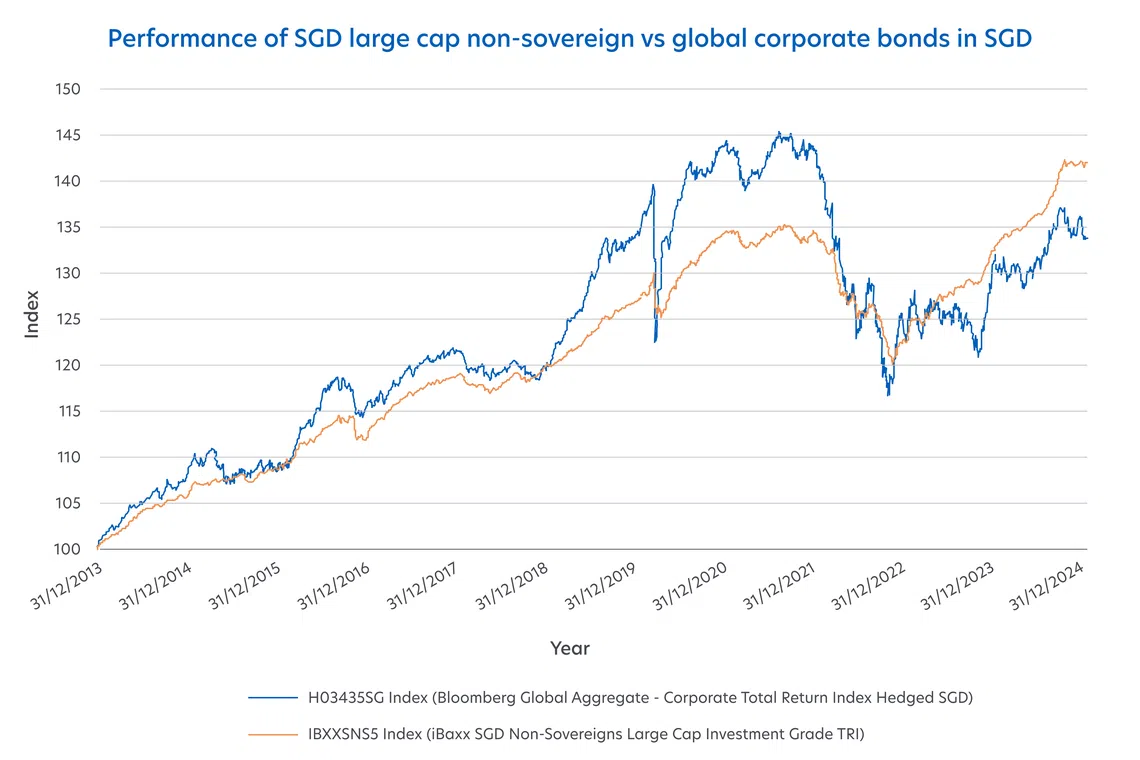

4. SGD non-sovereign bonds offer diversification benefits

The SGD bond market is smaller in size compared to its larger Asian neighbours such as China, Japan and Korea, but punches above its weight due to Singapore’s stable growth prospects, strong currency and sound credit profile of its issuers, including statutory boards.

The performance of SGD large cap non-sovereign bonds and global corporate bonds in SGD between 2014 and 2024. The graph has been re-drawn and minor deviations may exist.SOURCE: BLOOMBERG / UOB ASSET MANAGEMENT

This has enabled the SGD bond market to display greater resilience in times of crisis. Over the past decade, SGD investment-grade corporate bonds underperformed compared to global peers in the pre-pandemic period when rates were low. However, this trend reversed in 2022 as global interest rates started to spike. In general, SGD corporate bonds offer a good means of diversification, not just for global equity but also global bond portfolios.

This article was written by Ms Joyce Tan, head of Asia Fixed Income at UOB Asset Management.

Important notice and disclaimers

All information in this publication is based upon certain assumptions and analysis of information available as at the date of the publication and reflects prevailing conditions and UOB Asset Management Ltd (“UOBAM”)‘s views as of such date, all of which are subject to change at any time without notice. Although care has been taken to ensure the accuracy of information contained in this publication, UOBAM makes no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for the accuracy or completeness of the information.

Potential investors should read the prospectus of the fund(s) (the “Fund(s)”) which is available and may be obtained from UOBAM or any of its appointed distributors, before deciding whether to subscribe for or purchase units in the Fund(s). Returns on the units are not guaranteed. The value of the units and the income from them, if any, may fall as well as rise. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. An investment in the Fund(s) is subject to investment risks and foreign exchange risks, including the possible loss of the principal amount invested. Investors should consider carefully the risks of investing in the Fund(s) and may wish to seek advice from a financial adviser before making a commitment to invest in the Fund(s). Should you choose not to seek advice from a financial adviser, you should consider carefully whether the Fund(s) is suitable for you. Investors should note that the past performance of any investment product, manager, company, entity or UOBAM mentioned in this publication, and any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance of any investment product, manager, company, entity or UOBAM or the economy, stock market, bond market or economic trends of the markets. Nothing in this publication shall constitute a continuing representation or give rise to any implication that there has not been or that there will not be any change affecting the Funds. All subscriptions for the units in the Fund(s) must be made on the application forms accompanying the prospectus of that fund.

The above information is strictly for general information only and is not an offer, solicitation advice or recommendation to buy or sell any investment product or invest in any company. This publication should not be construed as accounting, legal, regulatory, tax, financial or other advice. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited, UOBAM, or any of their subsidiary, associate or affiliate or their distributors. The Fund(s) may use or invest in financial derivative instruments, and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund(s)’ prospectus.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd Co. Reg. No. 198600120Z

Join ST’s Telegram channel and get the latest breaking news delivered to you.