The overall evaluation of financial markets is often briefly described as “risk on” or “risk off”. In the former situation, investors seek risk assets such as equities and high-yield bonds, thus increasing the level of risk in their portfolios. In the opposite case, they reduce risk and prefer government bonds and cash holdings. The back and forth between these two states is central to asset allocation. In the following, however, the focus is one level deeper, namely on the question of when to favor equities over high-yield bonds and vice versa.

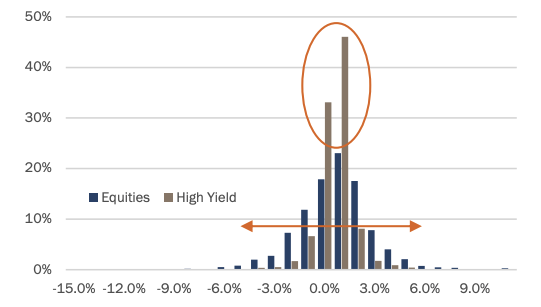

The chart shows the distribution of weekly returns on U.S. equities (MSCI USA Index) and high-yield bonds (ICE Bofa US High Yield Index) for the period 1990 to 2022. The excess returns of the two asset classes are considered, i.e., the return minus that of cash (in the case of equities) or of government bonds with the same maturity (in the case of high-yield bonds; average maturity of approximately five years).

Return distribution Equities vs High-yield bonds

Source: Refinitiv, Bank J. Safra Sarasin. Weekly excess returns 1990-2022.

The distributions of weekly excess returns of equities and high-yield bonds differ significantly. The frequency of returns close to zero for the latter is evident. Equities, on the other hand, exhibit a broader dispersion (higher volatility), which is reflected in more low and high excess returns. These characteristics reflect the most frequently cited investment motives of the respective asset class. Equities are held primarily to benefit from a price increase, while current income (“carry”) in the form of dividends is less important. High-yield bonds, on the other hand, are held primarily for income, while possible price gains are of secondary importance.

Two fundamental questions arise from these observations. First, how do the two asset classes behave over the long term and at different stages of the business cycle? Second, what signals the attractiveness of each asset class?

Long-term risk and return characteristics

The risk assets under consideration have various similarities, but also relevant differences. Both equities and high-yield bonds are issued by companies (government bonds with low credit ratings are not considered). By definition, high-yield bonds are the segment of corporate bonds with below-average credit quality (rated BB or lower). Such companies, in contrast to those with investment-grade ratings (BBB or higher), usually have an above-average debt ratio (high “leverage”) and high-interest costs relative to the earnings generated. This difference in the quality of debtors explains the higher credit spreads (“risk premiums”) and volatility of high-yield versus investment-grade bonds.

One company, two asset classes

From a corporate finance perspective, shares and bonds differ primarily in three aspects. Firstly, by the type of compensation, secondly with regard to the treatment in the event of bankruptcy or debt restructuring, and thirdly, by the voting rights of shareholders in corporate decisions. Bond investors are usually compensated through pre-determined coupon payments. Shareholders, on the other hand, are compensated in form of dividends based on performance. The claims of bond investors always have priority over those of shareholders – this is particularly important if a company is in financial difficulties. Bondholders therefore at best receive their invested capital plus all coupon payments. Shareholders, in turn, benefit from the companies’ earnings growth and dividend payments.

Generally speaking, both groups of investors benefit from good business development and a positive macroeconomic environment. However, there are differences to be considered. For example, shareholders will cheer over a record result, while bond investors are perfectly satisfied with a decent result for the year. The sensitivities between the two groups diverge especially when management chooses a risky strategy to achieve this result. To use a sports metaphor: Bond investors play for a draw, shareholders for a win. Accordingly, management must balance trade-offs between equity and bond investors, especially when it comes to the use of profits. Should capital expenditures be made, debt repaid or dividends paid out? Shareholders usually prefer the latter, while bond investors would rather see debt reduction and thus a potential improvement in the credit rating.