richcano

By Ivan Castano

At a Glance

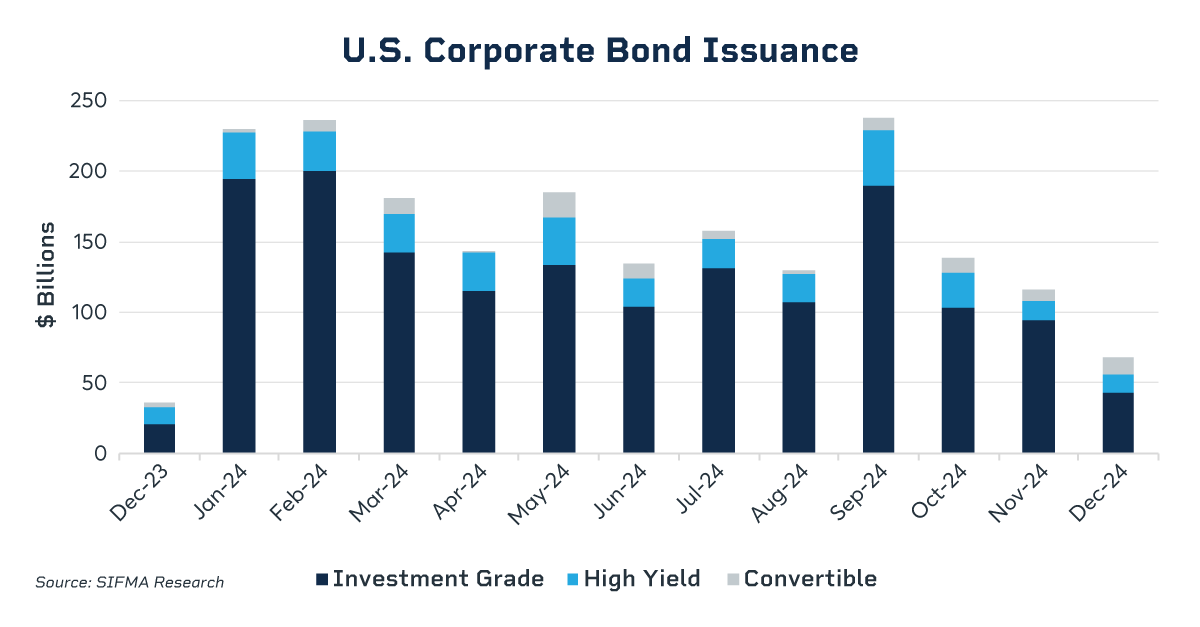

- Corporate bond issuance is rising, with issuance increasing around 30% in 2024 compared to 2023

- With corporate bond and interest-income markets gaining ground, CME Group launched Credit futures, which provide more precise hedging and greater product access

The U.S. corporate bond market closed 2024 with strong gains as firms issued debt ahead of potential risks tied to the economy and geopolitics.

The fourth quarter, for instance, saw massive issuance as firms rushed deals amid fears that market conditions (also ahead of the November presidential elections) could deteriorate.

“September issuance was very good,” said Kim Rupert, who oversees global fixed income for Action Economics. “There were 50 borrowers. It was the busiest month in three years.”

In 2024, investment-grade bond issuers garnered around $1.5 trillion, up nearly 24% from 2023 according to the Securities Industry and Financial Markets Association (SIFMA). Meanwhile, sales of high-yield or ‘junk’ notes lured $302 billion, well above the $183.6 billion in total issuance in the prior year.

“With inflation coming down and the Fed cutting rates and suggesting it still sees signs the economy is doing well, the [issuance] climate has been quite attractive,” said Rupert.

Activity could be more subdued [in 2025], especially if the Fed cuts rates more than expected, said Jeff Grills, head of U.S. cross markets and emerging markets debt at Aegon Asset Management.

“If you get dramatically lower rates, high-yield issuance could decline,” said Grills, as firms will have to pay a premium to execute deals in a softening economy. Investment grade names, however, may continue to issue bonds as investors pivot into safer positions.

Long-Term Strength

Skyler Weinand, managing partner at Regan Capital in Dallas, expects medium-to-long term issuance to remain strong, however, even if yields continue to decline and spreads remain tight. This is because U.S. corporate balance sheets are in good shape (as firms have been deleveraging since Covid), boosting credit quality and lowering default risk, according to Weinand. “There are many more buyers than sellers,” he noted.

Inflation, however, remains a lingering risk that could erode consumers’ buying power and long-term bond returns.

“The easing cycle plays into duration risk,” Rupert noted. “Yields are coming down because of the rate cuts and while inflation has been subsiding, if [inflation] starts to perk up, it will make duration less attractive. If you invest in a 10-year bond, you better get a return worth tying up your money in. While the bond may pay you 4%, if you have inflation jumping 6%, what are you left with?”

While the market could see a dip due to exogenous factors such as last August’s tech correction or Middle East tensions, only a much bigger, drawn out conflict could significantly derail future issuance, Grills noted.

Enter Credit Futures

To enable investors to manage risks around volatile credit markets, CME Group has introduced a series of credit futures tracking Bloomberg’s corporate bond indices.

Launched in June 2024, they have so far seen average daily volume [ADV] and open interest [OI] of around 1,500 and 1,100 contracts respectively, said Ted Carey, Executive Director of Rates and OTC products at CME Group. Roughly 25 firms comprising a mix of banks, asset managers, hedge funds and market makers are active participants.

Based on the Bloomberg U.S. Corporate Bond Index, which measures the performance of investment grade corporate bonds, and the Bloomberg U.S. High Yield Very Liquid Index tracking a more liquid segment of the broad high-yield, fixed-rate corporate bond market, they are the first contracts enabling fixed-income investors to effectively manage portfolio credit and duration risk tied to these indices.

The decision to launch the futures stemmed from participants’ growing need to offset risks linked to corporate bonds which have not been available for trading with index-based futures, unlike Treasuries or equities. The advent of electronic trading has also boosted efficiencies, helping grow the market.

Electronic Trading Boosts Growth

“Our clients have shown interest in these products as the corporate bond markets have grown in recent years,” said Carey. “Futures provide an effective method to manage risk directly tied to the bond indexes with low tracking error, and clients are excited about the 70% margin offsets with Rates and Equity futures.”

Capital efficiencies continue to remain in focus given the level of interest rates and volatility. The new credit derivatives provide more precise hedging than other alternatives and offer greater funding, leverage and product access, Carey said.

The continued electronification of credit trading has also brought innovations such as real-time bond pricing and enhanced relative value analytics to traders on the Terminal, according to Fateen Sharaby, index business manager with Bloomberg Indices. This has helped improve price transparency and enable further standardization in this market.

“Nearly 50% of investment grade bonds are traded electronically, while for high yield bonds this figure is about 35%, versus roughly 25% and around 15% respectively as of five years ago.”

The Bloomberg Corporate Index features a large number of U.S. blue chips, such as Apple or Verizon. This allows investors to tap into a large pool of double or triple A-rated firms on one of the most widely tracked indices in the market. The Bloomberg U.S. High Yield Very Liquid Index, meanwhile, tracks around 1,000 high yield securities with a minimum amount outstanding of $500m, with the index limiting issuer exposure to 2% of total market value to maintain diversification and prevent idiosyncratic risk.

There’s also a complementary future referencing a Duration-Hedged Index, enabling clients to trade only the credit component of the risk without exposure to interest rates (Treasury yields). It can be traded in conjunction with the investment grade and high-yield indices to provide an additional tool to express tactical views around duration.

Refining Strategies

Sharaby outlined some examples about how market participants are using the contracts.

“In a falling rate environment, investors are generally more inclined to take on credit risk and adjust duration due to the lower yields available from government bonds. Although, positive economic data and inflation trends have somewhat countered this dynamic. Yet, there is increasing demand for corporate bonds, particularly those with higher yields, as investors search for better returns.”

“The beauty of credit futures is that they reflect broad market sentiment about credit risk, allowing investors to make strategic or tactical adjustments based on overall market trends,” he added. “Hedging all or a portion of their portfolio is possible without selling the underlying bonds, avoiding liquidity issues or high transaction costs. We also find that more than half of the order book is trading inter-commodity spread risk, which means investors are long the corporate bond future and short the 10-year Treasury.”

Detailing another use case, Sharaby added that credit futures have arrived at a good time, with risk management needs rising.

“There is a lot of uncertainty about where markets are heading, such as interest rates, inflation, rising corporate debt levels and the potential for credit downgrades in certain sectors. As market volatility persists, investors will continue to evaluate tools necessary to manage these risks,” he said. “If there are concerns about rising defaults and their impact on high-yield portfolios, for instance, a manager can take a short position in the credit future to offset potential losses.”

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.