A company having to pay more to its creditors is not necessarily a bad thing, especially if you’re the creditor.

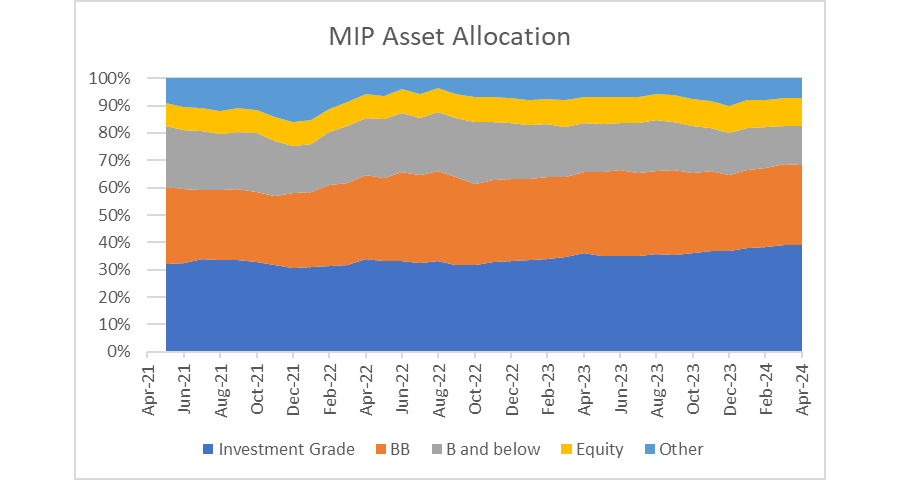

Our fund’s exposure to bonds rated B and below has rarely been lower. This part of the market is a natural hunting ground for us, given its explicit mandate to deliver high income. Yields remain higher here than in BB and above. So, why steer away from it?

There are two sides to this. One is the presence of attractive alternatives, both in outright yields and on a risk-to-reward basis. With the rise in interest rates, yields on higher quality bonds, in BB and investment grade, have been good. There is no need to chase income.

The flip-side of this positive is a concern that the yields offered on assets in the lower part of the credit quality spectrum do not justify the risks.

Source: Invesco

Competing forces – growth versus re-financing risk

As shown in the chart above, our exposure to lower quality bonds has continued to fall in the past couple of quarters, despite this market segment being bolstered by improved growth data and rising hope of a soft economic landing. High yield bonds have outperformed investment grade.

Source: Invesco

Growth is good for high yield. High yield companies tend to be more indebted and so have higher debt-servicing costs relative to their earnings. This means they are more sensitive to changes in earnings. As an asset class, high yield is more correlated with equities than more rate-sensitive investment grade and government bonds.

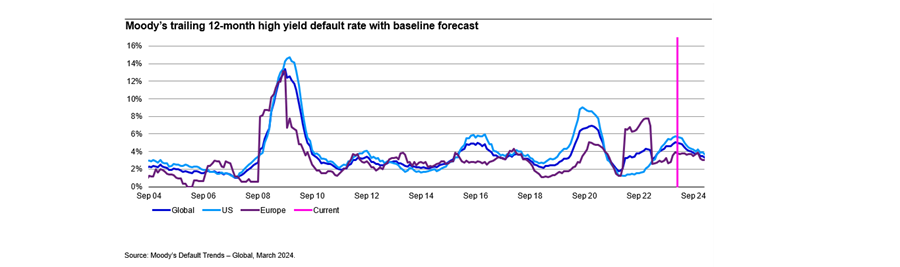

With earnings holding up well across the corporate sector, commonly followed metrics for high yield, such as the ratio of debt to EBITDA and interest coverage, are looking healthy. Default rates and default expectations have also remained within the normal range.

Source: Invesco

My reason for concern about lower-quality credit is not that I see an immediate risk of an earnings recession. It is to do with re-financing risk.

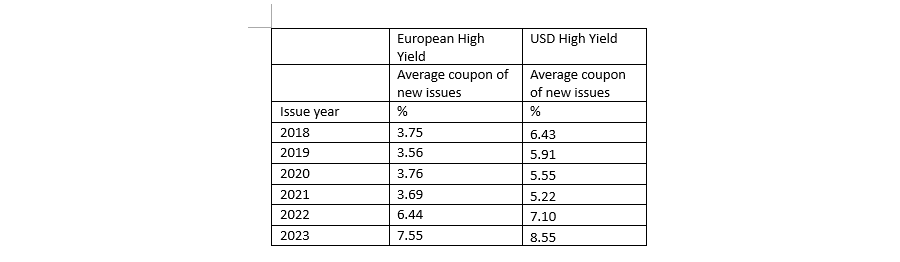

For several years before 2022, ultra-low interest rates enabled bond issuers to finance very cheaply, with historically low coupons.

Source: Invesco

This changed in 2022. Higher interest rates meant the high yield bond market had to adjust to remain competitive. The price of these low coupon bonds fell below par and the coupons on new bonds began to rise.

New bonds have to offer a yield that is competitive with the secondary market. At current market yields, that means coupons on new bonds, issued at par, will have to be substantially higher.

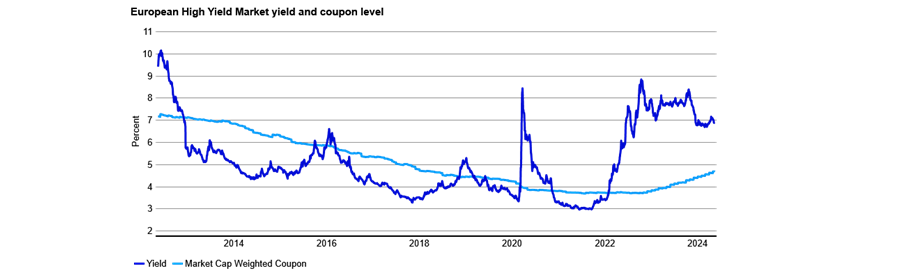

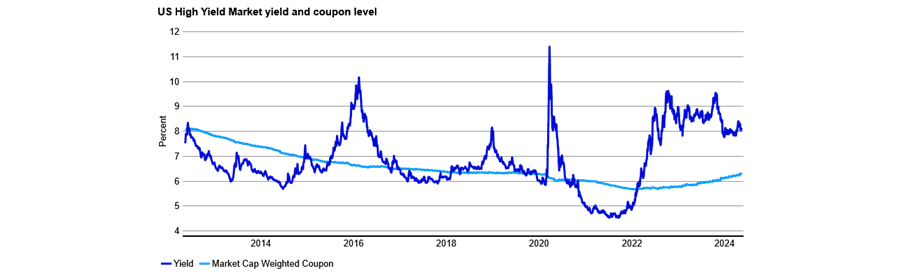

The charts below compare the weighted average coupon of high yield bonds with the market yield. In both the European and the dollar markets, coupons are substantially below the yield. Unless the yield drops, issuers will have to pay more coupon to close this gap.

Source: Invesco

Source: Invesco

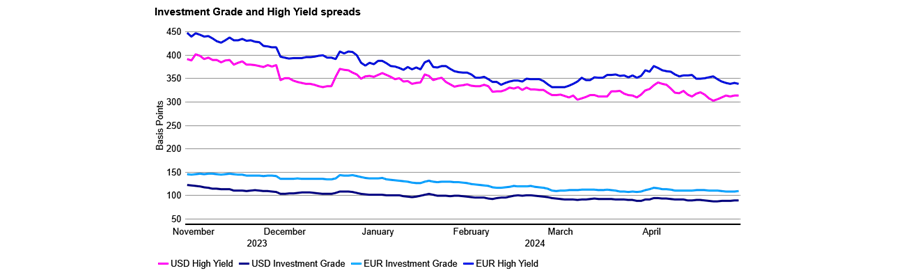

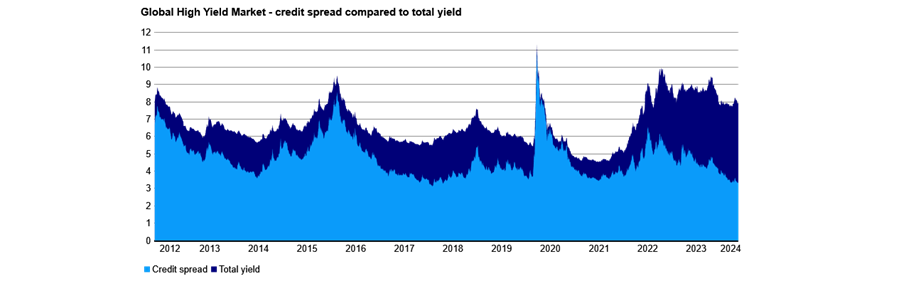

Spreads are not unusually high. In fact, they are well below average. As the chart below reminds us, the dominant driver of today’s higher yields are interest rates.

Source: Invesco

While interest rates remain high, high yield issuers face a re-financing challenge. According to Bank of America research, 25% of the US high yield market will be free cash flow negative if they have to carry out the next two years of re-financing at current rate expectations. In other words, these companies’ balance sheets don’t work unless the Federal Reserve cuts more than is currently priced.

Taking a step back, this environment is a little counterintuitive. Better growth conditions pose a threat to the high yield market. Higher earnings will increase the ability of corporates to service their existing debt, but if interest rate expectations stay high (in part because of better growth), then many will struggle with re-financing.

What this means for my portfolio

Monthly Income Plus is built on fundamental credit research and bond selection. I am wary of the re-financing risk faced by high yield and I have reduced exposure to that part of the market. But that doesn’t mean I will avoid it altogether.

These risks may offer opportunities at the individual company level. High yield companies, as a whole, will have to pay more interest. Some companies will struggle in this environment.

I will be aiming to avoid them through careful credit assessment. But others will be able to manage. That a company has to pay more to its creditors is not necessarily a bad thing, especially if you’re the creditor.

We have already seen good companies coming to the market and paying coupons several percentage points higher than when they borrowed a few years ago. We’ve been happy to invest and to take those coupons.

Rhys Davies, manager of Invesco’s Monthly Income Plus fund. The views expressed above should not be taken as investment advice.