Richard Drury/DigitalVision via Getty Images

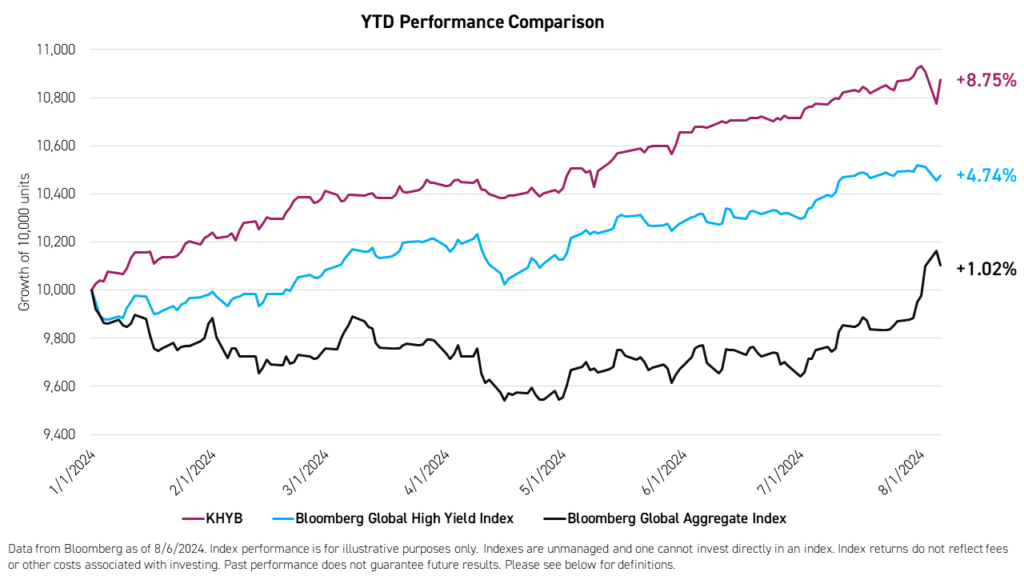

Asia’s high yield bond market has been a star performer globally so far this year. Represented by the KraneShares Asia Pacific High Income USD Bond ETF (KHYB), Asia’s high yield bond market has outperformed both global investment grade and global high yield year-to-date (YTD).1

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed or sold, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted.

KHYB is denominated in US dollars and actively managed by Nikko Asset Management, a leader in Asia fixed income with 30+ years of experience in the market.

What has led to this outperformance?

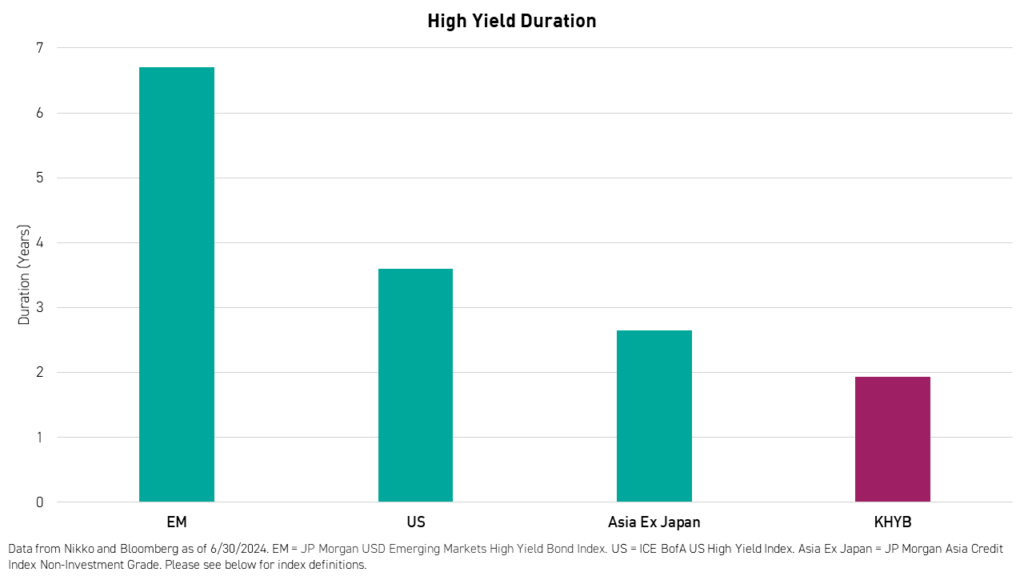

Low Duration

Interest rate risks have driven returns in most fixed income markets over the past six months. Going into 2024, some analysts were optimistic that the US Fed would move swiftly to cut rates, pricing in up to six separate interest rate cuts throughout the year.2 This led to a rally in investment grade bonds globally. However, the rally fizzled out earlier this year as the cuts did not materialize.

High yield bonds issued by quality corporates in Asia excluding Japan tend to be issued with shorter maturities compared to their US and global counterparts. This leads to a lower overall duration, or interest rate risk, compared to both broader emerging markets and the United States. This has insulated the bonds held by KHYB’s portfolio from interest rate-fueled volatility.

Strong corporate balance sheets in Asia

An interest coverage ratio measures a company’s ability to pay interest on its debts by dividing its earnings by its net interest expense over a given period. As such, the higher the coverage ratio, the better the company’s ability to cover its interest payments. Asian high yield issuers had an average interest coverage ratio of 4 times in 2023, even amid stress in China’s real estate industry, which is nearly equivalent to the current average in the US, where spreads remain tight. Meanwhile, the 10-year average interest coverage ratio is more than 5 times in Asia ex Japan compared to only 2.6 times in the United States.3 This has likely led to confidence among investors and dampened potential sell offs.

Limited Supply

Issuance in Asia ex Japan’s high yield bond market declined to a decade low in 2023.4 Meanwhile, according to Nikko, demand has remained robust from regional institutions,4 leading to strong price performance for the limited number of issues on the market.

What are some catalysts for continued strong performance in Asia’s high yield bond market?

Strong economic growth in the region

In July, the International Monetary Fund (IMF) raised its 2024 GDP forecast for India to 7% from the 6.8% projection that it issued in April.5 Meanwhile, Southeast Asia, as a region, is forecast to grow by 4.6% in 2024, up from 4.1% in 2023.6 Growth trends in the region are fundamentally supported by policy, as many central banks mull cutting interest rates as inflation nears targets, and structural shifts, including global manufacturers’ “China +1” strategy of moving parts of supply chains to other countries in the region to avoid import duties.

A Potential Rebound in China real estate bonds

Most tier 1 cities in China have removed the home purchasing restrictions instituted as part of a significant de-risking in the sector that started in 2021. Meanwhile, the phrase “Housing is for living in, not for speculation,” was not included in the government’s communique following the Third Plenum, an important policy meeting held in Beijing last month.7 This should allow for private developers to increase sales again, potentially benefitting their bonds that currently trade at significant discounts.

US Dollar Denomination

The bonds held in KHYB are exclusively denominated in US dollars. With the dollar at record highs and the potential for interest rate cuts by the US Fed toward the end of this year, we could see a significant US dollar depreciation in the coming years. This would benefit the financial health of Asia’s high yield issuers, whose income is denominated in local currency, making their coupon and interest payments more sustainable.

Conclusion

Asia’s high yield bond market has outperformed both global investment grade and global high yield so far this year because of its low duration, strong balance sheets among issuers, and record low supply. We believe Asia high yield could continue its outperformance trend thanks to strong regional economic growth, a potential rebound in China real estate developer bonds, and an increase in the sustainability of coupon and interest payments with a potential US dollar depreciation on the horizon.

In our opinion, Asia high yield warrants inclusion in a global fixed income allocation. We believe the asset class’s outsized performance this year is a testament to its potential diversification* benefits.

Investors can easily access Asia’s high yield, US dollar-denominated bond market and benefit from Nikko Asset Management’s market expertise through the KraneShares Asia Pacific High Income USD Bond ETF (KHYB).

*Diversification does not ensure a profit or guarantee against a loss.

Citations:

- Data from Bloomberg as of 7/26/2024.

- Caldwell, Preston. “We Predict 6 Interest-Rate Cuts in 2024,” Morningstar. December 14, 2023.

- Data from JP Morgan as of 12/31/2023.

- Data from Nikko Asset Management as of 6/30/2024.

- “IMF raises India’s economic outlook, says global growth will remain lackluster,” CNBC. July 17, 2024.

- Data and forecast from the International Monetary Fund (IMF) as of 6/30/2024.

- “Full text: Resolution of CPC Central Committee on further deepening reform comprehensively to advance Chinese modernization,” Xinhua. July 21, 2024.

Index Definitions:

JP Morgan Asia Credit Index Non-Investment Grade: The J.P. Morgan Asia Credit Index Core (JACI Core) consists of liquid US-dollar denominated debt instruments issued out of Asia ex Japan. The JACI Core is based on the composition and established methodology of the J.P. Morgan Asia Credit Index (JACI), which is market capitalization weighted. JACI Core includes the most liquid bonds from the JACI by requiring a minimum $350 million in notional outstanding and a minimum remaining maturity of 2 years. JACI Core also implements a country diversification methodology. Historical returns and statistics for the JACI Core are available from December 30, 2005. The non-investment grade version of the index is limited to issuers classified as non-investment grade based on the middle rating between Moody’s, Fitch, and S&P

JP Morgan USD Emerging Markets High Yield Bond Index: The JP Morgan USD Emerging Markets High Yield Bond Index tracks liquid, US Dollar emerging market fixed and floating-rate debt instruments issued by corporate, sovereign, and quasi-sovereign entities. The index tracks instruments that are classified as non-investment grade (HY) in the established JP Morgan EMBI Global Diversified Core and JP Morgan CEMBI Broad Diversified Core indices, and combines them with a market capitalization based weighting. The returns and statistics are available since December 2011.

ICE BofA US High Yield Index: The ICE BofA US High Yield Index provides a comprehensive, accurate representation of the US high yield market and its components.

Bloomberg Global High Yield Index: The Bloomberg Global High Yield Index is a multi-currency flagship measure of the global high yield debt market. The index represents the union of the US High Yield, the Pan-European High Yield, and Emerging Markets (EM) Hard Currency High Yield Indexes. The high yield and emerging markets sub-components are mutually exclusive. The index was launched on January 1, 1990.

Bloomberg Global Aggregate Index: Bloomberg Global Aggregate Index: The Bloomberg Global Aggregate Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate, and securitized fixed-rate bonds from both developed and emerging markets issuers. The index was launched on January 1, 1990.

Term Definitions:

Duration: A measure of interest rate risk, duration expresses, in years, the change in the time it would take for a bond to be repaid with every 1% change in interest rates.

Interest Coverage Ratio: A debt and profitability ratio used to determine how easily a company can pay interest on its outstanding debt. The interest coverage ratio may be calculated by dividing a company’s earnings before interest, taxes, depreciation, and amortization (EBITDA) by its interest expense during a given period.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.