NikkiZalewski/iStock via Getty Images

How did this happen? I have been a high yield or “junk bond” skeptic as long as I can remember. A very long time ago, I worked for a few years for Donaldson, Lufkin & Jenrette, which at one time was the David to Goliath of this market segment. In other words, they were much smaller than some other firms, but they were good. Really good. That had a lot to do with their purchase of a firm called Drexel Burnham Lambert a few years before I arrived there. Drexel had been the home of a couple of fellows named Milken and Boesky, whose brilliance drove the firm’s growth, but whose crimes drove it into bankruptcy. DLJ sparked many careers during its run from the late 1950s through its purchase in 2000 by Credit Suisse. That includes current Oracle CEO Safra Catz and several other current Wall Street notables listed here.

Wikipedia

Why that trip down memory lane? Because that might be the last time I thought seriously about taking a position in anything related to high-yield/junk bond investing. So, nearly 30 years. The reasons are primarily because I have always felt that the reward of investing in this market segment for ETF investors was rarely commensurate with the risk.

However, a different breed of junk exists today. Or, to put it more properly, some of the things investors find in the junk section of the bond market in the modern investment era are less the money-losing/never-had-a-chance 15% yielding stuff of the past. There is a sub-segment of the high-yield market referred to as “fallen angels.” I’ve watched two ETFs for many years, and I have finally decided it is time to dip one of my 10 toes in the water with one of them. Until now, my participation in high-yield bonds was limited to buying put options on the original junk bond ETF, the iShares iBoxx $ High Yield Corporate Bond ETF (HYG), hoping for the credit markets to implode.

That may still happen. But as I have emphasized in both my articles on my YARP™ dividend portfolio and my recent guest spot on Seeking Alpha’s Investing Experts podcast, position size is what matters, as much as or more than the ETF or stock owned. That is, a 20% gamble in anything can hurt if it goes wrong, but a 1-2% position in something can literally go to zero and not change my life. I refer to this as “taking big shots with small amounts of money.”

And while fallen angels high-yield investing has historically been far less dramatic than taking a “big shot” by courting the potential for major loss, I am willing to start a position, as I did in my YARP portfolio this week. For those who have followed my YARP-focused articles the past few months, note that while that portfolio is primarily about 40 stock holdings with a put and call option purchase “pairing” around it, ETFs are fair game too. Particularly, ETFs that possess an attractive yield and also have upside potential in price, based on my technical analysis work that is the final decision tool I use.

That’s my thesis for high-yield investing via the fallen angels approach. Now, what ETF did I use to finally make a jump into junk, despite my ongoing concerns about an eventual credit crisis that would likely rock lower-rated bonds? And what’s a fallen angel, anyway?

Fallen Angel bonds – simply defined

Corporate bonds are initially rated as high as AAA (just a few still exist) and as low as D (if in default). Most of the traditional corporate market carries yields of AA to BBB. Below BBB is BB and then B, and this is where a lot of high-yield managers and indexes tend to hang out.

After a bond is issued with that rating, the rating can change when a rating agency decides the company issuing the bond is at greater risk of paying its obligations of interest and then paying the principal back when the bond is due to mature. Naturally, if a bond is rated BBB or higher (not junk) when it is issued, but then something happens to tip that rating below BBB, the bond’s value typically plummets.

And that is where fallen angel ETFs shop. There are two such ETFs that I have tracked for a while. One is the iShares Fallen Angels USD Bond ETF (FALN) run by ETF giant BlackRock. The other, which preceded FALN by about four years, is the Van Eck Fallen Angel High Yield Bond ETF (NASDAQ:ANGL). As we’ll see below, the difference between them is largely splitting hairs.

Both are solid for what they do. My focus is on ANGL, primarily because when I judge two ETFs to be very similar, the tie-breaker for me to choose which one to buy is not what it is for many ETF investors.

2 things I disagree with compared to many ETF investors

I don’t ever expect anyone to follow what I do, and vice versa. That’s what makes a market. But personally, after decades of ETF analysis, I put very low emphasis on expense ratio and “trailing” past performance. Expense ratios make sense to focus on when deciding which S&P 500 index fund to own for the next 10-100 years. But when, as in this case, it is about identifying something I can add to my YARP portfolio, and fluctuate the weighting up and down in a range based on my tactical adjustment process, what matters to me is what I’m buying. And who I am buying.

So ANGL gets the nod, simply because I find their communication about ANGL to be more informative. That’s what firms below the very biggest tend to do, and Van Eck does a nice job of that – putting information and insight on their website on a regular basis to allow investors to go beyond simply perusing a list of top holdings, performance and expense ratios. Analysts call that “transparency,” and in my ETF assessment process, it is a priority.

ANGL vs. FALN: slim difference, but worth reviewing

This article is as much about me writing up my own research approach as it is about this familiar but rarely used segment of the market. So I did a couple of comparisons to see if I was missing something in choosing ANGL over FALN.

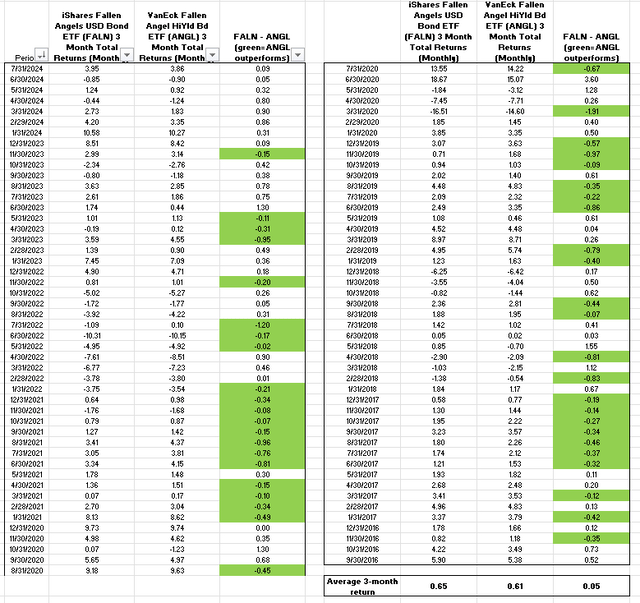

First below, we see a comparison of rolling 3-month total returns back to the two ETFs’ common inception date. Bottom line to me: Neither ETF has blown up or surged consistently relative to the other. If someone said to me, “you can buy any high-yield ETF except for ANGL” I would not sweat it and use FALN. They are that close.

SungardenInvestment.com (Ycharts data)

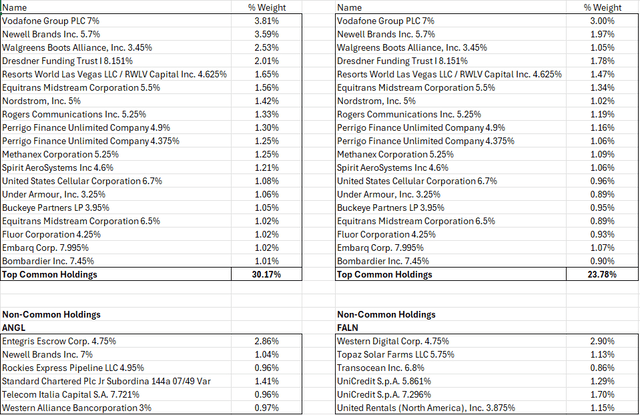

Taking it a step further, I grabbed the top 25 bond holdings from each fund (ANGL on the left, FALN on the right) and looked for differences. Because the similarities were many. That rationalizes the small, not large performance differentials shown above. Either of these ETFs can capitalize on better conditions in the market for fallen angel bonds, and they would suffer roughly equally if that market cratered.

The common holdings are grouped on top, and the different holdings between ANGL and FALN are just below that.

SungardenInvestment.com (Ycharts data)

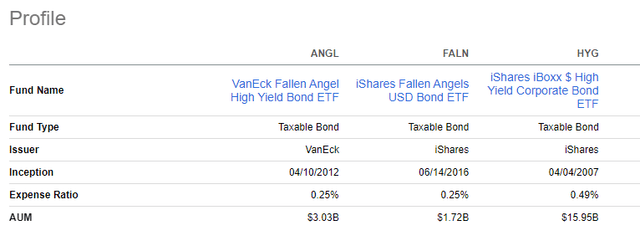

Note that both ANGL and FALN are much smaller than HYG, the default choice for many high-yield bond investors, including the Fed some years back (look it up!). And their expense ratios are actually half that of HYG. So while I am not an expense ratio-driven investor, this only helps the case to include ANGL in my portfolio.

Seeking Alpha

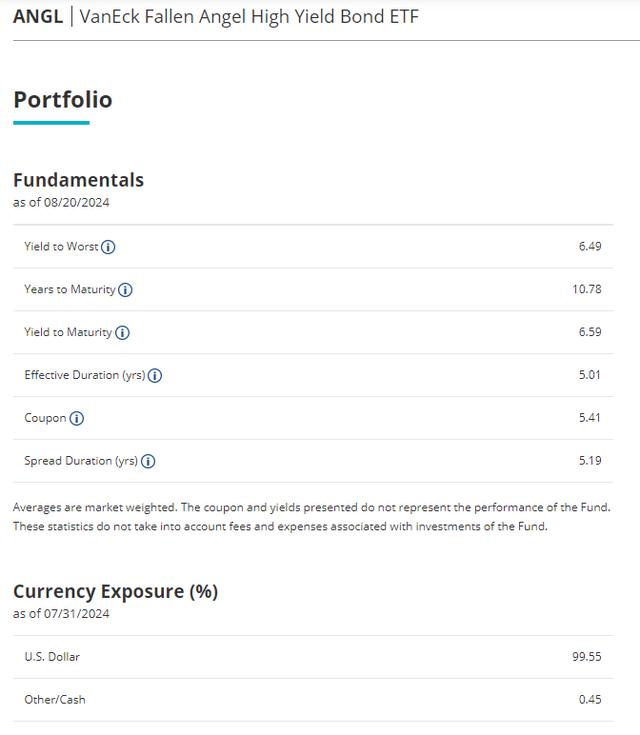

Focusing now solely on ANGL, that’s a nice yield to maturity compared to equities and naturally well above US Treasuries.

But perhaps the key statistic to me in this table is the yield compared to the coupon rate. The average bond in this portfolio has a price of $94, so these are not bonds that have been knocked down to $80 or $60 as classic “junk” would be.

VanEckfunds.com

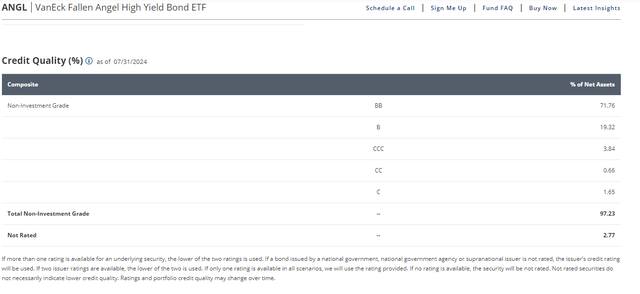

As per ANGL’s approach, most of the portfolio is crowded into BB bonds, and to a lesser extent, B-rated securities. I was actually a bit surprised to not see more non-rated bonds in here.

VanEckfunds.com

Can you apply YARP dividend analysis to bond ETFs? Sure you can!

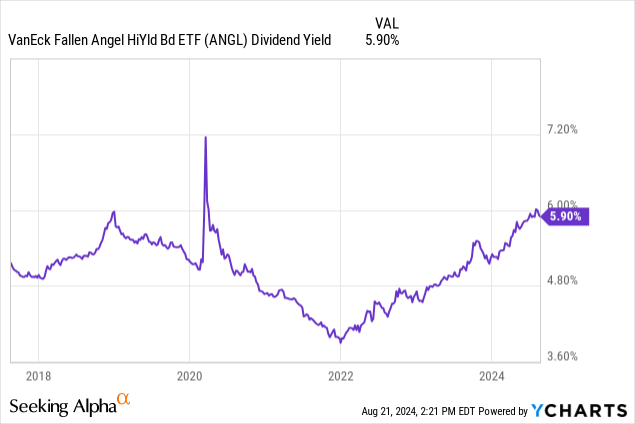

My Yield At a Reasonable Price (YARP) approach to dividend investing is rooted in a key starting point: where is the dividend yield compared to where it has been across the past seven full years.

Here is ANGL visually. I see without doing any calculations that it is toward the top of its 7-year yield range, which spiked to 7.2% with pretty much all high-yield bonds in early 2020, and troughed in early 2022 at around 3.8%. At 5.9% currently and hinting at tipping lower (i.e. the price of the ETF is starting to tip higher), we have something here.

Now, a quick peek into my detailed YARP history analysis. Same data as above, but sorted from highest to lowest dividend yield. You see the current reading in yellow, and it tells us that ANGL’s yield is in the top 3% (97% percentile) of readings over the past seven years. In YARP terms, that means “cheap” historically, but it can also be too early.

SungardenInvestment.com (Ycharts data)

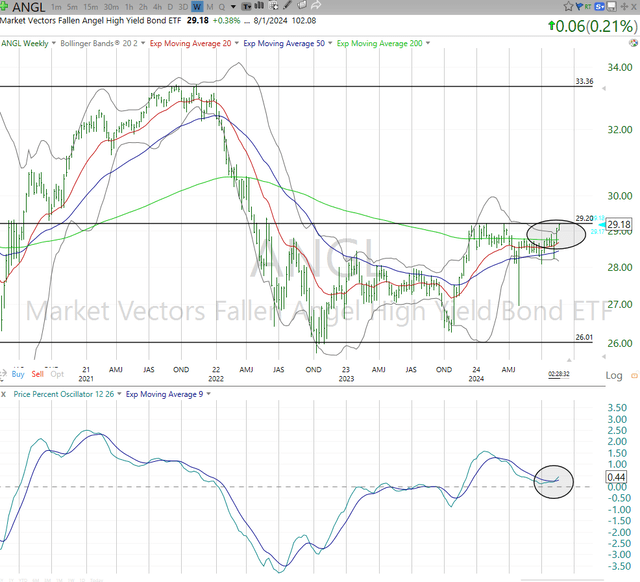

ANGL: technical chart view

And that 97% percentile reading “begs” for a look at the price chart, so that’s what I’ll do here to finish up. I see a potential breakout at hand in this chart of weekly prices. I also see upside to $33, and this excludes that nearly 6% yield, so that total return is very much in my YARP-zone if you will. And, the bottom of the chart shows that momentum for ANGL is just starting to cross upward. The daily chart (not shown) looks similar to me.

SungardenInvestment.com (TC2000 data)

Angels in my portfolio

I still can’t believe I’m writing that, but yes, I’m willing to start an ANGL position. In fact, I did. It is smallish for now, but if I get better, firmer signs of a breakout in price, and all stays calm in the BB-B bond market for a while, I feel like I’m getting a nice contrarian buy here within a very complex and misunderstood part of the bond market.

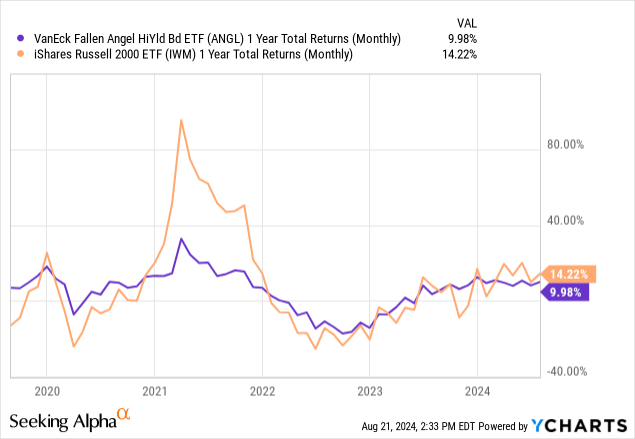

In fact, I’ll throw one more chart in here to make the point that I prefer this approach to investing in small to midsized companies than owning a small-cap ETF like IWM. Sure there, are some higher-quality small-cap funds and I track a few. However, I am about total return, and mostly about risk management.

I like the reward-risk tradeoff here, and ANGL complements my YARP stock portfolio very well. I’m in it, and I rate it a buy. Just be sure not to misinterpret that rating. As I said on the podcast and in articles here for a long time, position sizing is everything. So I’m flying with the angels, just not too high yet.