By Matt Tracy and Shankar Ramakrishnan

(Reuters) -When President Donald Trump’s 90-day pause on U.S. tariffs ends Wednesday, once-bitten-twice-shy bond investors could take on more risk by adding high-yield bonds to portfolios, rather than panic-sell credit as seen after April 2’s ‘Liberation Day’ tariff announcement, said many fund managers and bankers.

Credit market shops as a whole are likely to avoid a knee-jerk reaction to sell the riskiest bonds in their portfolios, and instead buy them as they view any impasse on tariff negotiations as a way to a watered-down solution rather than a non-negotiable outcome, the fund managers and bankers said.

“Investors are likely to take any news of a tariff deadline extension in their stride and not overreact because there is always a put with this government – they will find some resolution to any impasse like they did post-Liberation Day,” said Sandeep Desai, co-head of North America leveraged debt capital markets at Deutsche Bank.

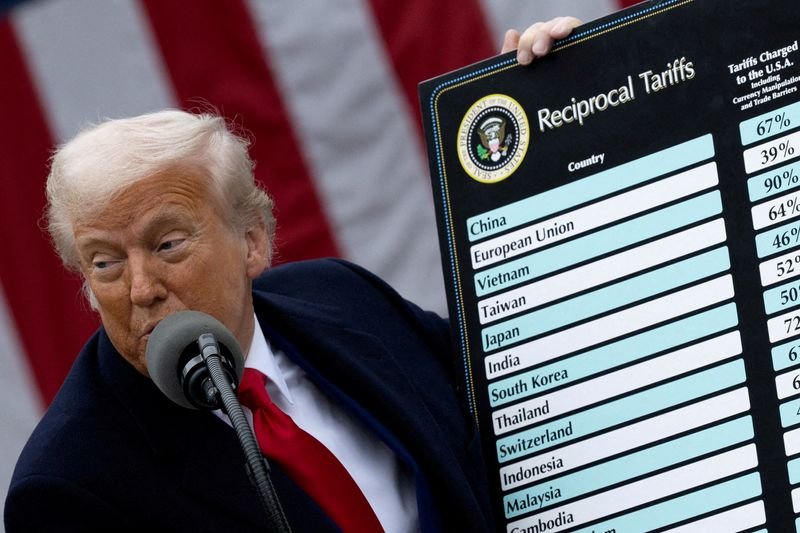

High-yield credit spreads, or the premium paid by companies over risk-free Treasuries, touched their widest levels in two years in the days after Liberation Day, when Trump announced wide-ranging tariffs on 57 countries.

Widening spreads mean an increase in borrowing costs and reflect market perceptions of a rise in default risk.

But this negativity did not last beyond a fortnight, and spreads are now a whopping 149 basis points (bps) inside those levels as of last week’s close, according to ICE BofA Global data..

On Wednesday, expectations of some sort of deal-making got a boost when Trump announced that the U.S. had struck a deal for a lower-than-promised 20% tariff on many Vietnamese exports.

A retracement in spreads showed credit investors were simply not worried that the macroeconomic impact of tariffs would lower the ability of a broad swathe of companies with the riskiest credit ratings to make interest payments on their debt.

The conviction in their fundamentals was so strong that even extreme geopolitical events – including an escalating war between Israel and Iran in late June – failed to push junk bond credit spreads or the default risk gauge wider.

“There definitely seems to be a lot of looking through the headlines and what would, in prior periods, have served as extreme sources of volatility,” said Michael Levitin, managing director and co-head of liquid credit at MidOcean Partners.

For Joseph Lynch, global head of non-investment-grade credit at Neuberger Berman, it was a case of investors appreciating the improved quality of the high-yield bond universe.