Canadian streaming and royalty company Triple Flag Precious Metals has entered a definitive agreement to acquire all issued and outstanding shares of Orogen Royalties for a total consideration of approximately C$421m ($304.7m) on a fully diluted basis.

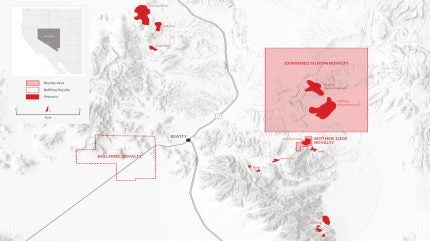

The acquisition will bolster Triple Flag’s mining portfolio, particularly with the inclusion of a life-of-mine royalty on the promising Expanded Silicon gold project in Nevada.

The Expanded Silicon gold project is one of the largest new gold discoveries in the US in more than a decade.

Operated by AngloGold, the project is expected to contribute meaningfully to Triple Flag’s growth beyond 2029.

The transaction comprises approximately C$171.5m in cash, around C$171.5m in shares of Triple Flag and shares in a new entity, referred to as Orogen Spinco, which has an implied value of approximately C$78m.

Orogen Spinco will be led by current Orogen CEO Paddy Nicol and will retain all of Orogen’s mineral assets except the 1% Expanded Silicon net smelter return royalty.

Once Orogen Spinco becomes a publicly listed company, Triple Flag has committed to investing C$10m to acquire around an 11% stake in it.

Triple Flag CEO Sheldon Vanderkooy said: “This is a rare opportunity to acquire a gold asset located in a premier jurisdiction and operated by a top-tier operator, AngloGold Ashanti plc. Nevada is a prolific gold mining region and host to many of the world’s most successful producers.

“Given the rapid pace of resource growth demonstrated at Expanded Silicon, we believe that the long-term growth potential of this asset in an emerging new gold camp is unparalleled. This royalty is a great illustration of the value creation inherent in the royalty model, as we will benefit from future exploration expenditures and success, as well as the future capital expenditures to develop the project, at no further cost to Triple Flag.”

Orogen Spinco will inherit a portfolio of royalties and exploration projects, along with an exploration alliance with Triple Flag in the western US. The alliance aims to generate gold and silver targets with an initial budget of $435,000.

Nicol said: “Orogen will be spun-out as a new company and will continue its pursuit of organic royalty creation and royalty acquisition with the stability of the cash-flowing Ermitaño royalty, our treasury, our portfolio of exciting exploration-stage royalties, and various discovery opportunities through its exploration partnerships and alliances.”

The transaction is expected to close in the third quarter of 2025 (Q3 2025), and is subject to shareholder, regulatory and court approvals, with Orogen shareholders controlling approximately 39.5% of the common shares already in support.

Last month, Triple Flag’s subsidiary, Triple Flag International, secured 5% silver and gold streams from both the Arcata and Azuca mines in Peru for $35m.