Chart 1: Bloomberg commodity price index

Source: Bloomberg and XTB

Past performance is not a reliable indicator of future results.

Opec can’t prop up the oil price

If we look at the oil price first, Brent crude oil is currently trading below $80 per barrel. Some of the decline is due to selling from speculative investors who may not see further upside potential in the oil price. Speculative investors were net sellers of crude for two straight weeks at the end of July, which added to the downside price pressure. The risk for the oil market is that speculative traders tend to overdo it when it comes to their positioning. If that happens then we could see further selling pressure on oil prices before the price potentially bounces back. The lowest level for Brent crude for 2024 was just below $75 per barrel, reached in early July.

The selling pressure on oil has been immense in recent months, so we cannot rule out the oil price falling to this level, however, if that happens then Opec could step in to reduce oil production once again. Interestingly, the oil price has continued to fall even though the Opec + group of oil producer nations are withholding 4 million barrels per day of crude oil production from the market, to try and boost the oil price. There are a couple of reasons why the market seems to be ignoring the production cuts from Opec +.

Firstly, Opec’s June meeting could be partly to blame. Back then it said that it would reverse some of its production easing plans, due to concerns from some of its members. There are various reports on how the easing of some of the production cuts could hit the future supply/ demand balance for crude oil. Opec itself states that easing its production cuts would still mean that oil supply is below demand through to 2026. However, the International Energy Agency thinks the opposite is true. If Opec eases its production cuts, then supply will be significantly higher than oil demand for at least the next two years. This is a powerful driver of weaker oil prices.

China’s economic malaise weighs on industrials

Demand for crude is also a weak link for the oil price right now. Manufacturing powerhouses like Germany and China are very energy intensive economies, however, these economies are both struggling. Germany GDP slipped back into contraction territory in Q2, and the Chinese economy is slowing once more. Annual Chinese GDP moderated to 4.7% in Q2, down from 5.3% in Q1 and less than the 5% growth rate expected. Demand in China is not expected to pick up anytime soon, which is weighing on the price of oil and industrial metals like copper. China has huge stockpiles of copper, however, in further signs that its economy is struggling, China is now exporting its surplus copper to the rest of the world, which is adding downward pressure to the copper price, which has fallen more than 10% in the last three months.

China is a major consumer of commodities and raw materials and when it sneezes, it seems like the commodity market catches a cold. Iron ore futures, which are lower by 26% so far this year, have also been affected by China. It is one of the main inputs for steel production, and China is one of the world’s leading steel producers. The sharp drop in the price of iron futures is another sign that China is struggling and not making as much steel as it used to. The market takes time to adjust to a demand shock – in this case a weaker China. Chinese GDP is still not back to pre-covid levels, in 2019, Chinese annual growth rates were above 6%. Thus, the outlook for many commodities will hinge on where the Chinese economy goes next.

Natural Gas gets hit by supply and demand factors

While prices do not sell off forever, they may not go back to the heights that they reached earlier this year, when the copper price reached a record. Industrial metals and brent crude are not the only commodities that are under pressure. The price of gas is also weakening sharply. Nat Gas has come under heavy selling pressure since the start of this year, and it is lower by nearly a fifth so far in 2024. Fundamental factors are to blame. Gas inventories remain above their 5-year average, as consumption remains weaker than expected, but production has returned to pre-Covid levels. The Nat Gas market is now in contango, where the spot price is higher than the forward price. This is considered ‘normal’, however, as we move into the second half of the year, forward prices for Nat Gas are stretched to the downside.

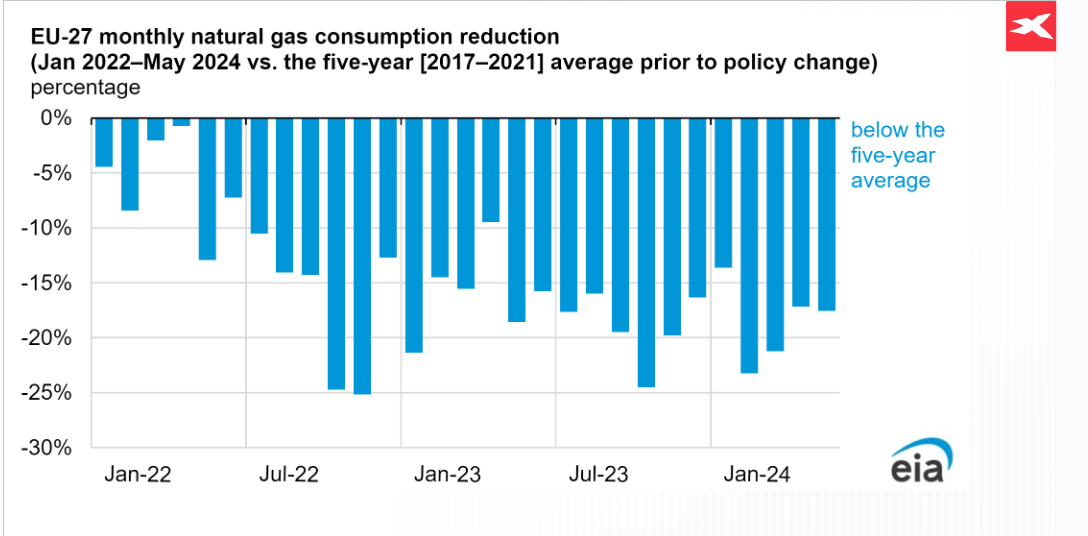

On the demand side, levels of demand in Europe are returning to normal after a spike post the Russian invasion of Ukraine in 2022. The EU’s monthly gas consumption is now below its 5-year average as you can see in the chart below. Supply has also shifted this year, with the US becoming the biggest LNG exporter in the world. However, with demand dwindling, US exports may well slow in the coming months.

Chart 2: Monthly EU natural gas consumption

Source: XTB

Source: XTB

Past performance is not a reliable indicator of future results.

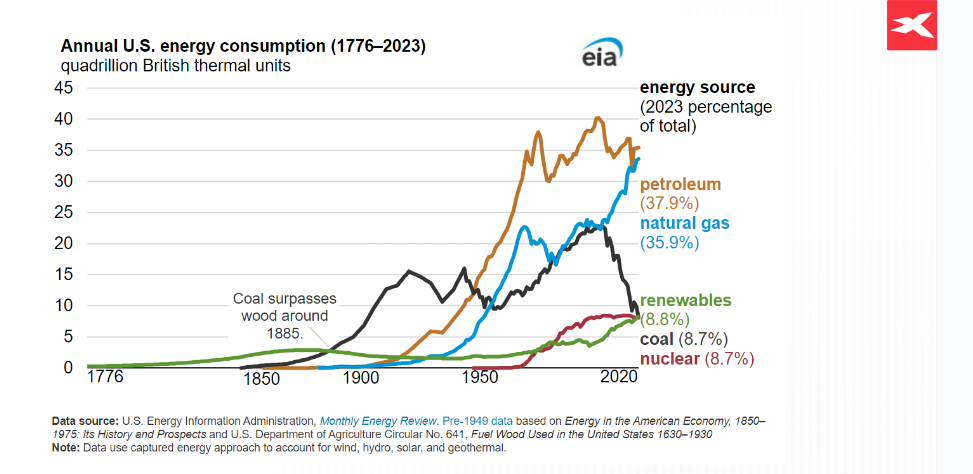

However, we would point out that as demand for gas in the EU dwindles, it is an important part of the energy mix for the US, and has grown rapidly in recent years. It is also outperforming renewable energy, which has seen demand plummet in the same time period, as you can see in the chart below.

Chart 3: US energy supply mix

Source: XTB

Source: XTB

Past performance is not a reliable indicator of future results.

Looking forward, the Nat Gas price is often driven by a mixture of positioning and weather. Positioning is neutral right now and long-term positioning indicators are not giving a clear signal about where the Nat Gas price will go next. Thus, with plentiful supply, especially from the US, which is outside of current geopolitical hot spots, the focus will be on the outlook for the weather for the rest of 2024. If another warm winter is forecast, then we could see another leg lower for the Nat Gas price. So far, the summer season has seen short heat waves in the US, which has limited demand for gas to fuel surplus air conditioning demand. While long-term weather forecasts are notoriously unreliable, so far, they do not suggest that there will be a huge surge in demand for Nat Gas this Autumn and winter, which could also limit the chance of a recovery.

Since the US is now the main centre for supply and demand for Nat Gas, weather patterns and production are worth watching closely if you are trading this commodity in the months to come.

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.