Bulls maintained their strong hold over Dalal Street for second consecutive week ended April 17, helping the market recoup all its tariff-led losses in a short span of time and surpass its March swing high driven by value buying and short-covering. The benchmark indices recorded the biggest weekly gains since February 1, 2021, especially after a pause in US reciprocal tariffs with rising prospects for negotiations with trade partners, and exemptions for some tech products by Trump administration.

Renewed FIIs buying interest, the forecast of above-normal monsoon and lower oil prices also lifted market sentiment. Banking & financial services led rally from the front, supported by favourable monetary environment, which in fact resulted into the Nifty Bank reaching closer to record high and Nifty Financial Services hitting fresh record high last week.

Going ahead, with the easing tariff concerns, the market is expected to remain positive despite intermittent consolidations and profit booking which is generally healthy for the bull run, while the more focus on corporate earnings and further developments related to Trump tariffs, according to experts.

The Nifty 50 rallied 1,023 points (4.48 percent) to 23,852, and the BSE Sensex surged 3,396 points (4.52 percent) to 78,553, while the Nifty Midcap 100 index was up 4.27 percent and Smallcap 100 index gained 4.55 percent for the week.

“Sector- and stock-specific investment strategy is anticipated, driven by upcoming earnings releases and subsequent management commentary, which will play a key role in shaping market sentiment,” Vinod Nair, Head of Research at Geojit Investments said.

According to him, the earnings growth for the fourth quarter of FY25 is likely to be insipid due to muted demand and margin pressures. Investors should adopt a cautious stance, particularly with export-oriented stocks, and instead focus on pure domestic themes such as banking, consumer goods, healthcare, transportation, and infrastructure, he advised.

Here are 10 key factors to watch out for next week:

The earnings activity will increase as more than 100 companies will release their March quarter earnings in the coming week including prominent names like HCL Technologies, Tata Consumer Products, Axis Bank, Hindustan Unilever, SBI Life Insurance Company, Tech Mahindra, and Maruti Suzuki.

Among others, Nestle India, LTIMindtree, Aditya Birla Money, Mahindra Logistics, AU Small Finance Bank, Havells India, Mahindra & Mahindra Financial Services, Tata Communications, Waaree Energies, Bajaj Housing Finance, Dalmia Bharat, Syngene International, Thyrocare Technologies, Cyient, Indian Energy Exchange, L&T Technology Services, Mphasis, Persistent Systems, SBI Cards and Payment Services, Sterling and Wilson Renewable Energy, Cholamandalam Investment and Finance Company, L&T Finance, Poonawalla Fincorp, RBL Bank, Shriram Finance, Tata Technologies, IDFC First Bank, and India Cements will also announce quarterly earnings next week.

“Quarterly and full-year FY25 earnings will be pivotal in shaping the market’s direction, as investors and market participants closely evaluate corporate performance and forward guidance. Disappointing earnings could dampen the current market sentiment and erode recent gains,” Vishnu Kant Upadhyay, AVP – Research & Advisory at Master Capital Services said.

Trump Tariff Developments

The market participants will keep a close watch on the US trade negotiations with the European Union and China, especially after a 90-day pause in tariff rate for all trade partners (except China) implementation. Last week, the US announced 245 percent tariff on China products, escalating the trade tariff war between them. However, the US President Donald Trump has expressed optimism over-reaching agreements with both key partners, though he has yet to offer concrete details or a timeline, experts said.

Meanwhile, investor sentiment in Indian equities was buoyed last week by expectations that the US-China trade dispute may not harm, but rather benefit, India.

IMF Meeting

Further, the focus will also be on the meetings of World Bank Group and International Monetary Fund (IMF) amid rising weakening macroeconomic environment due to trade war ignited by the US. The Spring meeting of the current year is scheduled during April 21-26 in Washington, DC. According to reports, global economic issues including trade war and its impact on the global growth along with the progress in World Bank and IMF’s work will be discussed.

Global Economic Data

Manufacturing and services PMIs flash numbers from major economies are scheduled on April 23, which are expected to provide early insights into business activity in April.

Additionally, durable goods orders, weekly jobs data, and consumer inflation expectations numbers for April from the US will also be watched.

Domestic Economic Data

Back home, HSBC Manufacturing and Services PMI flash data for April will be announced on April 23. The manufacturing PMI recovered to 58.1 in March, increasing sharply from 56.3 in previous month, while the services activity index in the same period declined to 58.5, from 59, as a slowdown in external activity weighed on demand for Indian services.

Bank loan and deposit growth for week ended April 11, and foreign exchange reserves for fortnight ended April 18 will be released on April 25.

The market participants will also focus on the activity at the desk of foreign institutional investors (FIIs) who turned significant buyers in the last three days of the week gone by, buying to the tune of Rs 14,670 crore worth shares in the cash market (as per provisional data) on fall in US dollar index and expectations of better India growth compared to US & China. This resulted into cutting down net selling amount for the current month to Rs 19,972 crore. “FII buying trend can sustain even in this uncertain environment,” VK Vijayakumar, Chief Investment Strategist at Geojit .

However, domestic institutional investors (DIIs) utilised this market rally to book some profits, selling to the tune of Rs 6,471 crore in the last three days, but overall, they net bought Rs 21,118 crore worth shares for the current month.

The US dollar index hit more than three years low last week, falling 0.18 percent to 99.23, the lowest closing level since March 28, 2022, and trading well below all key moving averages. After a sharp run in the previous week, the US 10-year bond yield dropped to 4.33 percent, down 3.65 percent WoW.

Oil Prices

The oil prices movement will also be watched as the Brent crude oil futures rallied nearly 5 percent during the week to settle at $67.96 a barrel amid improving prospects for US-China trade talks and fading expectations of relaxed sanctions on Iranian oil after Iran rejected US demands to end its nuclear program. The US Treasury also announced new sanctions targeting Chinese importers of Iranian crude, reinforcing efforts to drive Iran’s exports to zero, Kaynat Chainwala of Kotak Securities said.

Despite this rally, the prices still traded well below all key moving averages on the weekly basis, which remains supportive for oil importers like India.

Technical View

Technically, the Nifty 50 looks strong, crossing previous swing high and moving closer to 50 percent Fibonacci retracement (from record high of September and April low – 24,010). The index formed long bullish candle on the weekly charts after gap-up opening, in addition to robust bullish candle in the previous week which is positive. The momentum indicators RSI (Relative Strength Index) at 53.95 is heading northward and MACD (Moving Average Convergence Divergence) reported positive crossover with improving histogram. Hence, if the index surpasses 24,000 and sustains above it, the rally toward 24,200 and 24,545 can’t be ruled out, however, the support is placed at the 23,650, followed by 23,350, according to experts.

F&O Cues

Given the strong momentum, the weekly options suggest that the Nifty 50 may face resistance at 25,000 in the short term, with support at

On the Call side, the maximum Call open interest was seen at the 25,000 strike, followed by the 24,000 and 24,500 strikes, with the maximum writing at the 25,000 strike, and then the 24,500 and 24,200 strikes. On the Put side, the 23,500 strike holds the maximum open interest, followed by the 23,000 and 23,300 strikes, with the maximum writing at the 23,500 strike, and then the 23,800 and 23,600 strikes.

Meanwhile, the India VIX, the fear index, fell sharply during the week by 23.08 percent to 15.47, giving the decisive comfort for bulls.

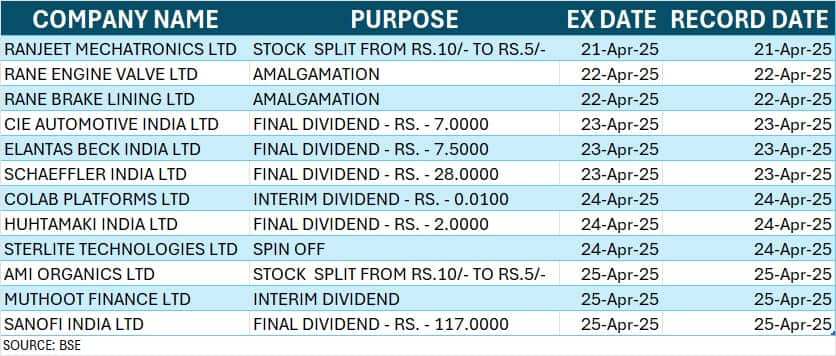

Corporate Action

Here are key corporate actions taking place in the coming week:

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.