Anca Manitiu, Deputy CEO of Impetum Group – one of the biggest private equity managers in Romania – analyzes the recent trends and numbers in the European and regional private equity market.

Europe’s alternative investment fund market – funds investing in private companies, startups, and growth projects – is transforming. While capital previously flowed freely to innovative and high-potential businesses, 2024 presented new challenges and opportunities for those who know where to look.

Europe: Mega-Funds Dominate

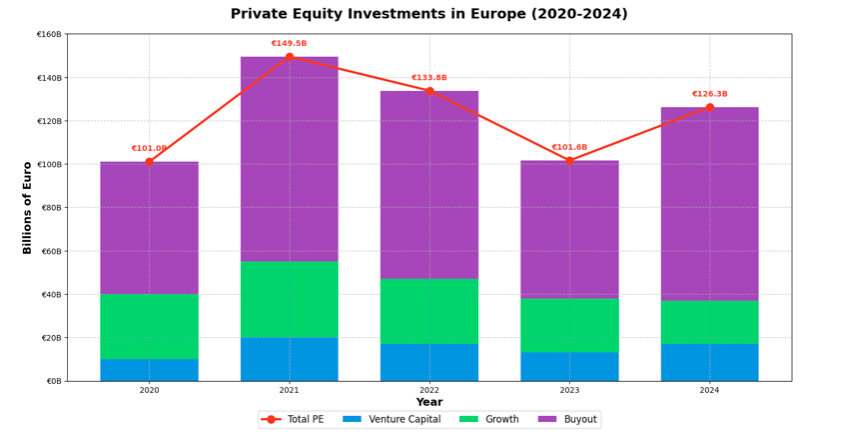

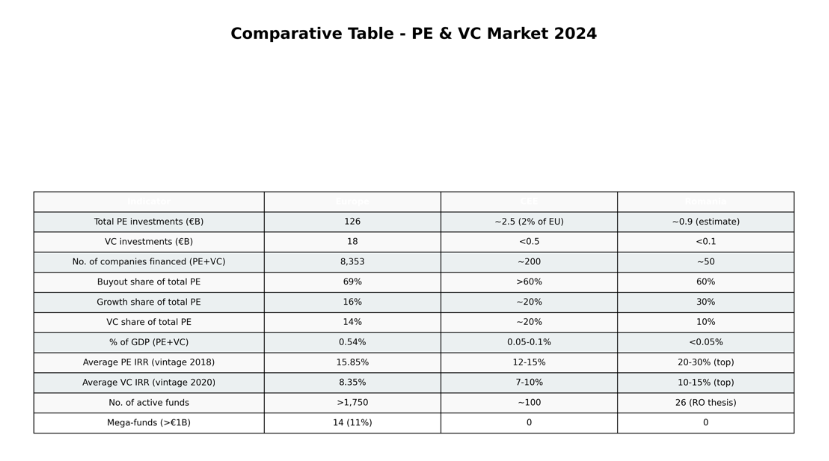

In 2024, private equity and venture capital funds invested over €126 billion in European companies, a 24% increase year-over-year. However, access to this capital was concentrated: over 60% went to just 14 mega-funds, and the number of new fund managers hit a decade low. The market is consolidating around large, established players.

Despite this concentration, investor appetite remains strong. Buyouts (acquiring and streamlining mature companies to grow their value and subsequently sell them) accounted for nearly 70% of total investments, with the technology sector in the lead. U.S. investors also played a major role, being involved in one of every five European deals.

CEE: Untapped Potential on the Periphery

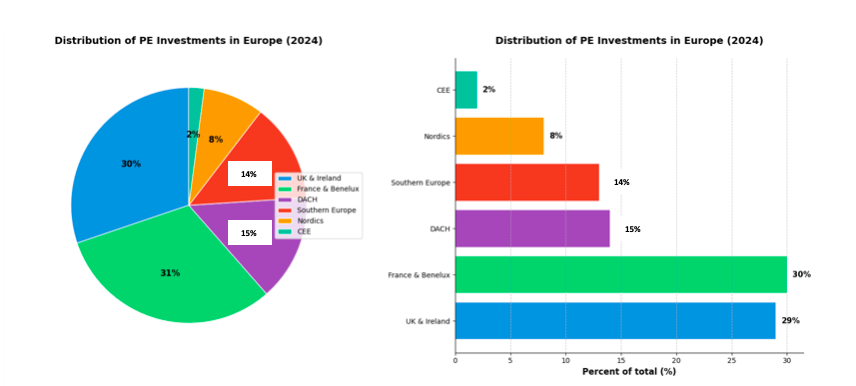

Central and Eastern Europe (CEE) remains on the periphery of major capital flows, receiving only 2% of European investment. The absence of large institutional investors like pension funds or insurance companies limits funding. While notable deals like the sale of Budapest Airport occurred, strategic companies, rather than startups or innovative businesses, continue to attract the largest sums.

Sources: Pitchbook, Invest Europe, internal analysis

Romania: High Activity, Small Deals

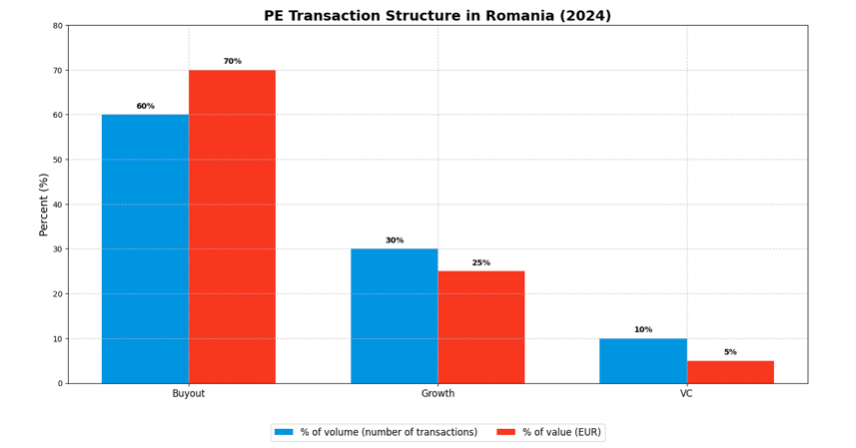

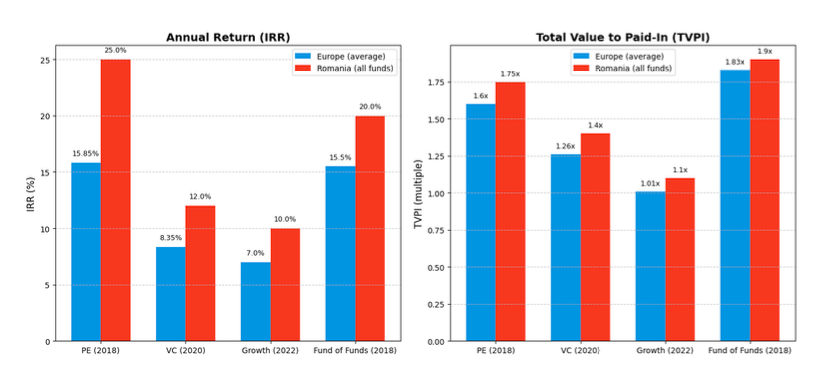

Romania’s alternative investments fund market is dynamic but small compared to its neighbors. In 2024, Romania-focused estimated funds raised under €1 billion. Deal volume is significant, but values are modest. Key sectors include energy, financial services and real estate, with local funds employing ‘buy-and-build’ strategies – buying small businesses to create regional leaders.

Sources: Pitchbook, Invest Europe, internal analysis

Key Trends:

- Romanian exits are generally smaller, occasionally boosted by mega-deals (e.g., Profi).

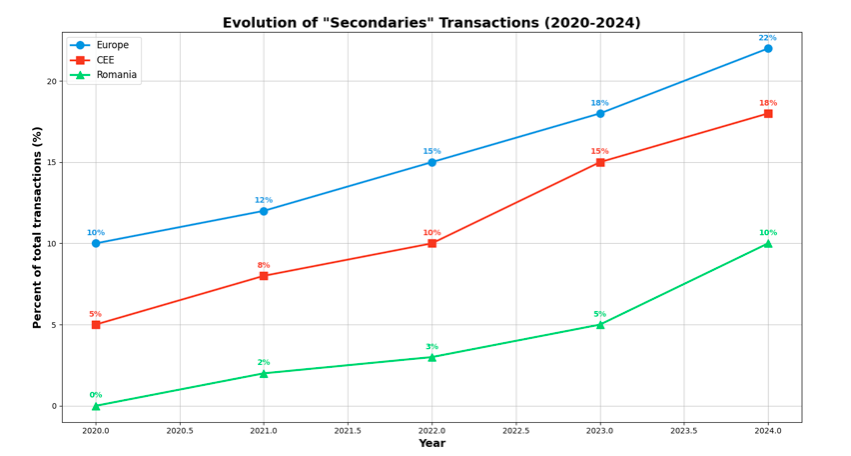

- Secondary transactions are emerging with the arrival of Polish funds and EIF financing.

- Average PE deal size varies by industry, with energy in the lead.

- Romanian funds are shifting toward majority stakes and buy-and-build models.

Notably, Romanian funds also emphasize growth and development, unlike the broader European focus on mature company acquisitions. The rise of secondary transactions – fund-to-fund deals – is a sign of a maturing market.

Sources: Pitchbook, Invest Europe, internal analysis

The Outlook

Experts anticipate increased activity from mid-sized funds and new capital sources, including from the Middle East. Fund-to-fund transactions will grow, and Romanian companies that consolidate and expand regionally will attract significant investment.

Sources: Pitchbook, Invest Europe, internal analysis

Conclusion

The alternative investment fund market in Europe and its surrounding regions is in constant flux.

Europe: A mature market dominated by buyouts and mega-funds, with growing secondary and take-private activity.

CEE: Marginal in volume and value, with high potential but constrained by a lack of institutional investors.

Romania: An emerging underrepresented market with high deal flow, focused on SMEs, scaling, and consolidation.

Romania’s challenge is to transition from an emerging market to a relevant regional player. Entrepreneurs and investors must be ready to capitalize on existing opportunities.

*This is Expert Content provided by ROCA Investments.