Crypto options trading volumes on CME Group rose to an all-time high in July ahead of the launch of spot ethereum exchange-traded funds during that month.

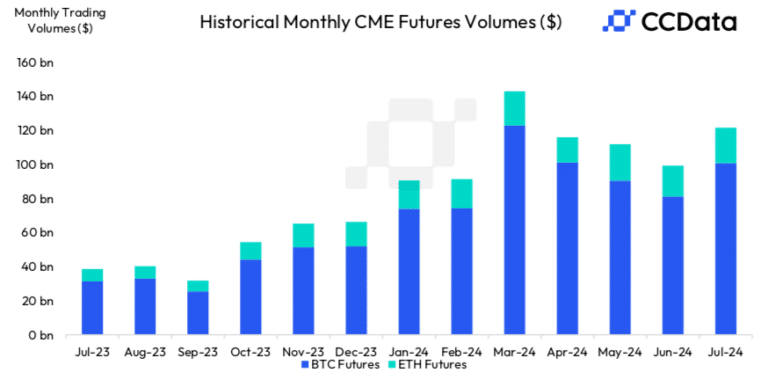

CCData, the FCA-authorised benchmark administrator and digital asset data provider, said in its July Exchange Review that crypto derivatives trading volume on CME rose 23.7% from June to $130bn, which was the second highest monthly volume of the year.

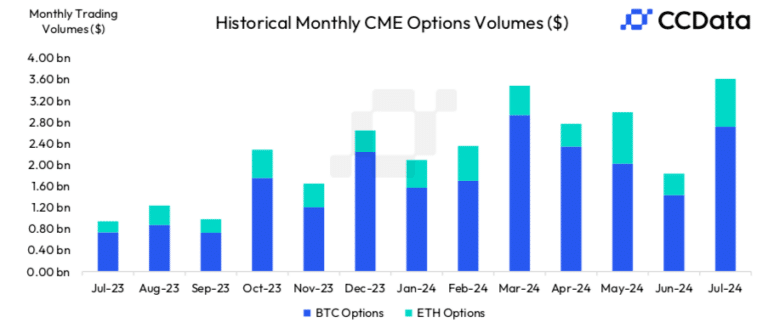

Options trading volume on CME nearly doubled to a record $3.69bn in July, an increase of 93.6% from June.

Bitcoin options volumes rose by 89.8% to $2.72bn over the same period. Ether options volume increased by 122% to $897m, the second-highest volume for the instrument in the exchange’s history according to CCData.

“The surge in ether options trading activity highlights the institutional interest in the asset ahead of the launch of spot ethereum ETFs in the US last month,” added the report.

Ether ETFs started trading on 23 July in the US after approval by the US Securities and Exchange Commission.

Trading volume of Bitcoin futures on CME was $101bn in July, an increase of 24% from previous month, while trading volumes of ether futures rose 15% to $20.7bn

Greg Cipolaro, global head of research at NYDIG, said in a report that BlackRock continues to outpace its next nearest competitor, Fidelity, in gathering fund inflows for ether ETFs.

“The low-cost accumulation fund strategy employed by Grayscale continues to yield mixed results as investors have put $201m into the low-cost ether ETF, but redeemed $2.1bn from the high-cost ether ETF,” added Cipolaro. “Finally, the loss of the ARK relationship for 21Shares continues to weigh on its ability to accumulate funds.”

BlackRock and Nasdaq have filed with the SEC to list and trade options on the iShares Ethereum Trust. The filing said the exchange believes that offering options on the trust will benefit investors by providing them with an additional, relatively lower cost investing tool to gain exposure to spot ether as well as a hedging vehicle to meet their investment needs in connection with ether products and positions.

“Similar to other commodity ETFs in which options may be listed on ISE (e.g. SPDR® Gold Trust, the iShares COMEX Gold Trust, the iShares Silver Trust, or the ETFS Gold Trust), the proposed ETF is a trust that essentially offers the same objectives and benefits to investors,” said the filing.

Nasdaq and BlackRock’s filing to add options on Ethereum ETFs has hit the SEC site. Final SEC decision on this from SEC likely to be around April 9th, 2025.

(SEC is not the only decision maker on adding options here. Also need signoff from OCC & CFTC) https://t.co/K4HunUPp7S pic.twitter.com/5kQH0mljTz

— James Seyffart (@JSeyff) August 6, 2024