- Stacks price accelerated its uptrend and retested the $0.90 resistance, fuelled by growing institutional interest.

- Stacks stablecoins market capitalization increased over 400%, becoming the third-largest chain in the Bitcoin ecosystem.

- The derivatives’ Open Interest surged to $73 million and a 54% increase in the volume signals growing confidence.

Stacks (STX) price rises, hitting a new weekly high at $0.90 during the Asian session on Friday. The Bitcoin layer-2 protocol shows bullish resilience, trading at $0.88 at the time of writing, reflecting growing institutional interest in the decentralized finance (DeFi) ecosystem. STX’s breakout appears strong enough to sustain the uptrend, targeting highs above $1.00 in the coming days.

Stacks uptrend steady as liquidity accelerates the DeFi ecosystem

Bitcoin sidechains have been performing impressively in the last few weeks, led by Stacks, the largest chain in the ecosystem. STX value is up more than 80% since its April low of $0.47, mirroring a broader bullish sentiment in the cryptocurrency market, which saw Bitcoin briefly return above $94,000 on Wednesday.

Based on on-chain data shared by the Stacks team on X, the growth in the price of STX can be attributed to investor interest in DeFi products, among other key factors.

liquidity in the stacks defi ecosystem is accelerating:

– 3k sbtc already on stacks – on track to become the #1 bitcoin l2 by btc supply

– stablecoin market cap surged 400% in q1, crossing $12M+

– new tvl record for stx being liquid stacked unlocking more stx capital pic.twitter.com/0mj3CWL9I4— stacks.btc (@Stacks) April 24, 2025

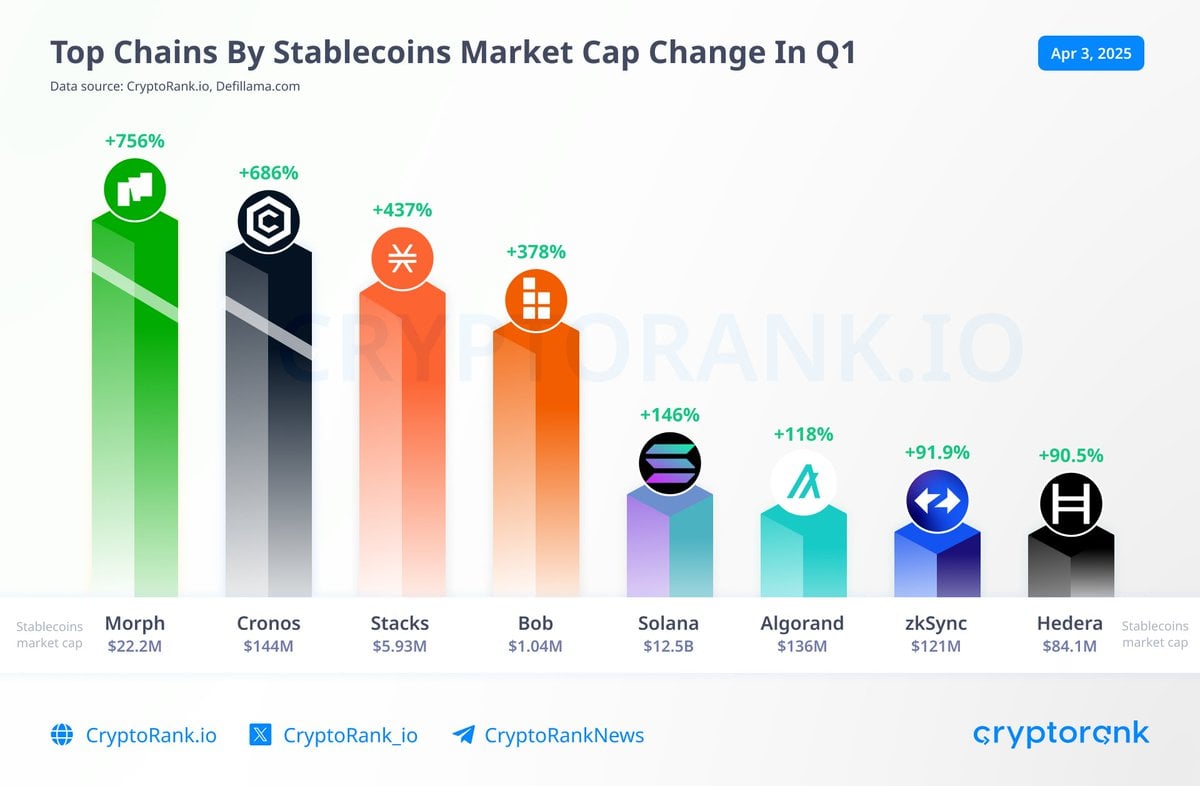

For instance, the protocol’s stablecoins market capitalization surged by more than 400% to nearly $6 million. As the chart below shows, Stacks is the third-largest protocol in this sector behind Cronos and Morph.

Stacks stablecoin market capitalization : Source: CryptoRank

Institutional interest in the Bitcoin ecosystem continues to fuel Stacks’ growth, supported by significant developments like Grayscale launching the STX Trust Fund. Select cryptocurrency exchanges such as crypto.com currently offer STX staking, allowing investors to lock their tokens to earn rewards. The increase in staking balance suggests investor confidence is growing amid heightened market activity.

institutions recognize that stacks is the leading bitcoin l2:

– jump, utxo, snz, and others invested in sbtc

– grayscale launched the stx trust fund

– exchanges like crypto(.)com offer stx stacking

– enterprise-grade validators with billions in aum support stacks as signers pic.twitter.com/K5v0MZDui3— stacks.btc (@Stacks) April 23, 2025

Stacks is back in the green based on monthly returns data compiled by CryptoRank. After recording declines in the first three months: -13.5% in January, -37.4% in February and -27.1% in March, Stacks returns in April stand at more than 44%, breaking a pattern of negative returns observed in the same month for three consecutive years.

Stacks monthly returns (USD) | Source: CryptoRank

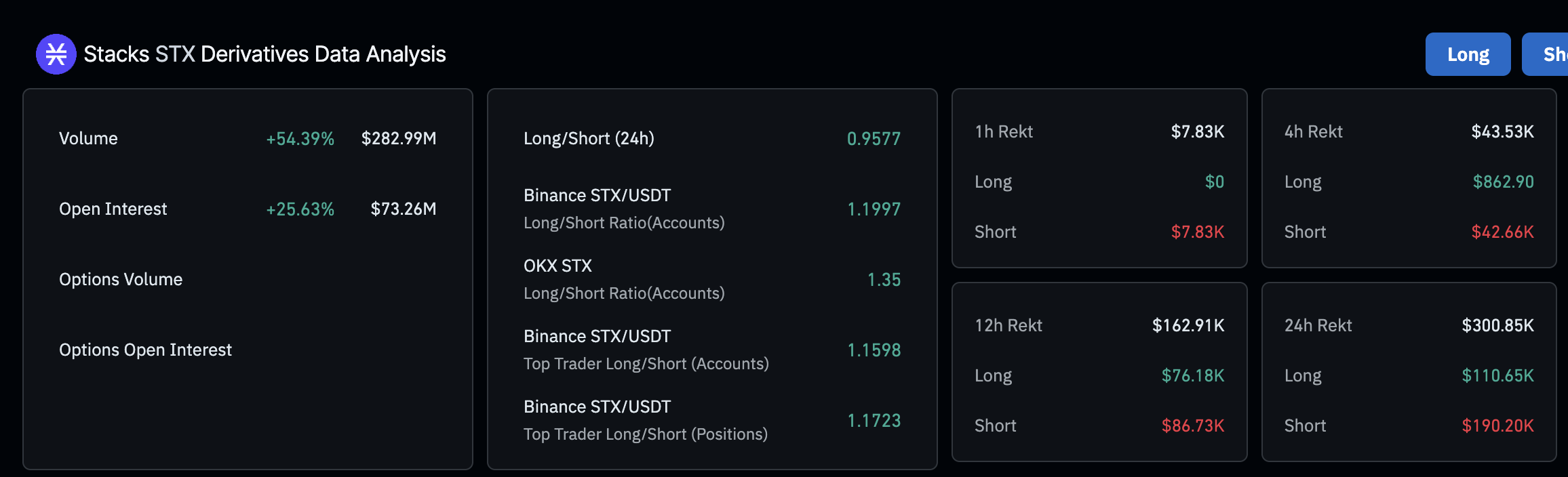

The derivatives market reinforces STX’s growth, with Open Interest (OI) increasing 25.63% to $73.26 million in the last 24 hours. Subsequently, the surge in the volume by 54.4% to approximately $283 million could confirm the heightened market activity and trader confidence in the token.

Stacks derivatives data | Source | Coinglass

Stacks price jumps, closing in on $1

Stacks’ price hovers at $0.88 at the time of writing, as bulls battle resistance at $0.90, highlighted by the 12-hour 200 Exponential Moving Average (EMA). An upward-moving Relative Strength Index (RSI) indicator overbought at 78.56 signals strong bullish momentum. This bullish outlook and rising trading volume uphold STX’s potential to climb above the next crucial resistance at $1.00.

STX/USDT 12-hour chart

The broader sentiment in the cryptocurrency market is expected to remain positive on Friday, bolstered by Bitcoin’s move above $93,000. However, the overbought conditions, especially for STX, could slow the uptrend, possibly resulting in a reversal ahead of the weekend. Hence, traders could keep key levels such as the green dotted descending trendline, the 100 EMA at $0.70, and the 50 EMA at $0.66 in mind as potential support areas in case of a larger retracement.