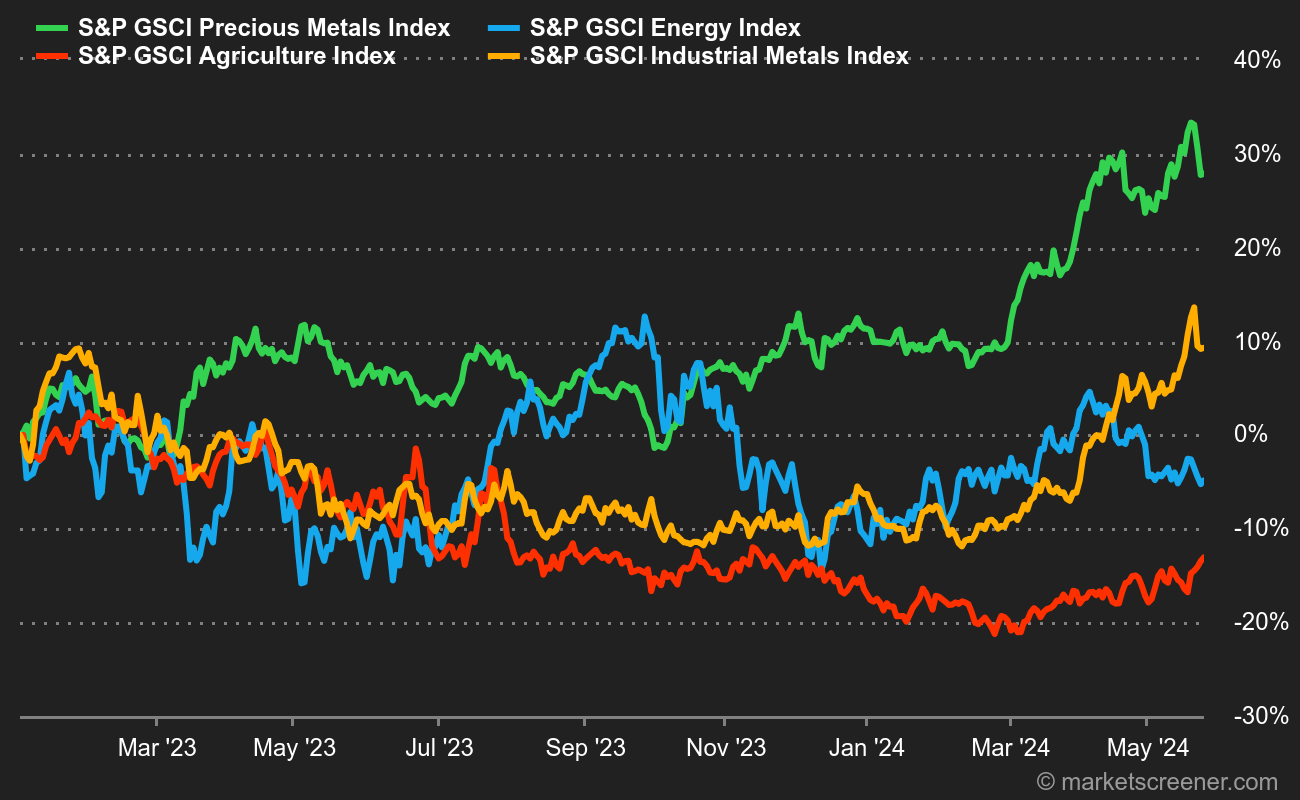

Every week, the commodities overview reviews the latest news on the commodities markets, to better understand the variations in the prices of energy, metals and agricultural raw materials.

Energy : Long relegated to the background, geopolitics is back in the spotlight, this time in Ukraine with the surprise offensive by Ukrainian forces on Russian territory, in the Kursk oblast. In the Middle East, tension continues unabated, as observers continue to fear a retaliation by Iran and its regional proxies, which could target Israeli territory. Finally, improved economic data in the United States eased concerns about the dynamics of oil demand, allowing crude prices to rebound this week. European Brent crude is trading higher at around USD 81, while US WTI is trading at around USD 78.70 a barrel.

Metals : The sinking of the Caixin Manufacturing index into negative territory (below 50 points) does not bode well for base metal prices, which continue to decline this week. A tonne of copper fell to USD 8794 last week (cash price) in London, registering a drop of over 20% from its May 2024 peak. Similar dynamics were observed for aluminum (USD 2274) and zinc (USD 2646). Gold stabilized at USD 2460, benefiting overall from bets on the Fed’s eminent easing of monetary policy, which could cut rates several times between now and the end of the year.

Agricultural products : In Chicago, corn prices continue to trend downwards due to favorable weather conditions for crops in the United States, synonymous with abundant supply. A bushel of corn is still trading at around 380 cents, while wheat is stabilizing at 540 cents.