Image © Adobe Images

Pound Sterling rose against all major currencies in early trade on Tuesday, driven by a bid in GBP/EUR, after official data showed employment rising and the unemployment rate falling late in the second quarter.

Sterling climbed against the Dollar, Euro and other major currencies with its largest gains coming in relation to low-yielding funding currencies like the Japanese Yen and Swiss Franc after the Office for National Statistics said the unemployment rate fell back to 4.2% in May, from 4.4%, reversing its second quarter increase.

The decline was aided by a 54k increase in employment in May, which was followed by a 16k increase in June that took total employment gains for the year to 241,000, equal to around 0.8% of the labour force.

However, claimant count data showed welfare claims rising to 1.663 million in June, which was followed by a large 135k increase in July – the largest since the onset of the pandemic – that overshot the consensus for a 14.5k increase.

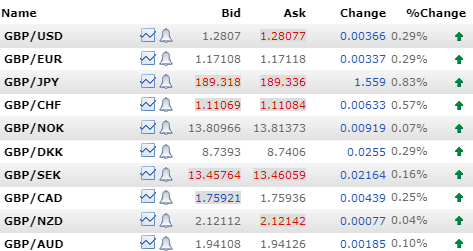

Above: Interbank reference rates for Sterling relative to G10 currencies on Tuesday. Source: Netdania.

Average earnings growth also moderated to its lowest since January 2021 when bonuses are included but the decline was less than expected if annual and one-off bonuses are excluded from the comparison.

Earnings rose 4.5% year-on-year in June when bonuses are included, down from 5.7% previously, and by 5.4% year-on-year if bonuses are excluded.

The latter was down from 5.8% in May but ahead of the consensus for a 4.6% year-on-year increase, which potentially explains Sterling’s reaction on Tuesday.

Average earnings growth is closely monitored by the Bank of England because it has been flagged as a leading indicator for inflation and the risk of it persisting at an above-target level over coming years.

Inflation fell back to the 2% target in May and remained there in June but statistical base effects are expected to lift it back to 2.3% when data for July are released on Wednesday.

The Bank of England remains concerned about the high level of inflation in the services sector, however, which remained around 5.7% in June. The fear is that this will sustain overall inflation at an above-target level.

Above: Pound to Dollar rate shown at daily intervals alongside Pound to Euro rate.