- We explore what the ascending USDT macro trend means for the market.

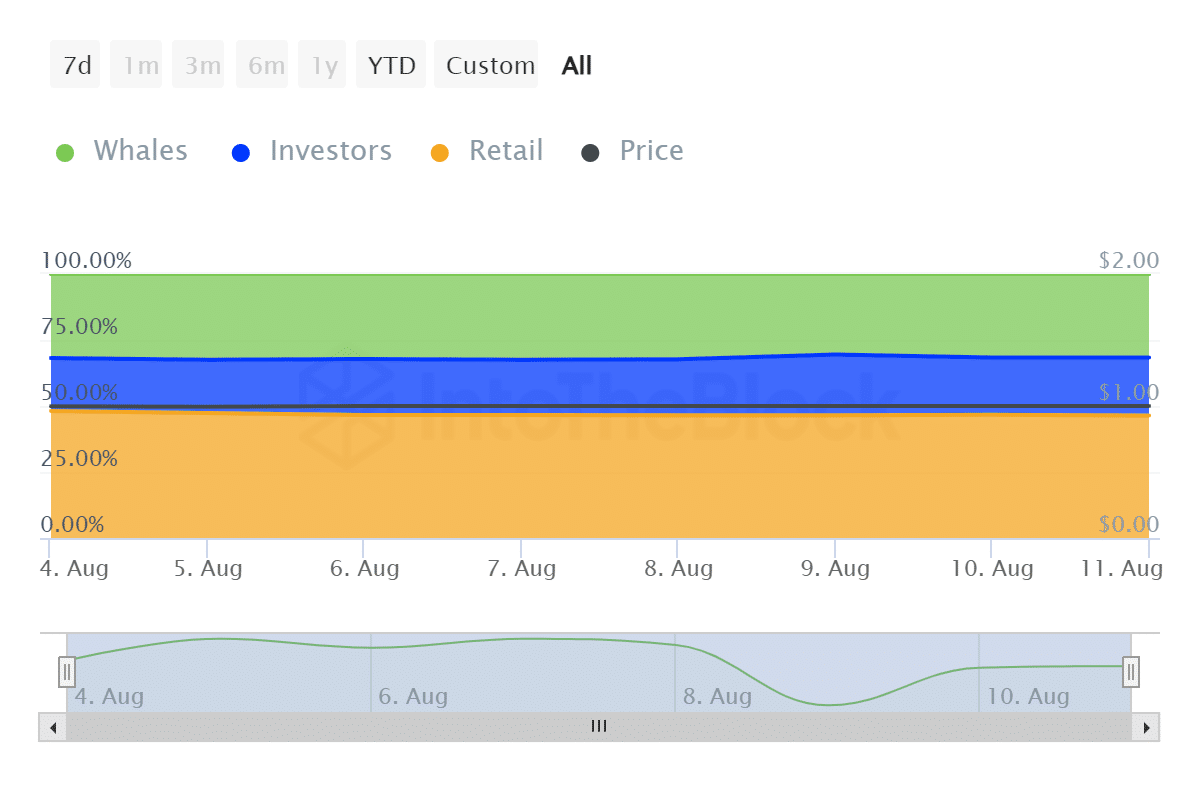

- Assessing the level of liquidity held by whales, retail, and the investor class.

Tether [USDT] registered a significant uptick during the weekend, an outcome that coincided with the resurgence of sell pressure for most cryptocurrencies.

This was no mere coincidence and could be a sign of things to come.

USDT dominance tends to rise when there is FUD in the market, triggering a selloff for most crypto asset.

This was evident during the latest crypto crash, during which USDT soared and even crossed above a key resistance line, followed quickly by a pullback.

The USDT dominance pushed as high as 6.77% during last week’s crash. It rallied to a high of 5.83% on the 12th of August before tracing to a press time level of 5.60%.

Note that USDT has been treading up since March, as the market demonstrated some weakness since then.

Although the market anticipated a stronger crypto market performance in August, recent developments in the financial world signaled a noteworthy possibility of selloffs.

Such an outcome could potentially push up USDT dominance in the weeks or months to come.

Flight to safety?

The recent market crash triggered by Japan’s interest rate hike had the markets in a chokehold, triggering a market wide selloff of risk assets.

Numerous analysts have weighed in on the matter, and the consensus suggests that the extent of the unwind is unknown and could still be in play.

If that is the case and there are more risks ahead, then it is highly likely that some more selloffs might be coming.

If that happens, then it could spell more dominance for USDT as investors swap their assets to avoid portfolio exposure.

AMBCrypto explored the stablecoin’s historical concentration in the last seven days to identify whether the situation was already playing out.

The findings revealed that whales held 16.52 billion USDT as of the 11th of August, a 0.18% decline in the last seven days. Investors held 11.47 billion USDT, a 1.91% gain compared to seven days ago.

Retail held 24.23 billion USDT, which was a 1.74% decline compared to 7 days prior. The findings revealed that whales and retail reduced their stablecoin holdings, while investors added to their holdings.

While the findings may not necessarily signal a flight to safety, they reveal something potentially more interesting.

Crypto investors had roughly 52.22 billion worth of dry powder in USDT form, ready to be deployed in case opportunities present themselves. That figure will likely go up if economic conditions worsen.