Supatman

Introduction

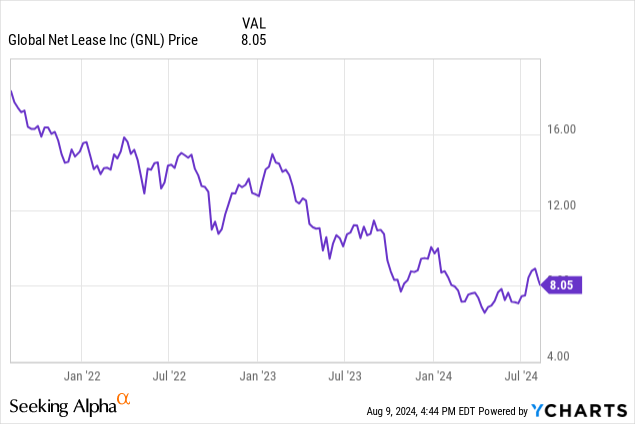

I have owned the preferred shares of Global Net Lease (NYSE:GNL) for several years now as they provided a nice and reliable quarterly income to my investment portfolio. However, as the situation in the REIT landscape has changed dramatically due to the higher interest rate environment, I really wanted to have another look at the preferred shares to ensure there will be no abrupt ending to the consistent cash flow.

This article will discuss Global Net Lease from the perspective of a preferred shareholder (I was a preferred shareholder of American Finance Trust, which was renamed to The Necessity Retail REIT before it merged with GNL). Due to balance sheet concerns, I have no interest in the REIT’s common stock at this time.

While the preferred shares enjoy excellent coverage, the deleveraging should continue

When I look at a preferred stock issue, I focus on two important elements: The balance sheet and the preferred dividend coverage ratio.

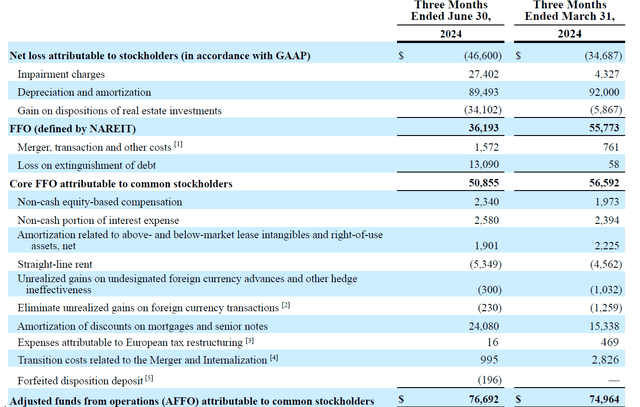

For the latter, the FFO and AFFO usually provide a good starting point. The starting point of the FFO calculation is the $46.6M net loss attributable to Global Net Lease’s common shareholders. Subsequently, the impairment charges and depreciation and amortization expenses have to be added back to the equation, while the gain on the disposition of assets should be deducted. This results in an FFO of $36.2M and a core FFO of almost $51M.

GNL Investor Relations

To move from the FFO to the AFFO calculation, there are plenty of adjustments that need to be made, as you can see above. The main element is adding back the amortisation of discounts on mortgages and senior notes, which adds just over $24M to the AFFO calculation. And when all is said and done, the total AFFO generated in the second quarter was approximately $76.7M.

It’s important to realize this already includes the preferred dividends. As you can see below in the income statement, the $46.6M net loss starting point includes almost $11M in preferred dividends. This means the pre-dividend AFFO was approximately $88M, and the REIT needed just around 12.5% of its pre-dividend AFFO to cover the preferred dividends. So as far as the preferred dividend coverage ratio is concerned, I’m more than fine with a sub-15% payout ratio.

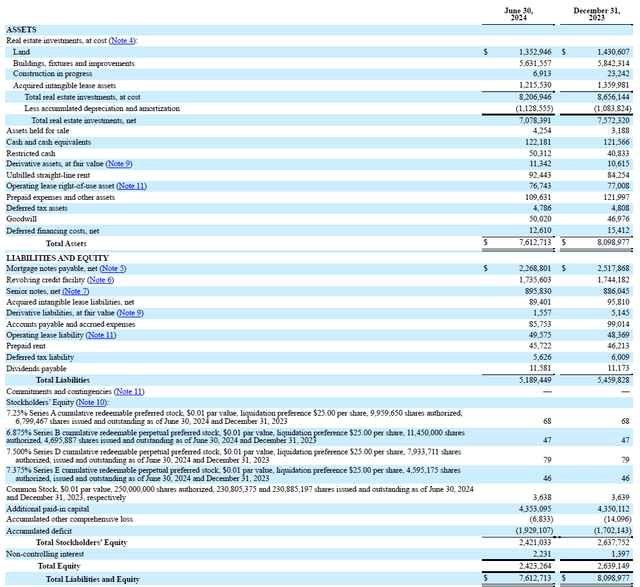

The situation on the balance sheet is a whole different game. As you can see below, the total asset base is just over $7.6B, of which almost $5.2B is funded by liabilities. The book value of the assets was $7.08B while the $173M in cash and restricted cash vs. the $4.9B in gross financial debt (excluding lease liabilities) results in a net debt of around $4.73B (and $4.82B if I’d include the intangible lease liabilities excluding the operating lease liabilities). Compared to the $7.08B book value, the LTV ratio is approximately 67%.

GNL Investor Relations

Of course, it would be wrong to use the book value of the real estate. Unlike in other countries, US-domiciled REITs actually have to depreciate their real estate assets, and as the balance sheet above shows, the $7.08B book value already includes $1.13B in accumulated depreciation. If I would use the acquisition cost of the real estate assets, the LTV ratio would be around 57.6%. That’s still pretty high, and the next step is to figure out what the “fair value” of the assets would be, as the market value will never be exactly the same as the book value or acquisition cost.

As disclosed by the REIT (and shown below) the Q1 NOI was approximately $167.8M, which is approximately $671M per year. The company also announced a leasing spread of 4.3% in the second quarter of the year, so I will use a forward NOI of $685M per year for Global Net Lease’s assets adjusted for occupancy, the fully occupied NOI would be around $725M.

This means the book value of the assets represents a yield of 10.2% (defined as occupancy-adjusted NOI versus the book value) while the acquisition cost represents a yield of 8.9%. The company was able to sell assets at an average cap rate of 7.3%, so I think it’s fair to use a 7.5-8% cap rate for GNL’s asset basis. Using 7.75% (I like to be conservative), the assets would have a fair value of $9.35B in which case the LTV ratio would be just around 50%, a high but still acceptable percentage.

The calculation of the fair value is also important for the asset coverage ratio of the preferred shares. There are currently four series of preferred shares outstanding, for a total of $600M. This means that with a total of $2.42B in equity on the balance sheet, there’s in excess of $1.8B in common equity which ranks junior to the preferred capital.

That’s based on the book value of the assets. If I would use a fair value of $9.35B, the implied equity value would be closer to $4.7B, of which $600M would be preferred equity (with a common equity cushion of in excess of $4B).

Although I was reluctant right after the merger with The Necessity Retail REIT closed, the preferred equity now gets the thumbs up from me as both the asset coverage ratio as well as the preferred dividend coverage ratio meet my requirements.

The terms of the preferred shares

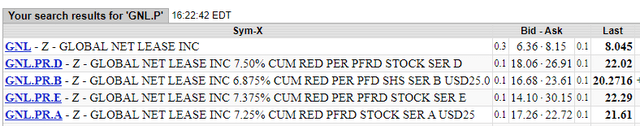

After the merger was completed, the REIT had (and still has) four series of preferred shares outstanding.

Stockwatch

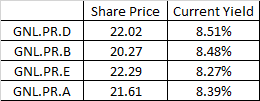

Based on the closing prices as of Friday, this results in the current overview of the yield (note, I’m using the same order as the ranking above).

Author Table

I have a long position in the Series D (GNL.PR.D) and Series E (NYSE:GNL.PR.E) and based on the table above, it could make sense to swap E for D if/when the opportunity arises (and if it makes sense after taking transaction fees into account).

Investment thesis

While I originally wasn’t interested in the common shares of Global Net Lease, I’m now feeling increasingly confident the REIT will be able to manage its balance sheet in a way that will alleviate the quality concerns (the REIT now expects to sell $650-800M in assets this year, up from $400-600M). And, of course, a stronger balance sheet reduces the refinancing risk.

It will remain important to keep the occupancy ratio high and to make sure all tenants continue to pay their rent, but as 59% of the portfolio is leased to investment-grade tenants, the rent collection rate should remain high.

I have a long position in the Series D and Series E of the preferred shares. And while I originally only intended to hold my existing position, I may actually further increase the position size as my main concerns are being alleviated with the asset sale program. That being said, I may also choose to buy the Series A and/or B preferred shares if their respective yields are higher.