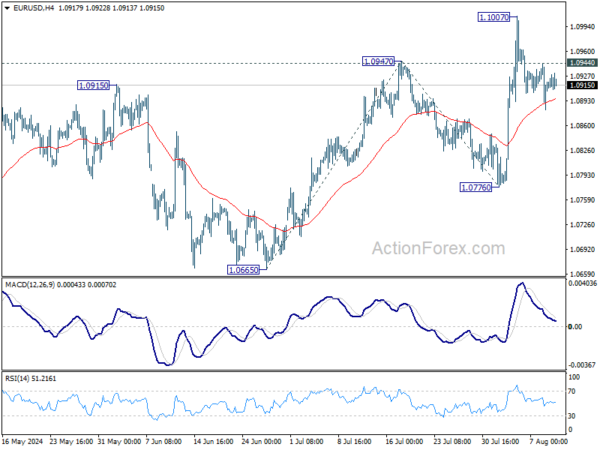

EUR/USD retreated after initial rise to 1.1007 last week and turned into consolidations. Initial bias stays neutral this week first. While deeper retreat cannot be ruled out, downside should be contained well above 1.0776 support. On the upside, above 1.0944 minor resistance will bring retest of 1.1007 first. Further break there will resume rally from 1.0665 to 100% projection of 1.0665 to 1.0947 from 1.0776 at 1.1056 next.

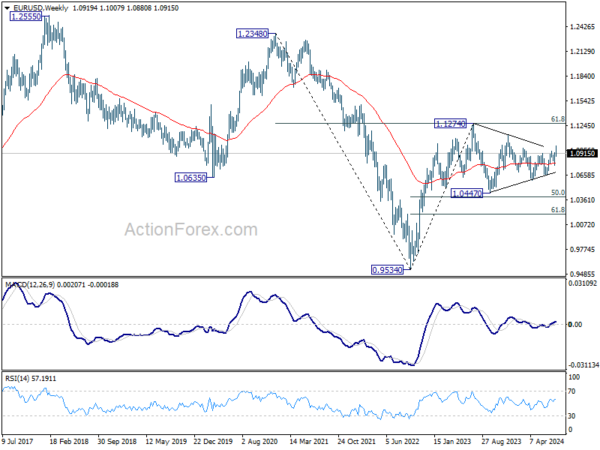

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern that’s still be in progress. Break of 1.1138 resistance will be the first signal that rise from 0.9534 (2022 low) is ready to resume through 1.1274 (2023 high). However, break of 1.0776 support will extend the correction with another falling leg back towards 1.0447 support.

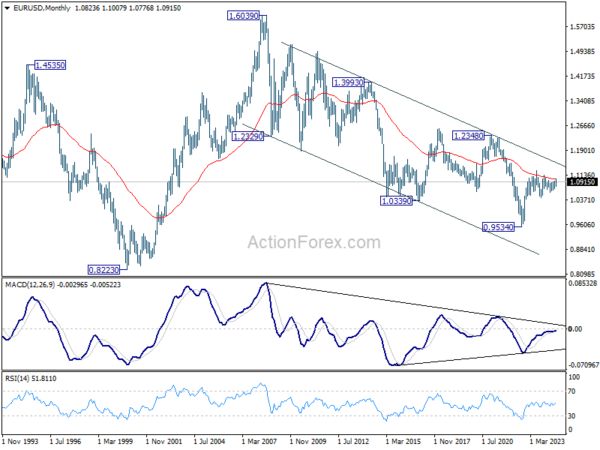

In the long term picture, a long term bottom is in place at 0.9534 (2022 low). Sustained break of 55 M EMA (now at 1.1008) will raise the chance of long term reversal. But even in this case, firm break of 1.2348 structural resistance is needed to confirm. Rejection by 55 M EMA will maintain bearishness for extend the down trend from 1.6039 (2008 high) through 0.9534 at a later stage.